Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grell, Hamilton, Kieffer, and Mally have been operating a consulting business as a partnership. Based on the provisions of the original articles of partnership,

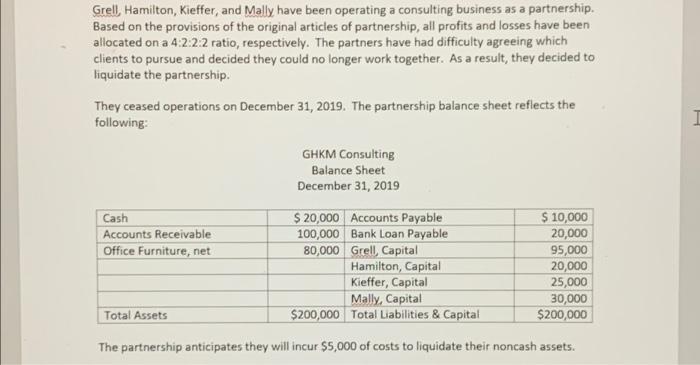

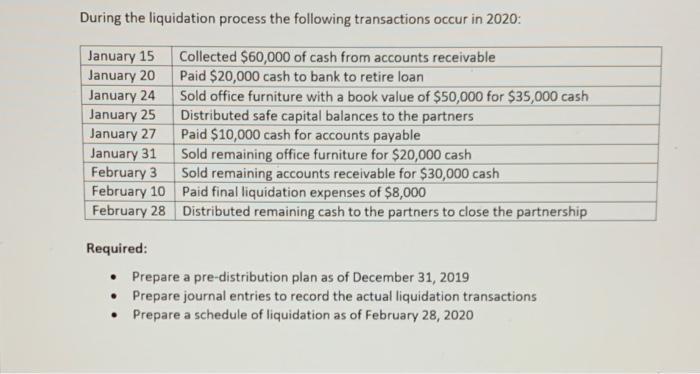

Grell, Hamilton, Kieffer, and Mally have been operating a consulting business as a partnership. Based on the provisions of the original articles of partnership, all profits and losses have been allocated on a 4:2:2:2 ratio, respectively. The partners have had difficulty agreeing which clients to pursue and decided they could no longer work together. As a result, they decided to liquidate the partnership. They ceased operations on December 31, 2019. The partnership balance sheet reflects the following: Cash Accounts Receivable Office Furniture, net GHKM Consulting Balance Sheet December 31, 2019 Total Assets $ 20,000 Accounts Payable 100,000 Bank Loan Payable 80,000 Grell, Capital $ 10,000 20,000 95,000 Hamilton, Capital 20,000 Kieffer, Capital 25,000 Mally, Capital 30,000 $200,000 Total Liabilities & Capital $200,000 The partnership anticipates they will incur $5,000 of costs to liquidate their noncash assets. H During the liquidation process the following transactions occur in 2020: January 15 Collected $60,000 of cash from accounts receivable Paid $20,000 cash to bank to retire loan January 20 January 24 January 25 Sold office furniture with a book value of $50,000 for $35,000 cash Distributed safe capital balances to the partners Paid $10,000 cash for accounts payable January 27 January 31 Sold remaining office furniture for $20,000 cash February 3 Sold remaining accounts receivable for $30,000 cash Paid final liquidation expenses of $8,000 February 10 February 28 Distributed remaining cash to the partners to close the partnership Required: Prepare a pre-distribution plan as of December 31, 2019 . Prepare journal entries to record the actual liquidation transactions Prepare a schedule of liquidation as of February 28, 2020 .

Step by Step Solution

There are 3 Steps involved in it

Step: 1

profit Da cash on 1900 sale of Office Furnity Account Receipt lost ratio 4222 PRE distribution plan ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started