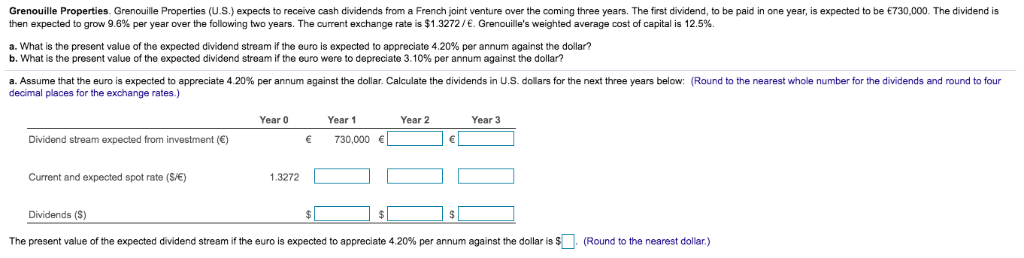

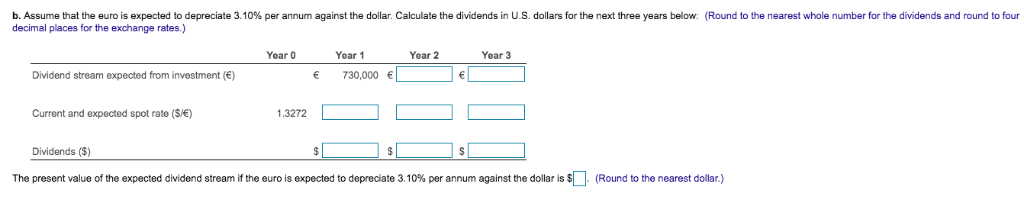

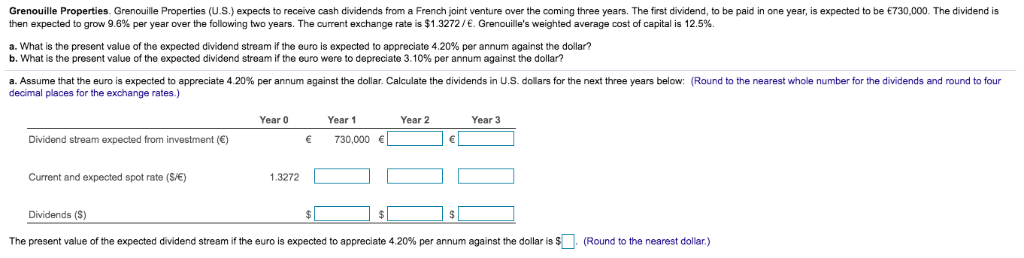

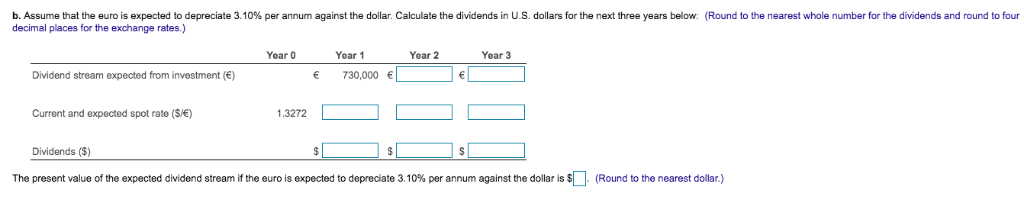

Grenouille Properties. Grenoui e Properties U expects o rece ve cash d idends rom a French int venture over he coming ree years. The st dividen to then expected to grow 9.6% per year over he ollowing two years. The current exchange rate is $13272/. Grenouille's weighted average cost of capital 2.5% 000 The paid one yer, s expected dend n 0 a. What is the present value of the expected dividend stream if the euro is expected to appreciate 4.20% per annum against the dollar? b. What is the present value of the expected dividend stream if the euro were to depreciate 3.10% per annum against the dollar? a. Assume that the euro is expected to appreciate 4.20% per annum against he dollar. Calculate he d vidends r u decimal places for the exchange rates.) Round to he earest dolars for the next three years below: hole number dends and round r ed our Year 1 Year 2 730,000e Dividend stream expected from investment () 1.3272 Current and expected spot rate (SE) Dividends ($) The present value of the expected dividend stream if the euro is expected to appreciate 420% per annum against the dolla is Round to the nearest dollar. b. Assume that the euro is expected to depreciate 3.10% per annum against the dollar. Calculate the dividends in US. dollars decimal places for the exchange rates.) or the next three years below: Round to the nearest whole number or the d dends and round to our Year 0 Year 2 Year 1 Year 3 730,000 Dividend stream expected from investment () Current and expected spot rate (S/6) 1.3272 Dividends (S) The present value of the expected dividend stream if the euro is expected to depreciate 3.10% per annum against the dollar is (Round to the nearest dollar) Grenouille Properties. Grenoui e Properties U expects o rece ve cash d idends rom a French int venture over he coming ree years. The st dividen to then expected to grow 9.6% per year over he ollowing two years. The current exchange rate is $13272/. Grenouille's weighted average cost of capital 2.5% 000 The paid one yer, s expected dend n 0 a. What is the present value of the expected dividend stream if the euro is expected to appreciate 4.20% per annum against the dollar? b. What is the present value of the expected dividend stream if the euro were to depreciate 3.10% per annum against the dollar? a. Assume that the euro is expected to appreciate 4.20% per annum against he dollar. Calculate he d vidends r u decimal places for the exchange rates.) Round to he earest dolars for the next three years below: hole number dends and round r ed our Year 1 Year 2 730,000e Dividend stream expected from investment () 1.3272 Current and expected spot rate (SE) Dividends ($) The present value of the expected dividend stream if the euro is expected to appreciate 420% per annum against the dolla is Round to the nearest dollar. b. Assume that the euro is expected to depreciate 3.10% per annum against the dollar. Calculate the dividends in US. dollars decimal places for the exchange rates.) or the next three years below: Round to the nearest whole number or the d dends and round to our Year 0 Year 2 Year 1 Year 3 730,000 Dividend stream expected from investment () Current and expected spot rate (S/6) 1.3272 Dividends (S) The present value of the expected dividend stream if the euro is expected to depreciate 3.10% per annum against the dollar is (Round to the nearest dollar)