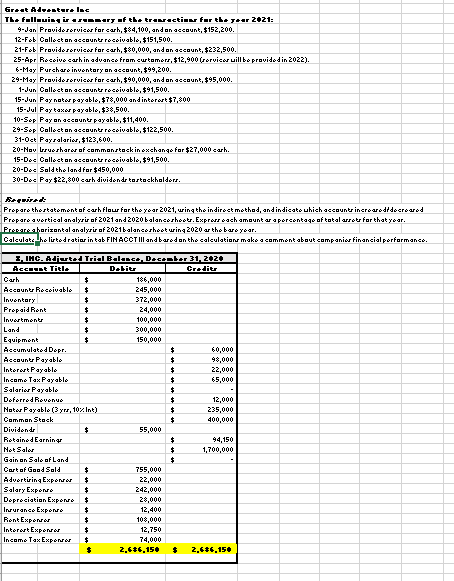

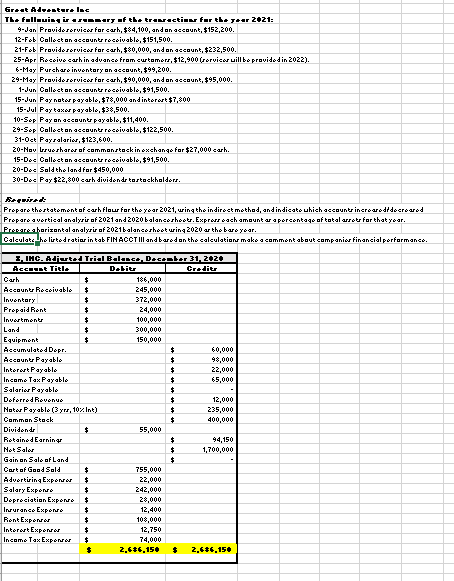

Greut Alunterlac The following in urmary of the trenection for the year 2021: 9-Jan Providerervices for carh, $84,100, and on account, $152,200. 12-Feb Collect on accounts receivable, $151,500. 21-Feb Pravidorervices for carh, $80,000, and an account, $232,500. 25-Apr Receive carhin advance from curtomers, $12,900 (servicar uill be provided in 2022). 6-May Purchare inventary on account, $99,200. 29-May Provide services for carh, $90,000, and on account, $95,000. 1-Jun Collect an accounts receivable, $91,500, 15-Jun Pay notar payable, $78,000 and interart $7,800 15-Jul Paytaxe payablo, $38,500. 10-Sop Payon accounts payable, $11,400. 29-Sop Collect an accounts receivable, $122,500. 31-Oct Paysalaries, $123,600. 20-Nov urrueshares of commansteck in exchange for $27,000 carh. 15-Dec Collect on accounts receivable, $91,500. 20-Des Sold the land for $450,000 30-Dec Pay $22,800 carh dividends tostockholders. Land Arquired Prepare thertatement of carh flour for the year 2021, wing the indirect method, and indicato which account increased decreared Proparo a vertical analysis of 2021 and 2020 balancoshootr. Exprorroach amountar a percentage of total arrots for that year. Prepare a horizontal analyrir of 2021 balancesheet wing 2020 ar the bare year. Calculate the listed ratior in tab FIN ACCT III and barodon the calculation make a comment about companier financial performance. E, INC. Adiuterial Balance, December 31, 2026 Account Title Debit Credits Carh $ 186,000 Account Receivable $ 245,000 Inventary $ 372,000 Propaid Rent $ 24,000 | Investments $ 100,000 $ 300,000 Equipment $ 150,000 Accumulated Dopr. $ 60,000 Account Payable Interart Payable $ 22,000 Income Tax Payablo $ 65,000 Salariar Payable $ Deferred Revenue $ 12,000 Notar Payable (3 yrs, 107. Int) $ 235,000 Common Stock $ 400,000 Dividende 55,000 Retained Earning 94,150 Net Salor $ 1,700,000 Gain on Sale of Land Cart of Good Sold $ 755,000 Advertiring Expona $ 22,000 Salary Enpero $ 242,000 Depreciation Expono 28,000 Insurance Expono $ 12,400 Rent Empen $ 108,000 Interort Exponer $ 12,750 Income To Expono $ 74,000 2.4+6.15 2.44.150 Greut Alunterlac The following in urmary of the trenection for the year 2021: 9-Jan Providerervices for carh, $84,100, and on account, $152,200. 12-Feb Collect on accounts receivable, $151,500. 21-Feb Pravidorervices for carh, $80,000, and an account, $232,500. 25-Apr Receive carhin advance from curtomers, $12,900 (servicar uill be provided in 2022). 6-May Purchare inventary on account, $99,200. 29-May Provide services for carh, $90,000, and on account, $95,000. 1-Jun Collect an accounts receivable, $91,500, 15-Jun Pay notar payable, $78,000 and interart $7,800 15-Jul Paytaxe payablo, $38,500. 10-Sop Payon accounts payable, $11,400. 29-Sop Collect an accounts receivable, $122,500. 31-Oct Paysalaries, $123,600. 20-Nov urrueshares of commansteck in exchange for $27,000 carh. 15-Dec Collect on accounts receivable, $91,500. 20-Des Sold the land for $450,000 30-Dec Pay $22,800 carh dividends tostockholders. Land Arquired Prepare thertatement of carh flour for the year 2021, wing the indirect method, and indicato which account increased decreared Proparo a vertical analysis of 2021 and 2020 balancoshootr. Exprorroach amountar a percentage of total arrots for that year. Prepare a horizontal analyrir of 2021 balancesheet wing 2020 ar the bare year. Calculate the listed ratior in tab FIN ACCT III and barodon the calculation make a comment about companier financial performance. E, INC. Adiuterial Balance, December 31, 2026 Account Title Debit Credits Carh $ 186,000 Account Receivable $ 245,000 Inventary $ 372,000 Propaid Rent $ 24,000 | Investments $ 100,000 $ 300,000 Equipment $ 150,000 Accumulated Dopr. $ 60,000 Account Payable Interart Payable $ 22,000 Income Tax Payablo $ 65,000 Salariar Payable $ Deferred Revenue $ 12,000 Notar Payable (3 yrs, 107. Int) $ 235,000 Common Stock $ 400,000 Dividende 55,000 Retained Earning 94,150 Net Salor $ 1,700,000 Gain on Sale of Land Cart of Good Sold $ 755,000 Advertiring Expona $ 22,000 Salary Enpero $ 242,000 Depreciation Expono 28,000 Insurance Expono $ 12,400 Rent Empen $ 108,000 Interort Exponer $ 12,750 Income To Expono $ 74,000 2.4+6.15 2.44.150