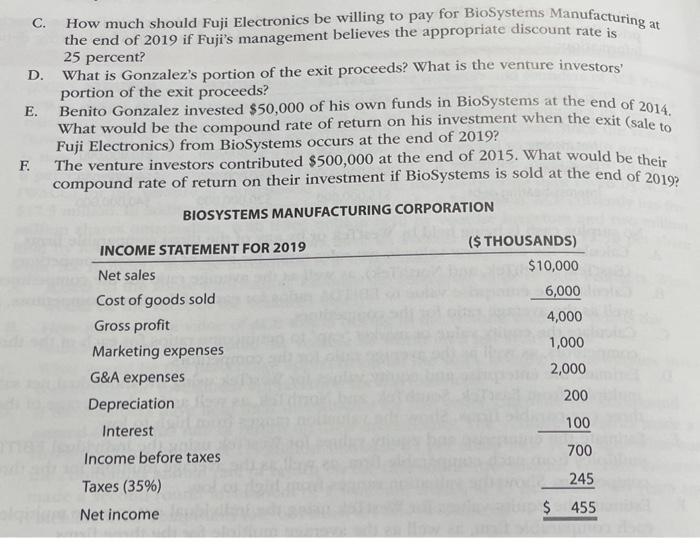

grew the 4. (Venture Capital (WC) Method Valuation Concepts) Benito Gonzalez founded and BioSystems Manufacturing Corporation over a several year period. However, Benito has decided to harvest or exit BioSystems now at the end of 2019 with the intention of start- ing a new entrepreneurial venture. The Fuji Electronics Company is considering acquiring BioSystems, which is 60 percent owned by Benito Gonzalez; the other 40 percent of the equity is held by venture investors who also desire to exit the venture. However, while the venture is currently profitable, Benito believes BioSystems will be entering a period of rapid growth and increasing profitability. BioSystems' sales are expected to grow from the 2019 level at a 20 percent annual compound rate over each of the next three (2020, 2021, 2022) years. Cost of goods sold, marketing, depreciation, and interest expenses are expected to move or vary with sales (i.e., they are variable expenses). General and admin- istrative (G&A) expenses are expected to remain constant each year (i.e., they are fixed expenses). The income tax rate is expected to be 35 percent. A. Using the percent-of-sales relationships indicated above, prepare BioSystems' pro- jected income statement for 2022. B. Fuji Electronics has examined other recent acquisitions in BioSystems' industry and believes that a 17 times price-earnings multiple would be appropriate for valuing BioSystems. Calculate BioSystems' equity value at the end of 2022. C. at How much should Fuji Electronics be willing to pay for BioSystems Manufacturing a the end of 2019 if Fuji's management believes the appropriate discount rate is 25 percent? D. What is Gonzalez's portion of the exit proceeds? What is the venture investors' portion of the exit proceeds? E. Benito Gonzalez invested $50,000 of his own funds in BioSystems at the end of 2014. What would be the compound rate of return on his investment when the exit (sale to Fuji Electronics) from BioSystems occurs at the end of 2019? F. The venture investors contributed $500,000 at the end of 2015. What would be their compound rate of return on their investment if BioSystems is sold at the end of 2019? BIOSYSTEMS MANUFACTURING CORPORATION ($ THOUSANDS) INCOME STATEMENT FOR 2019 $10,000 Net sales 6,000 Cost of goods sold 4,000 Gross profit 1,000 Marketing expenses G&A expenses 2,000 200 Depreciation Interest Income before taxes Taxes (35%) Net income 100 700 245 $ 455