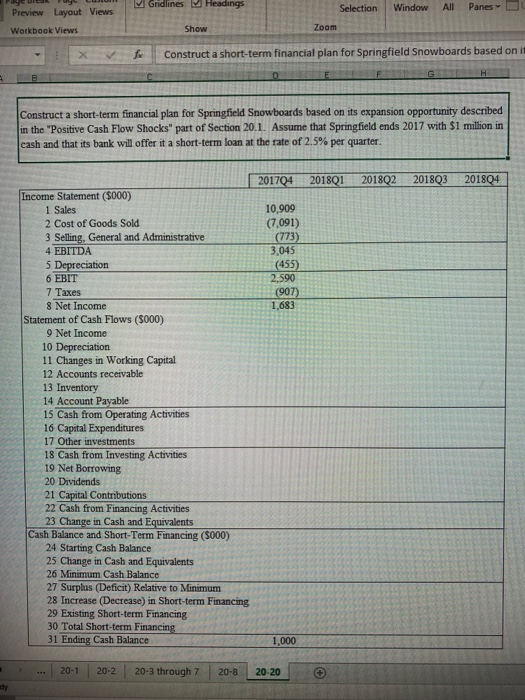

Gridlines M Headings Selection Window All Panes Preview Layout Views Workbook Views Show Zoom Construct a short-term financial plan for Springfield Snowboards based on in G Construct a short-term financial plan for Springfield Snowboards based on its expansion opportunity described in the "Positive Cash Flow Shocks" part of Section 20.1. Assume that Springfield ends 2017 with $1 million in cash and that its bank will offer it a short-term loan at the rate of 2.5% per quarter. 201704 201801 2018Q2 201803 201804 10,909 (7,091) (773) 3,045 (455) 2,590 (907) 1,683 Income Statement (5000) 1 Sales 2 Cost of Goods Sold 3 Selling, General and Administrative 4 EBITDA 5 Depreciation 6 EBIT 7 Taxes 8 Net Income Statement of Cash Flows ($000) 9 Net Income 10 Depreciation 11 Changes in Working Capital 12 Accounts receivable 13 Inventory 14 Account Payable 15 Cash from Operating Activities 16 Capital Expenditures 17 Other investments 18 Cash from Investing Activities 19 Net Borrowing 20 Dividends 21 Capital Contributions 22 Cash from Financing Activities 23 Change in Cash and Equivalents Cash Balance and Short-Term Financing (5000) 24 Starting Cash Balance 25 Change in Cash and Equivalents 26 Minimum Cash Balance 27 Surplus (Deficit) Relative to Minimum 28 Increase (Decrease) in Short-term Financing 29 Existing Short-term Financing 30 Total Short-term Financing 31 Ending Cash Balance 1,000 20-1 20-2 20-3 through 7 20-8 20-20 Gridlines M Headings Selection Window All Panes Preview Layout Views Workbook Views Show Zoom Construct a short-term financial plan for Springfield Snowboards based on in G Construct a short-term financial plan for Springfield Snowboards based on its expansion opportunity described in the "Positive Cash Flow Shocks" part of Section 20.1. Assume that Springfield ends 2017 with $1 million in cash and that its bank will offer it a short-term loan at the rate of 2.5% per quarter. 201704 201801 2018Q2 201803 201804 10,909 (7,091) (773) 3,045 (455) 2,590 (907) 1,683 Income Statement (5000) 1 Sales 2 Cost of Goods Sold 3 Selling, General and Administrative 4 EBITDA 5 Depreciation 6 EBIT 7 Taxes 8 Net Income Statement of Cash Flows ($000) 9 Net Income 10 Depreciation 11 Changes in Working Capital 12 Accounts receivable 13 Inventory 14 Account Payable 15 Cash from Operating Activities 16 Capital Expenditures 17 Other investments 18 Cash from Investing Activities 19 Net Borrowing 20 Dividends 21 Capital Contributions 22 Cash from Financing Activities 23 Change in Cash and Equivalents Cash Balance and Short-Term Financing (5000) 24 Starting Cash Balance 25 Change in Cash and Equivalents 26 Minimum Cash Balance 27 Surplus (Deficit) Relative to Minimum 28 Increase (Decrease) in Short-term Financing 29 Existing Short-term Financing 30 Total Short-term Financing 31 Ending Cash Balance 1,000 20-1 20-2 20-3 through 7 20-8 20-20