Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grixdale Tax Services prepares taxes for individuals. Grixdale offers a simplified pricing model with two alternatives for taxpayers: Standard Deduction (Standard) or Itemized Deductions

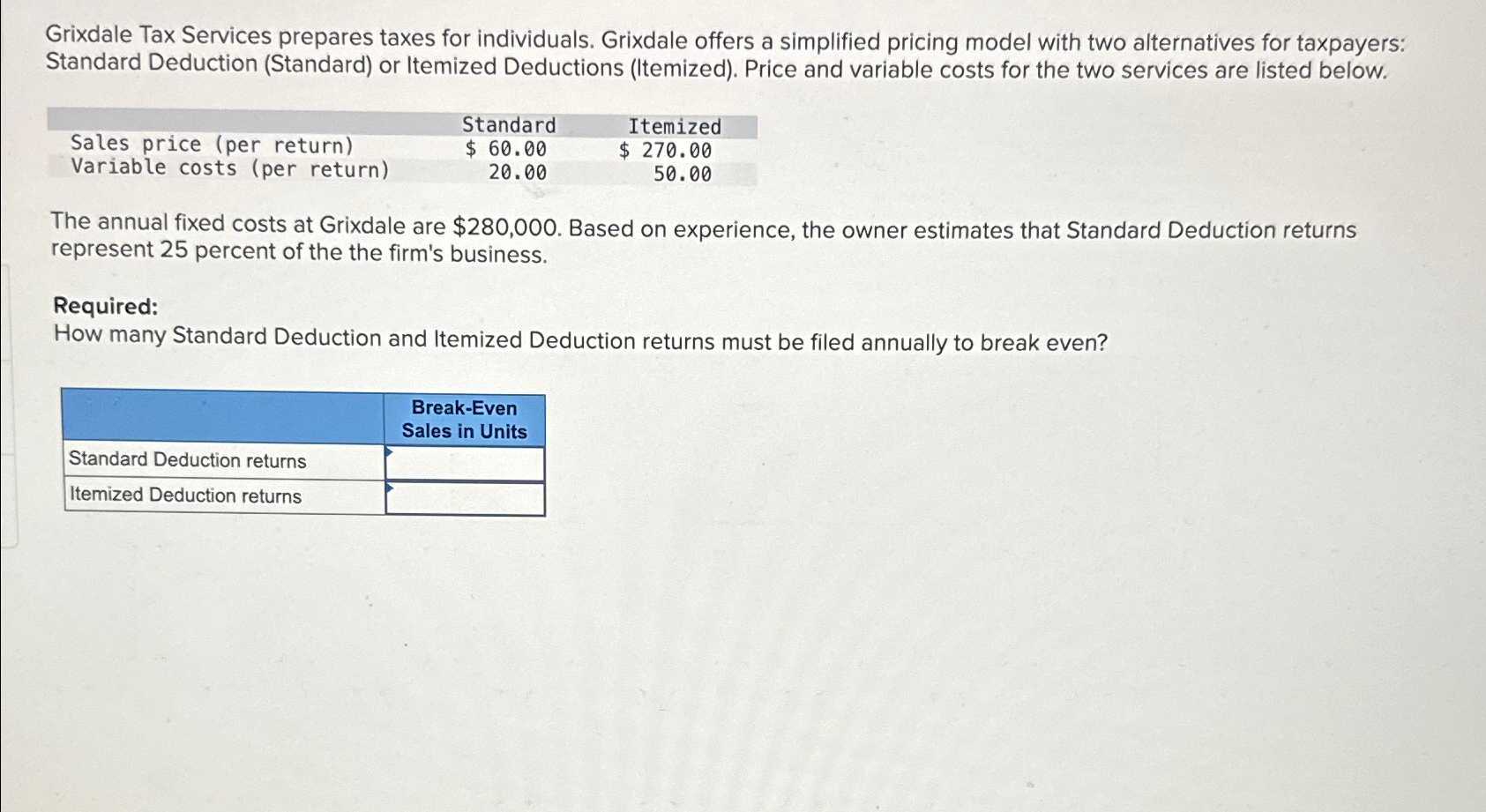

Grixdale Tax Services prepares taxes for individuals. Grixdale offers a simplified pricing model with two alternatives for taxpayers: Standard Deduction (Standard) or Itemized Deductions (Itemized). Price and variable costs for the two services are listed below. Sales price (per return) Variable costs (per return) Standard $ 60.00 20.00 Itemized $ 270.00 50.00 The annual fixed costs at Grixdale are $280,000. Based on experience, the owner estimates that Standard Deduction returns represent 25 percent of the the firm's business. Required: How many Standard Deduction and Itemized Deduction returns must be filed annually to break even? Standard Deduction returns Itemized Deduction returns Break-Even Sales in Units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the breakeven point we need to determine the total contribution margin per return for each service The contribution margin is the difference between the sales price per return and the var...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started