Answered step by step

Verified Expert Solution

Question

1 Approved Answer

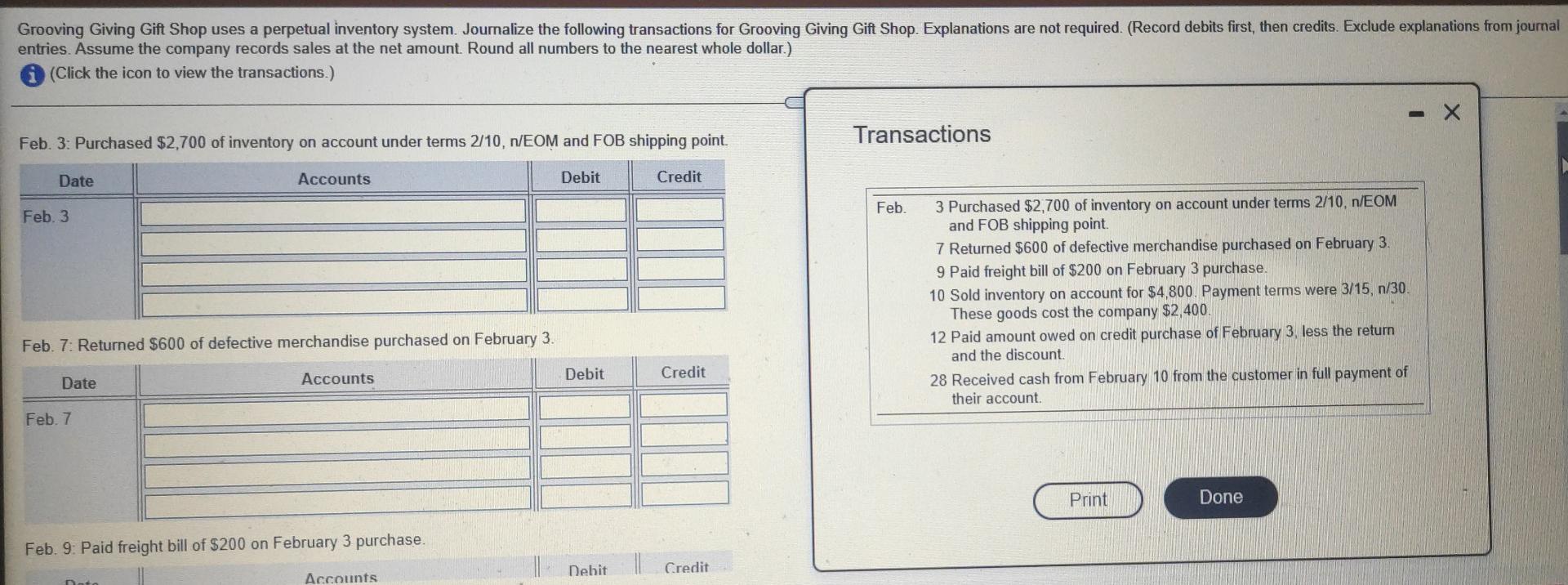

Grooving Giving Gift Shop uses a perpetual inventory system. Journalize the following transactions for Grooving Giving Gift Shop. Explanations are not required. (Record debits first,

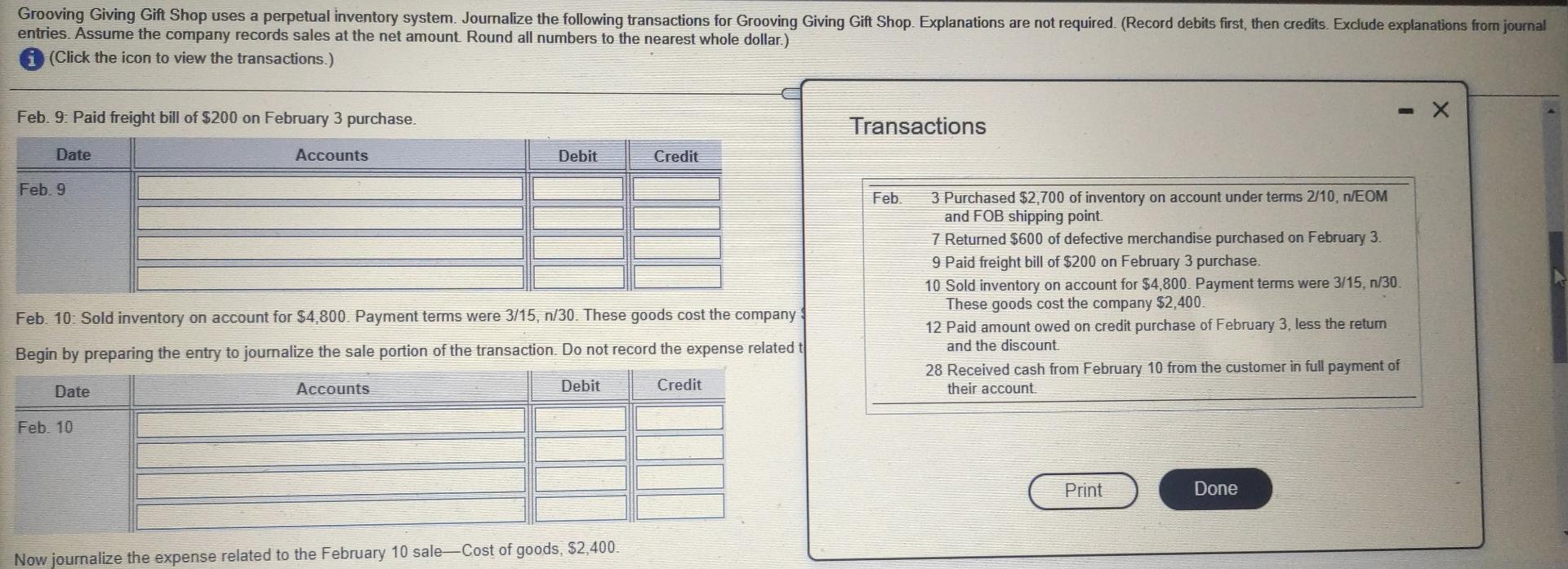

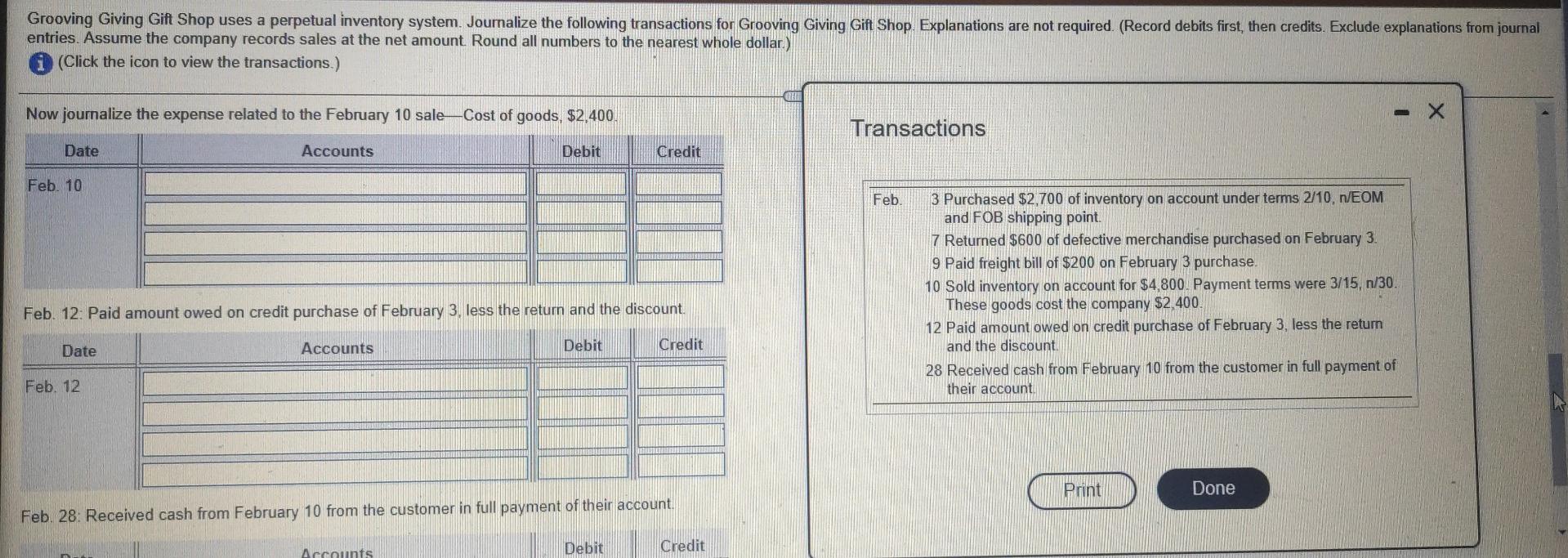

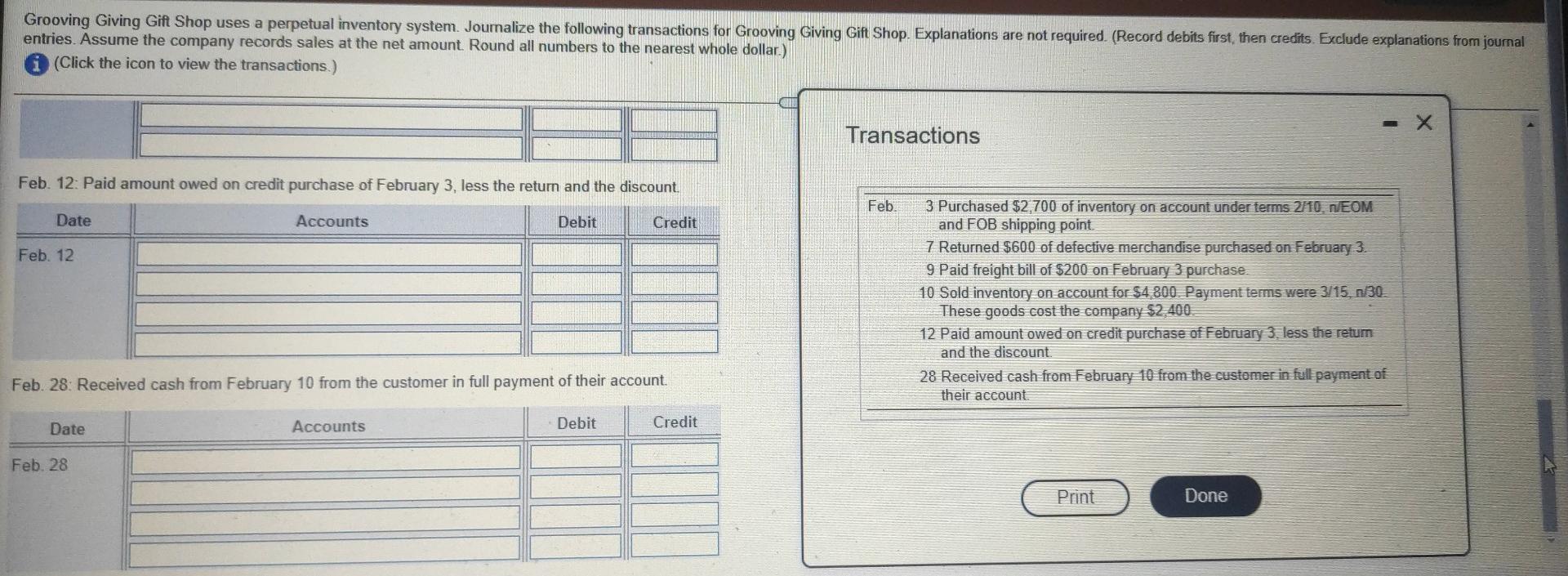

Grooving Giving Gift Shop uses a perpetual inventory system. Journalize the following transactions for Grooving Giving Gift Shop. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount. Round all numbers to the nearest whole dollar.) (Click the icon to view the transactions.) - X Transactions Feb. 3: Purchased $2,700 of inventory on account under terms 2/10,n/EOM and FOB shipping point. Date Accounts Debit Credit Feb. Feb. 3 3 Purchased $2,700 of inventory on account under terms 2/10, n/EOM and FOB shipping point. 7 Returned $600 of defective merchandise purchased on February 3. 9 Paid freight bill of $200 on February 3 purchase. 10 Sold inventory on account for $4,800. Payment terms were 3/15, n/30. These goods cost the company $2,400. 12 Paid amount owed on credit purchase of February 3, less the return and the discount 28 Received cash from Febru 10 from the customer in full payment of their account. Feb. 7. Returned $600 of defective merchandise purchased on February 3. Accounts Debit Date Credit Feb. 7 Print Done Feb. 9: Paid freight bill of $200 on February 3 purchase. Debit Credit Accounts Grooving Giving Gift Shop uses a perpetual inventory system. Journalize the following transactions for Grooving Giving Gift Shop. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount Round all numbers to the nearest whole dollar.) (Click the icon to view the transactions.) Feb. 9: Paid freight bill of $200 on February 3 purchase. Transactions Date Accounts Debit Credit Feb. 9 Feb. 3 Purchased $2,700 of inventory on account under terms 2/10, n/EOM and FOB shipping point 7 Returned $600 of defective merchandise purchased on February 3. 9 Paid freight bill of $200 on February 3 purchase. 10 Sold inventory on account for $4,800. Payment terms were 3/15, n/30 These goods cost the company $2,400 12 Paid amount owed on credit purchase of February 3, less the return and the discount. 28 Received cash from February 10 from the customer in full payment of their account. Feb. 10: Sold inventory on account for $4,800. Payment terms were 3/15, n/30. These goods cost the company Begin by preparing the entry to journalize the sale portion of the transaction. Do not record the expense related t Date Accounts Debit Credit Feb. 10 Print Done Now journalize the expense related to the February 10 sale Cost of goods, $2,400. Grooving Giving Gift Shop uses a perpetual inventory system. Journalize the following transactions for Grooving Giving Gift Shop Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount Round all numbers to the nearest whole dollar.) (Click the icon to view the transactions.) Now journalize the expense related to the February 10 sale-Cost of goods, $2,400. Transactions Date Accounts Debit Credit Feb. 10 Feb 3 Purchased $2,700 of inventory on account under terms 2/10, n/EOM and FOB shipping point 7 Returned $600 of defective merchandise purchased on February 3 9 Paid freight bill of $200 on February 3 purchase. 10 Sold inventory on account for $4,800. Payment terms were 3/15, n/30. These goods cost the company $2,400. 12 Paid amount owed on credit purchase of February 3, less the return and the discount, 28 Received cash from February 10 from the customer in full payment of their account. Feb. 12: Paid amount owed on credit purchase of February 3, less the return and the discount Date Accounts Debit Credit Feb. 12 Print Done Feb. 28: Received cash from February 10 from the customer in full payment of their account. Accounts Debit Credit Grooving Giving Gift Shop uses a perpetual inventory system. Journalize the following transactions for Grooving Giving Gift Shop. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount Round all numbers to the nearest whole dollar.) (Click the icon to view the transactions.) - X Transactions Feb. 12: Paid amount owed on credit purchase of February 3, less the return and the discount Feb Date Accounts Debit Credit Feb. 12 3 Purchased $2,700 of inventory on account under terms 2710. nEOM and FOB shipping point 7 Returned $600 of defective merchandise purchased on February 3. 9 Paid freight bill of $200 on February 3 purchase. 10 Sold inventory on account for $4.800. Payment terms were 3/15, n/30 These goods cost the company $2.400. 12 Paid amount owed on credit purchase of February 3. less the retum and the discount. 28 Received cash from February 10 from the customer in full payment of their account Feb. 28: Received cash from February 10 from the customer in full payment of their account. Date Accounts Debit Credit Feb. 28 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started