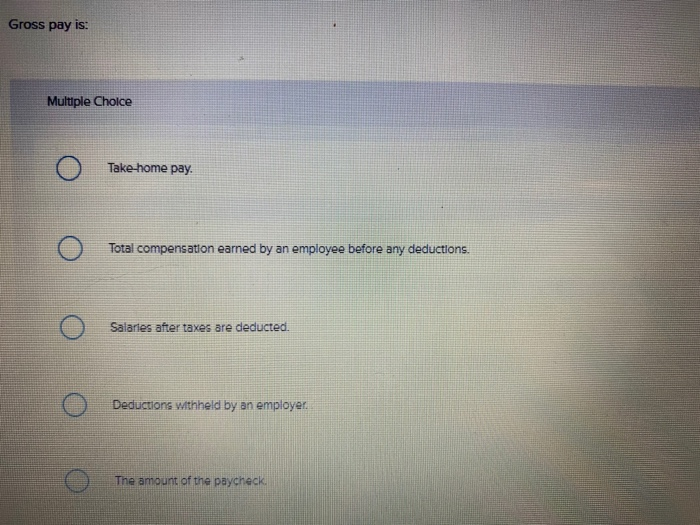

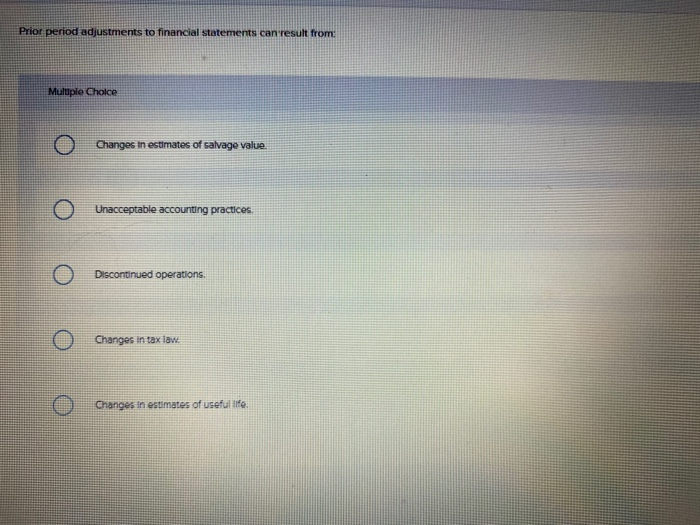

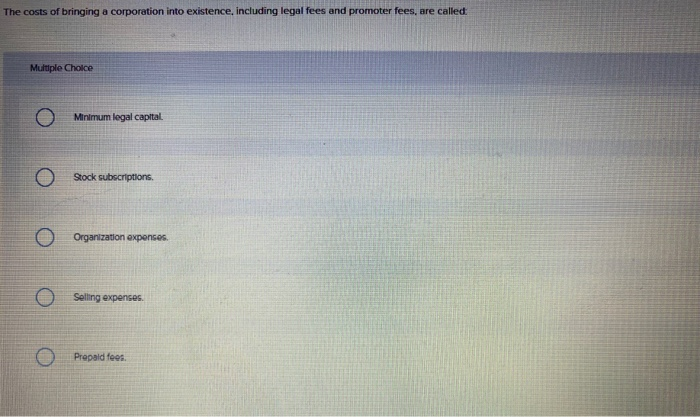

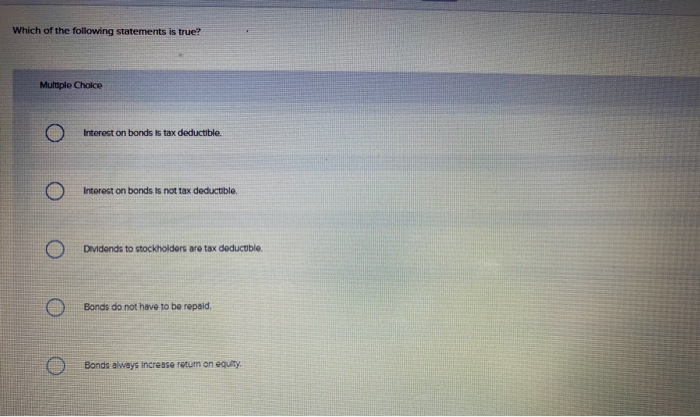

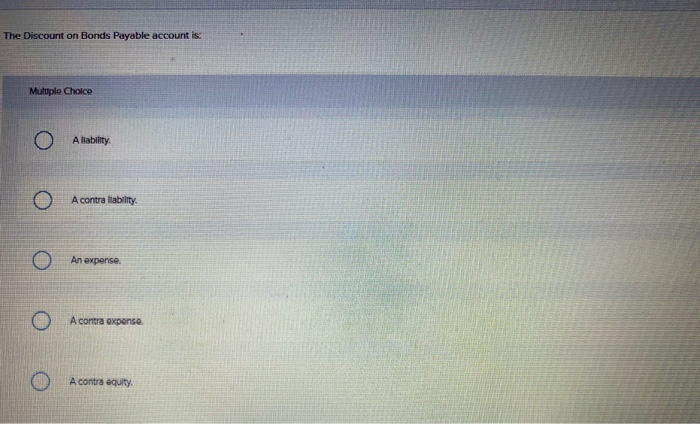

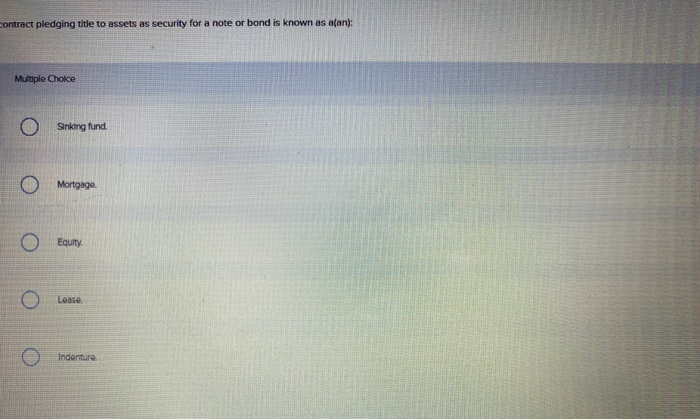

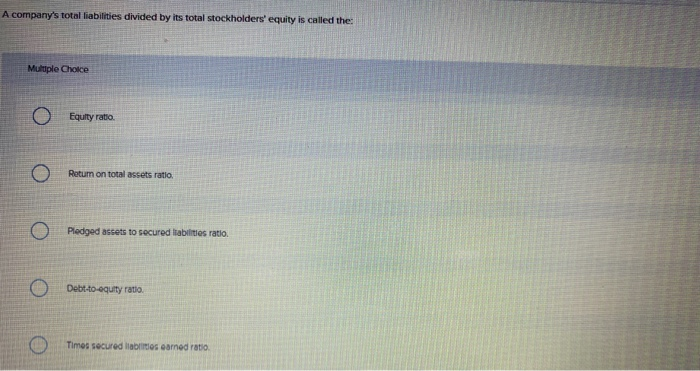

Gross pay is: Multiple Choice Take home pay. Total compensation earned by an employee before any deductions. Salaries after taxes are deducted. Deductions withheld by an employer. The amount of the paycheck. Prior period adjustments to financial statements can result from: Multiple Choice Changes in estimates of salvage value. Unacceptable accounting practices. Discontinued operations. Changes in tax law. Changes in estimates of useful for Accrued vacation benefits are a form of estimated liability for an employer. True or False True False The costs of bringing a corporation into existence, including legal fees and promoter fees, are called Multiple Choice Minimum legal capital O Stock subscriptions Organization expenses O Selling expenses. O Prepaid tees. Which of the following statements is true? Multiple Choice Interest on bonds is tax deductible. Interest on bonds is not tax deductible. Dividends to stockholders are tax deductible Bonds do not have to be repaid Bonds always increase retum on equity The Discount on Bonds Payable account is: Multiple Choice Allability A contra liability An expense A contra expense. A contra equity. contract pledging title to assets as security for a note or bond is known as aan): Multiple Choice O sinking fund. O Mortgage OEauty O Lease Indertura A company's total liabilities divided by its total stockholders' equity is called the Muluple Choice Equity ratio Return on total assets ratio. O Pledged assets to secured liabilities ratio. O Debt-to-equity ratio Times secured liabits earned ratio Accounts payable are: Multiple Choice Amounts owed to suppliers for products and/or services purchased on credit Amounts received in advance from customers for future services Estimated liabilities Not usually due on specific dates. Always payable within 30 days FICA taxes include: Multiple Choice Social Security and Medicare taxes. Charitable giving Employee state income tax Federal and state unemployment taxes Farming income crop adjustment taxes The state unemployment tax rates applied to an employer are adjusted according to an employer's merit rating. True or False True False Debt guarantees are: Multiple Choice Never disclosed in the financial statements. Considered to be contingent liabilities. A bad business practice Recorded as liabilities even though it is highly unlikely that the original debtor will default Considered to be an unearned revenue