Answered step by step

Verified Expert Solution

Question

1 Approved Answer

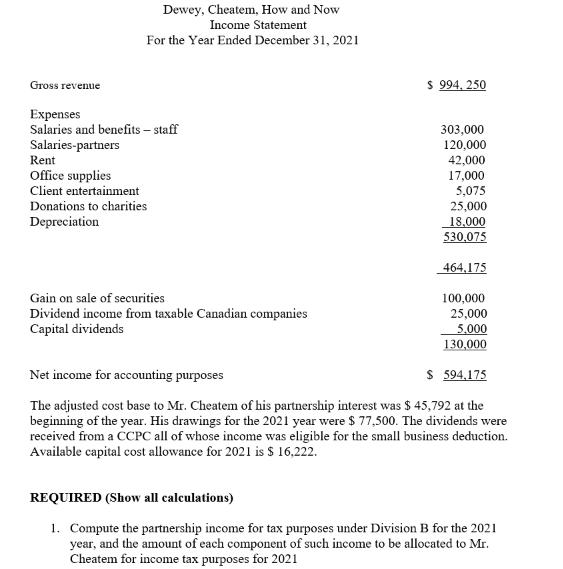

Gross revenue Dewey, Cheatem, How and Now Income Statement For the Year Ended December 31, 2021 Expenses Salaries and benefits - staff Salaries-partners Rent

Gross revenue Dewey, Cheatem, How and Now Income Statement For the Year Ended December 31, 2021 Expenses Salaries and benefits - staff Salaries-partners Rent Office supplies Client entertainment Donations to charities Depreciation Gain on sale of securities Dividend income from taxable Canadian companies Capital dividends $ 994,250 303,000 120,000 42,000 17,000 5,075 25,000 18,000 530,075 464,175 100,000 25,000 5,000 130,000 Net income for accounting purposes $ 594,175 The adjusted cost base to Mr. Cheatem of his partnership interest was $ 45,792 at the beginning of the year. His drawings for the 2021 year were $ 77,500. The dividends were received from a CCPC all of whose income was eligible for the small business deduction. Available capital cost allowance for 2021 is $ 16,222. REQUIRED (Show all calculations) 1. Compute the partnership income for tax purposes under Division B for the 2021 year, and the amount of each component of such income to be allocated to Mr. Cheatem for income tax purposes for 2021

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Starting with the net income for accounting purposes Net income for accounting purposes 594175 Calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started