Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gross wages = $57408 per year. marital status: single Many people count on tax returns for income to help them catch up on bills, buy

Gross wages = $57408 per year.

marital status: single

Many people count on tax returns for income to help them catch up on bills, buy something nice, etc. Lets say you claim head of household for tax purposes. With the new house though, your itemized deductions are $12,150.

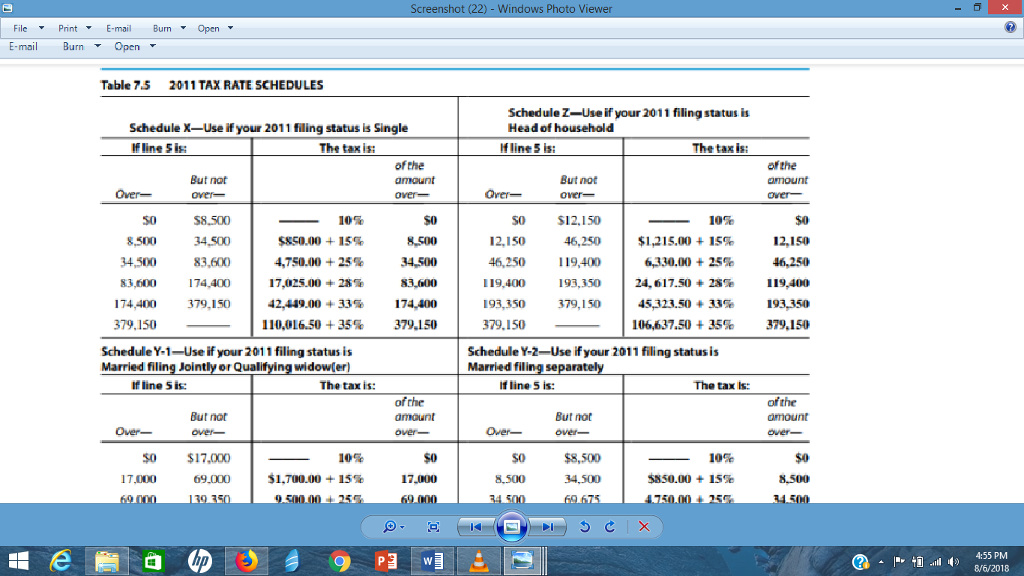

15)Use the tax table below to calculate your incometax liability. Assume three exemptions.

Is this any better? The bottom is cut off but the filing status for single is on the top. The picture dimensions seem to change after I upload the question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started