Question

Group Real World Workshop Presentation Please answer the questions at the bottom of this document in a PowerPoint presentation (maximum 2 slides for scenario 1

Group Real World Workshop Presentation

Please answer the questions at the bottom of this document in a PowerPoint presentation (maximum 2 slides for scenario 1 and 2, 3 slides for scenario 3, plus an appendix if desired) which will constitute your recommendations to the management team.

You are not allowed to exchange information with other teams or use any other outside information as that would totally defeat this opportunity to learn and will automatically culminate in an F on the assignment. In the real world, you cannot have a look at 'what happened' as you make it happen! The goal is for you to help the CEO.

The purpose of this exercise is to learn how to improve profits in commoditized markets where differentiation options are very limited. Cost cutting is obviously one of them but overlooked ones are (1) service optimization (which we will discuss later on as well) and (2) price optimization. The case below is about the latter.

Case description (disguised):

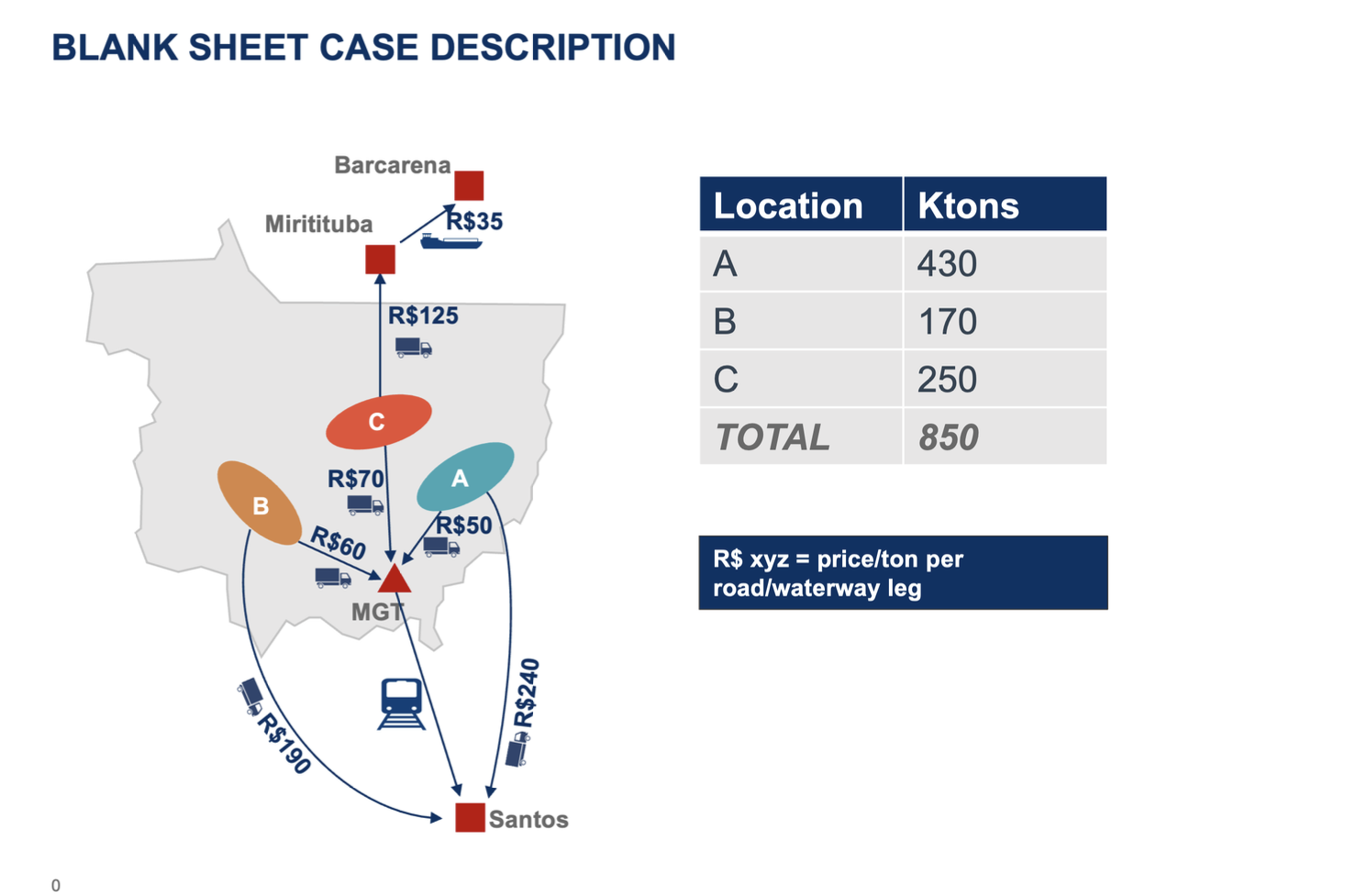

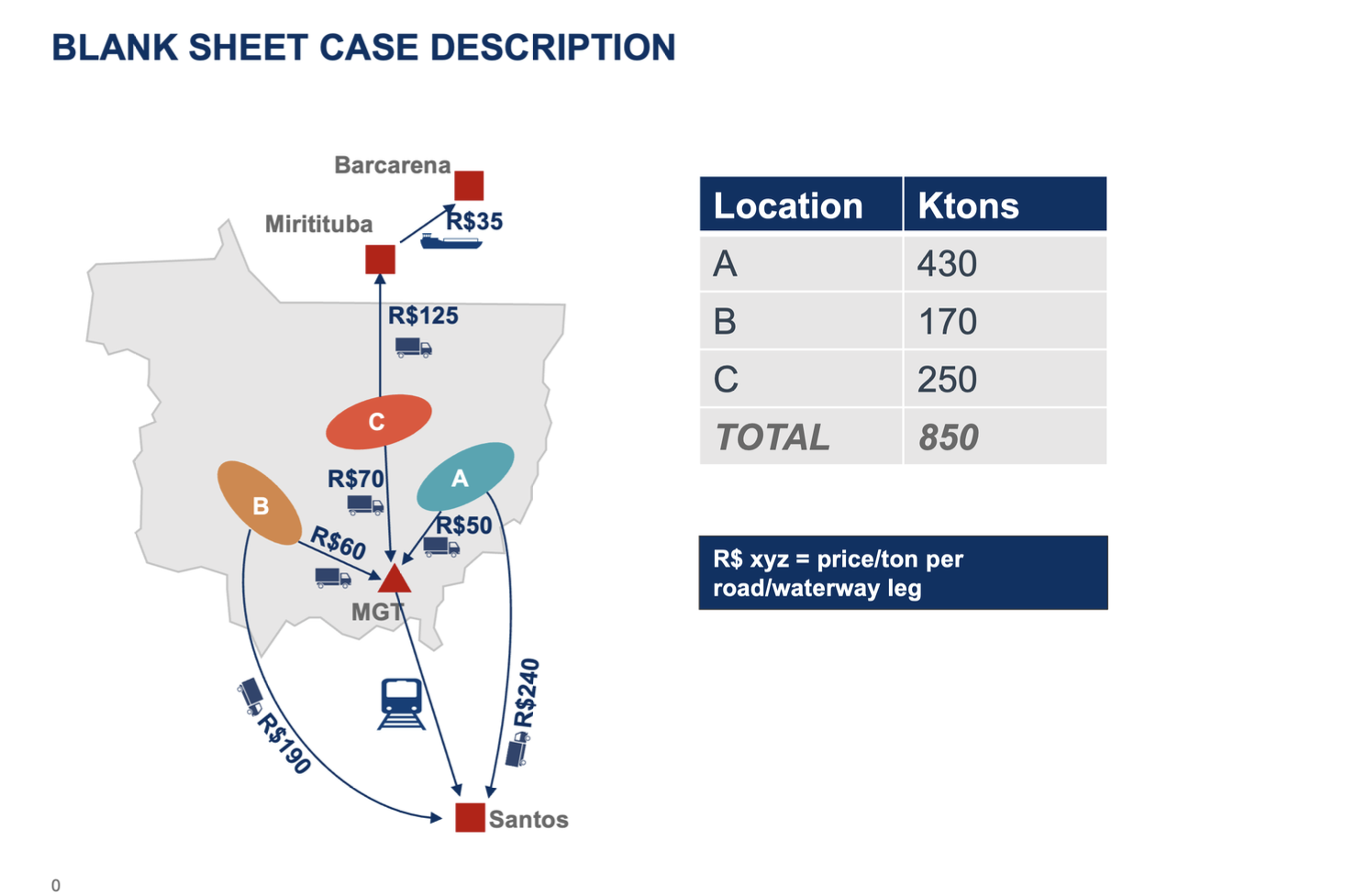

A particular rail freight company MGC needs to set a price/ton (in R$/ton) to transport grains (corn) from the rail terminal of MGT to the seaport of Santos, near Sao Paolo in Brazil. The company has (for simplicity) 3 customers (farmers) on 3 different locations A, B and C who want to transport the corn to one of Brazil's seaports and from there via a large sea vessel to its customers worldwide. One customer, located in A needs to transport 430 Ktons (1 Kton = 1000 tons), the customer located in B needs to transport 170 Ktons and another customer located in C needs to transport 250 Ktons. The total volume that these customers need to transport to a seaport is therefore 850Ktons.

Customer Ktons location

A 430

B 170

C 250

Two of these customers, A and B have 2 viable options:

- Option 1 (truck-rail): They can transport the grains by truck to MGT and unload them onto a number of MGC's rail freight cars which will transport them to the seaport of Santos. In Santos the trucks are then unloaded and then uploaded onto a sea vessel. The price per ton to bring the corn to the MGT terminal is R$50/t for customer A and R$60/t for customer B (who is located closer to the train terminal).

- Option 2 (truck only): They can transport the grains by truck from their location all the way to the port of Santos. That costs R$240/t for customer A who is located further from the port of Santos and R$190/t for customer B who is closer to the port of Santos than customer A.

1

Group real-world workshop presentation Customer C is located up North in Brazil. This customer has 2 viable options too:

- Option 1 (truck-train): As with customers A and B, the customer can either load the grains onto a number of trucks at its farm. These trucks will then transport the grains to MGT where they will be uploaded onto a number of train cars. These grains then be transported by rail to the port of Santos. The price per ton to transport them from farm C to MGT is R$70/t.

- Option 2 (truck-inland waterways): As the customer is located more to the North, it can also take the truck-waterways combination: First transport the grains by truck to the city of Miritituba at a price of R$125/t and load them on a river cargo ship that will transport them on the river to the seaport of Barcarena at a price of R$35/t. In Barcarena, the grains can then be unloaded from the river boat and loaded on a sea vessel to be transported to this customer's customers world-wide. You can assume that the cost of transporting grains from both seaports of Santos and Barcarena to its customers world-wide is the same.

The situation is presented below:

2

Group real-world workshop presentation

There are lots of small truck companies in Brazil and their prices are not influenced by the price charged by MGC. It is determined by the price of diesel and is expected to stay the same next year.

Assume also that there is no difference in quality of service between the truck-rail versus the truck-only or the truck-inland waterways options with the following exception:

There are different percentages of grain losses associated with the combined modes of transportation: 0.25% of the grains are lost when unloading from a truck onto a train and another 0.25% is lost during transportation by train. Hence of 1 ton loaded onto a truck at the farm only 0.995t reaches the seaport of Santos when using the truck/train mode.

0.25% of the grains are lost when unloading grains from a truck onto a river cargo ship but no grains are lost during the transportation by river cargo ship. Here again, of 1 ton loaded onto a truck at farm C, only 0.9975 t reaches the seaport of Barcarena when using the truck - internal waterways mode.

The loss of grains when onloading from either a truck, train or river cargo ship onto a sea vessel (either in Santos or Barcarena) is the same and can be ignored here. The loss in value of a ton of grains to the farmer equals R$2000.

Assume that MGC customers pay per ton of grain that is transported from the farm onto the truck, irrespective of later losses. Assume that at equal transportation costs customers will prefer the truck- rail combination.

The MGC trains run all the time (even empty) so the marginal cost of transporting any extra tonnage of grain is negligible (consider it zero). The average total cost at historic capacity utilization levels has been about R$60/t. There is plenty of available capacity on the trains.

3

Group real-world workshop presentation

SCENARIO 1 (35 points):

Question 1: What does the demand curve for MGC look like? Please draw it. (15 points)

Question 2: Assuming MGC does not price differentiate (i.e., charges the same price per ton to all customers), what price should MGC charge per ton to maximize profits. (15 points)

Question 3: If the Northern River Cargo (NRC) ship company Miritituba - Barcarena would respond to any loss of profitable volumes due to MGC pricing, would that affect your price/ton? (5 points)

SCENARIO 2 (30 points)

Imagine that customers A, B and C were to be acquired by one company (say Cargill) so that A, B and C are now just different farming and harvesting locations from which that customer originates grains.

Question 4: How would that change your price per ton, if at all? (15 points)

Note that you cannot engage in take-it-or leave it negotiations. You can only set a price per ton (and not make it conditional on, say, using MGC for all of Cargill's volume)

The rationale for this (which you can ignore if it confuses you) is as follows: In reality, MGC has other buyers (other than Cargill) and hence has a price policy rather than negotiated pricing.

Question 5: Imagine you could now use a volume discount mechanism (E.g. A price of R$P for the first x tons, a discount of R$D1/t and hence a price of R$(P-D1) for a volume exceeding x tons and yet another deeper discount of R$D2/t and hence a price of R$(P-D2) for a volume exceeding y tons next, what would that discount structure be (i.e. what is (x, D1) and (y, D2)? (15 points)

SCENARIO 3 (25 points)

Imagine now that we are back in Scenario 1 with 3 independent farmers in location A, B and C. The total volume that these 3 farmers need to transport to a seaport of Brazil (and from there to their clients overseas) is the same as before: 850Ktons.

In scenario 3, however, the farmer in location A harvested and needs to transport 320 Ktons of corn. The farmer in location B needs to transport 180 Ktons and the farmer in location C needs to transport 350 Ktons.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started