Answered step by step

Verified Expert Solution

Question

1 Approved Answer

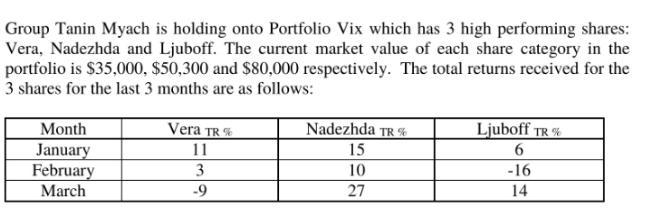

Group Tanin Myach is holding onto Portfolio Vix which has 3 high performing shares: Vera, Nadezhda and Ljuboff. The current market value of each

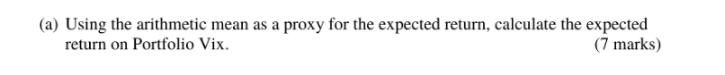

Group Tanin Myach is holding onto Portfolio Vix which has 3 high performing shares: Vera, Nadezhda and Ljuboff. The current market value of each share category in the portfolio is $35,000, $50,300 and $80,000 respectively. The total returns received for the 3 shares for the last 3 months are as follows: Month January February March Vera TR% 11 3 -9 Nadezhda TR % 15 10 27 Ljuboff TR % 6 -16 14 (a) Using the arithmetic mean as a proxy for the expected return, calculate the expected (7 marks) return on Portfolio Vix. (b) Which stock category is the most risky? Mathematically prove your result by calculating the variance and standard deviation of returns for each share. (7 marks)

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a Using the arithmetic mean as a proxy for the expected return calculate the expected return on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started