Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Growth Company is a global power and automation technologies firm that is listed on the Stock Exchange. It is all equity funded at present

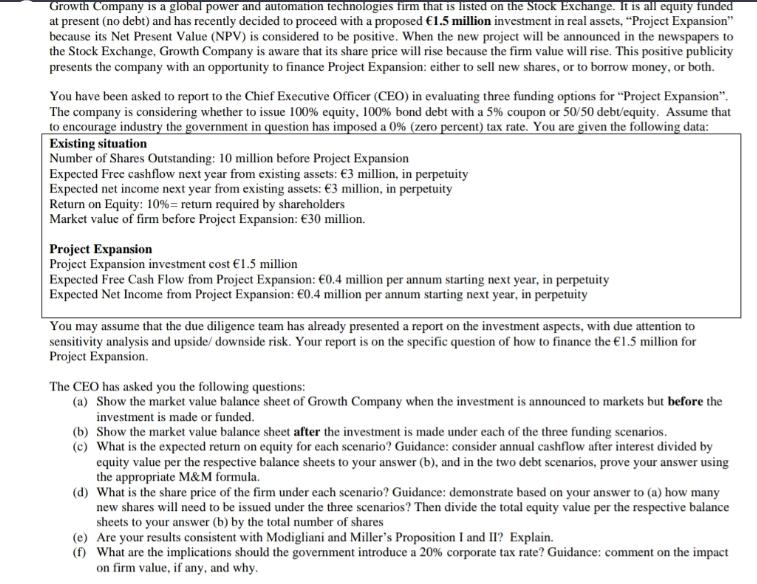

Growth Company is a global power and automation technologies firm that is listed on the Stock Exchange. It is all equity funded at present (no debt) and has recently decided to proceed with a proposed 1.5 million investment in real assets, "Project Expansion" because its Net Present Value (NPV) is considered to be positive. When the new project will be announced in the newspapers to the Stock Exchange, Growth Company is aware that its share price will rise because the firm value will rise. This positive publicity presents the company with an opportunity to finance Project Expansion: either to sell new shares, or to borrow money, or both. You have been asked to report to the Chief Executive Officer (CEO) in evaluating three funding options for "Project Expansion". The company is considering whether to issue 100% equity, 100% bond debt with a 5% coupon or 50/50 debt/equity. Assume that to encourage industry the government in question has imposed a 0 % (zero percent) tax rate. You are given the following data: Existing situation Number of Shares Outstanding: 10 million before Project Expansion Expected Free cashflow next year from existing assets: 3 million, in perpetuity Expected net income next year from existing assets: 3 million, in perpetuity Return on Equity: 10% = return required by shareholders Market value of firm before Project Expansion: 30 million. Project Expansion Project Expansion investment cost 1.5 million Expected Free Cash Flow from Project Expansion: 0.4 million per annum starting next year, in perpetuity Expected Net Income from Project Expansion: 0.4 million per annum starting next year, in perpetuity You may assume that the due diligence team has already presented a report on the investment aspects, with due attention to sensitivity analysis and upside/ downside risk. Your report is on the specific question of how to finance the 1.5 million for Project Expansion. The CEO has asked you the following questions: (a) Show the market value balance sheet of Growth Company when the investment is announced to markets but before the investment is made or funded. (b) Show the market value balance sheet after the investment is made under each of the three funding scenarios. (c) What is the expected return on equity for each scenario? Guidance: consider annual cashflow after interest divided by equity value per the respective balance sheets to your answer (b), and in the two debt scenarios, prove your answer using the appropriate M&M formula. (d) What is the share price of the firm under each scenario? Guidance: demonstrate based on your answer to (a) how many new shares will need to be issued under the three scenarios? Then divide the total equity value per the respective balance sheets to your answer (b) by the total number of shares (e) Are your results consistent with Modigliani and Miller's Proposition I and II? Explain. (f) What are the implications should the government introduce a 20% corporate tax rate? Guidance: comment on the impact on firm value, if any, and why.

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a Show the market value balance sheet of Growth Company when the investment is announced to markets but before the investment is made or funded Market Value Balance Sheet Before Investment and Funding ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started