Question

Growth Enterprises, Inc. (GEI) has $40 million that it can invest in any or all of the four capital investment projects, which have cash flows

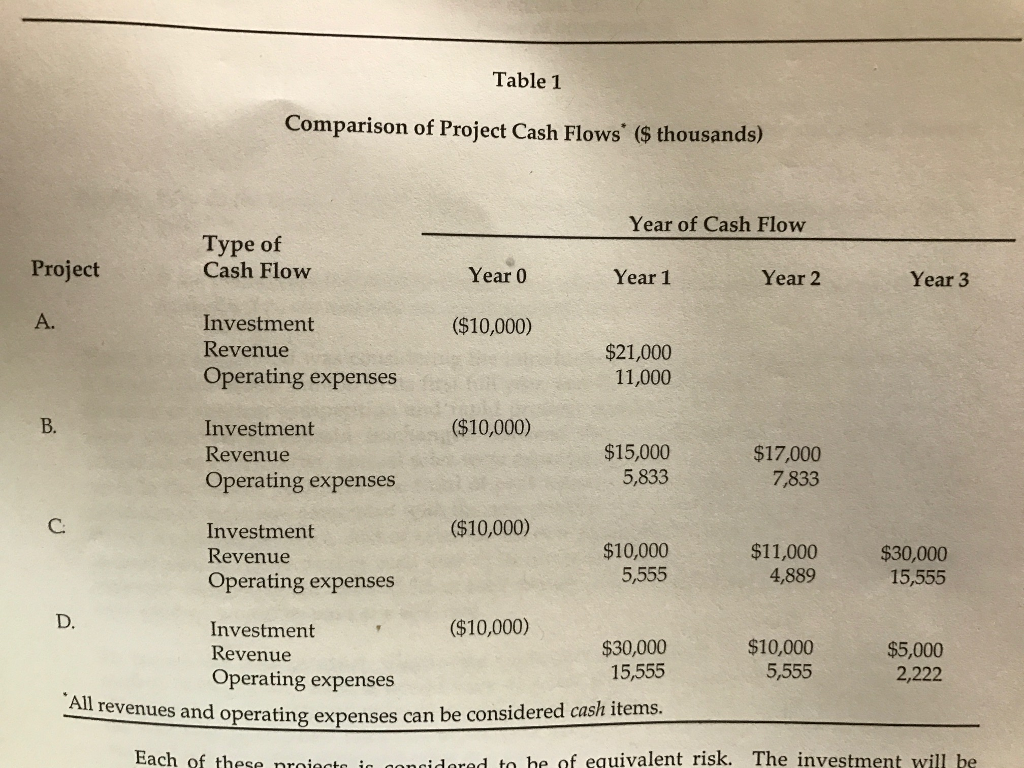

Growth Enterprises, Inc. (GEI) has $40 million that it can invest in any or all of the four capital investment projects, which have cash flows as shown in Table 1 below.

Each of these projects is considered to be of equivalent risk. The investmentw ill be depreciated to zero on a straight-line basis for tax purposes. GEI's marginal corporate tax rate on taxable income is 40%. None of the projects will have any salvage value at the end of their respective lives. For purposes of analysis, it should be assumed that all cash flows occur at the END of the year in question.

A. Rank GEI's four projects according to the following four commonly used capital budgeting criteria:

1. payback period

2. accounting return on investment. for purposes of this exercise, the accounting return on investment should be defined as folows: (average annual after tax profits) / (required investment/2)

3. internal rate of return

4. net present value, assuming alternately a 10% discount rate and a 35% discount rate

B. Why do the rankings differ? What does each technique measure and what assumptinos does it make?

C. If the projects are independent of each other, which should be accepted? If they are mutually exclusive (ie. one and only one can be accepted), which one is best?

Table 1 Comparison of Project Cash Flows (s thousands Year of Cash Flow Type of Project Cash Flow Year 0 Year 1 Year 2 Year 3 Investment ($10,000) Revenue $21,000 Operating expenses 11,000 ($10,000) Investment $15,000 $17,000 Revenue 5,833 7,833 Operating expenses ($10,000) Investment $11,000 $30,000 4,889 15,555 $10,000 Revenue 5,555 Operating expenses ($10,000) Investment $30,000 $10,000 $5,000 Revenue 5,555 15,555 2,222 Operating expenses All revenues and operating expenses can be considered cash items. Each of these proia in nn dared to be of equivalent risk. The investment will beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started