Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Guidant returned damaged merehandise that was purchased on October 8 for a $3,500 credit on account. The merchandise originally cost $2,185 and was not restored

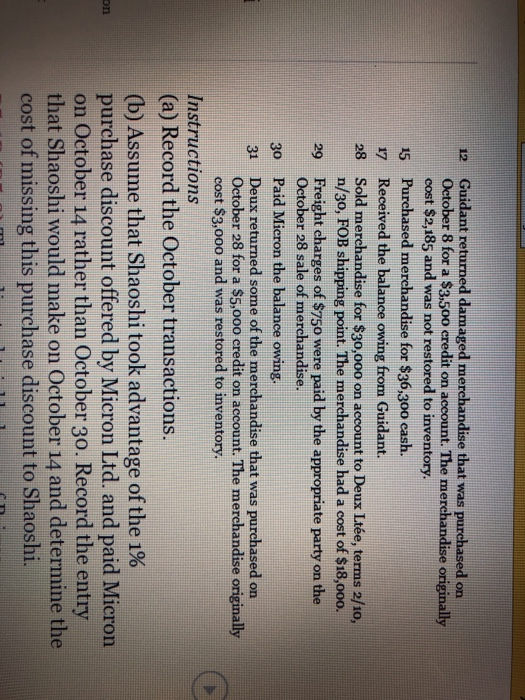

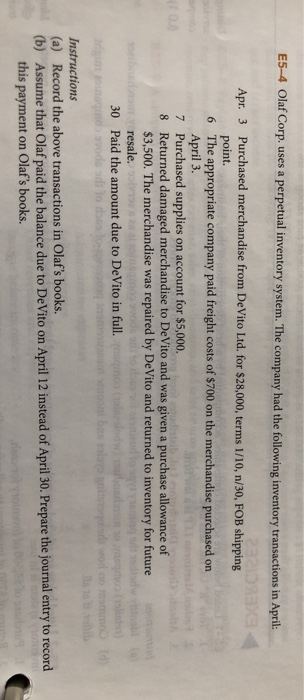

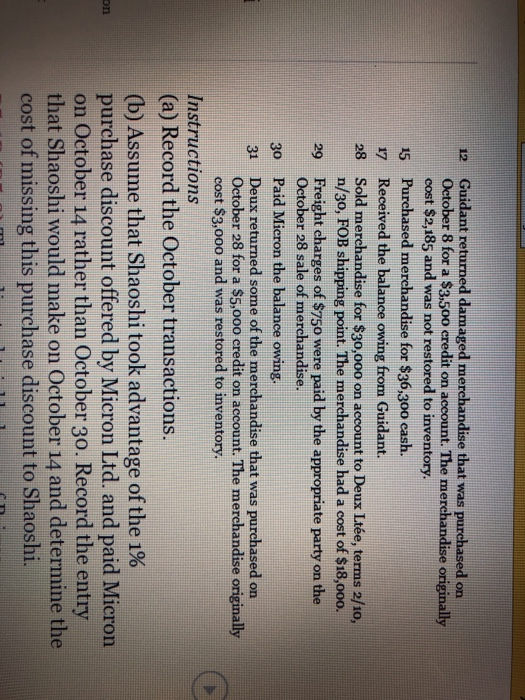

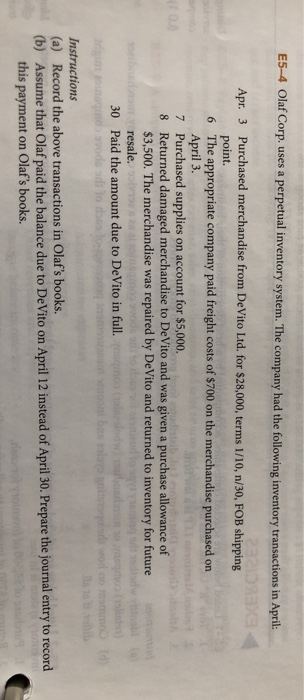

Guidant returned damaged merehandise that was purchased on October 8 for a $3,500 credit on account. The merchandise originally cost $2,185 and was not restored to inventory 12 15 Purchased merchandise for $36,300 cash. 17 Received the balance owing from Guidant. Sold merchandise for $30,000 on account to Deux Lte, terms 2/10, n/30, FOB shipping point. The merchandise had a cost of $18,o00. 28 Freight charges of $750 were paid by the appropriate party on the October 28 sale of merchandise. 29 30 Paid Micron the balance owing. 31 Deux returned some of the merchandise that was purchased on October 28 for a $5,000 credit on account. The merchandise originally cost $3,000 and was restored to inventory Instructions (a) Record the October transactions. (b) Assume that Shaoshi took advantage of the 1% purchase discount offered by Micron Ltd. and paid Micron on October 14 rather than October 30. Record the entry that Shaoshi would make on October 14 and determine the cost of missing this purchase discount to Shaoshi. on E5-4 Olaf Corp. uses a perpetual inventory system. The company had the following inventory transactions in April: Purchased merchandise from DeVito Ltd. for $28,000, terms 1/10, n/30, FOB shipping point. 6 The appropriate company paid freight costs of $700 on the merchandise purchased on April 3. 7 Purchased supplies on account for $5,000. 8 Returned damaged merchandise to DeVito and was given a purchase allowance of $3,500. The merchandise was repaired by DeVito and returned to inventory for future Apr. 3 EXELCIRES 0.3 resale. 30 Paid the amount due to DeVito in full. Instructions (a) Record the above transactions in Olaf's books. (b) Assume that Olaf paid the balance due to DeVito on April 12 instead of April 30. Prepare the journal entry to record this payment on Olaf's books. Guidant returned damaged merehandise that was purchased on October 8 for a $3,500 credit on account. The merchandise originally cost $2,185 and was not restored to inventory 12 15 Purchased merchandise for $36,300 cash. 17 Received the balance owing from Guidant. Sold merchandise for $30,000 on account to Deux Lte, terms 2/10, n/30, FOB shipping point. The merchandise had a cost of $18,o00. 28 Freight charges of $750 were paid by the appropriate party on the October 28 sale of merchandise. 29 30 Paid Micron the balance owing. 31 Deux returned some of the merchandise that was purchased on October 28 for a $5,000 credit on account. The merchandise originally cost $3,000 and was restored to inventory Instructions (a) Record the October transactions. (b) Assume that Shaoshi took advantage of the 1% purchase discount offered by Micron Ltd. and paid Micron on October 14 rather than October 30. Record the entry that Shaoshi would make on October 14 and determine the cost of missing this purchase discount to Shaoshi. on E5-4 Olaf Corp. uses a perpetual inventory system. The company had the following inventory transactions in April: Purchased merchandise from DeVito Ltd. for $28,000, terms 1/10, n/30, FOB shipping point. 6 The appropriate company paid freight costs of $700 on the merchandise purchased on April 3. 7 Purchased supplies on account for $5,000. 8 Returned damaged merchandise to DeVito and was given a purchase allowance of $3,500. The merchandise was repaired by DeVito and returned to inventory for future Apr. 3 EXELCIRES 0.3 resale. 30 Paid the amount due to DeVito in full. Instructions (a) Record the above transactions in Olaf's books. (b) Assume that Olaf paid the balance due to DeVito on April 12 instead of April 30. Prepare the journal entry to record this payment on Olaf's books

Guidant returned damaged merehandise that was purchased on October 8 for a $3,500 credit on account. The merchandise originally cost $2,185 and was not restored to inventory 12 15 Purchased merchandise for $36,300 cash. 17 Received the balance owing from Guidant. Sold merchandise for $30,000 on account to Deux Lte, terms 2/10, n/30, FOB shipping point. The merchandise had a cost of $18,o00. 28 Freight charges of $750 were paid by the appropriate party on the October 28 sale of merchandise. 29 30 Paid Micron the balance owing. 31 Deux returned some of the merchandise that was purchased on October 28 for a $5,000 credit on account. The merchandise originally cost $3,000 and was restored to inventory Instructions (a) Record the October transactions. (b) Assume that Shaoshi took advantage of the 1% purchase discount offered by Micron Ltd. and paid Micron on October 14 rather than October 30. Record the entry that Shaoshi would make on October 14 and determine the cost of missing this purchase discount to Shaoshi. on E5-4 Olaf Corp. uses a perpetual inventory system. The company had the following inventory transactions in April: Purchased merchandise from DeVito Ltd. for $28,000, terms 1/10, n/30, FOB shipping point. 6 The appropriate company paid freight costs of $700 on the merchandise purchased on April 3. 7 Purchased supplies on account for $5,000. 8 Returned damaged merchandise to DeVito and was given a purchase allowance of $3,500. The merchandise was repaired by DeVito and returned to inventory for future Apr. 3 EXELCIRES 0.3 resale. 30 Paid the amount due to DeVito in full. Instructions (a) Record the above transactions in Olaf's books. (b) Assume that Olaf paid the balance due to DeVito on April 12 instead of April 30. Prepare the journal entry to record this payment on Olaf's books. Guidant returned damaged merehandise that was purchased on October 8 for a $3,500 credit on account. The merchandise originally cost $2,185 and was not restored to inventory 12 15 Purchased merchandise for $36,300 cash. 17 Received the balance owing from Guidant. Sold merchandise for $30,000 on account to Deux Lte, terms 2/10, n/30, FOB shipping point. The merchandise had a cost of $18,o00. 28 Freight charges of $750 were paid by the appropriate party on the October 28 sale of merchandise. 29 30 Paid Micron the balance owing. 31 Deux returned some of the merchandise that was purchased on October 28 for a $5,000 credit on account. The merchandise originally cost $3,000 and was restored to inventory Instructions (a) Record the October transactions. (b) Assume that Shaoshi took advantage of the 1% purchase discount offered by Micron Ltd. and paid Micron on October 14 rather than October 30. Record the entry that Shaoshi would make on October 14 and determine the cost of missing this purchase discount to Shaoshi. on E5-4 Olaf Corp. uses a perpetual inventory system. The company had the following inventory transactions in April: Purchased merchandise from DeVito Ltd. for $28,000, terms 1/10, n/30, FOB shipping point. 6 The appropriate company paid freight costs of $700 on the merchandise purchased on April 3. 7 Purchased supplies on account for $5,000. 8 Returned damaged merchandise to DeVito and was given a purchase allowance of $3,500. The merchandise was repaired by DeVito and returned to inventory for future Apr. 3 EXELCIRES 0.3 resale. 30 Paid the amount due to DeVito in full. Instructions (a) Record the above transactions in Olaf's books. (b) Assume that Olaf paid the balance due to DeVito on April 12 instead of April 30. Prepare the journal entry to record this payment on Olaf's books

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started