Question: Guided Work 2 : Calculating Full Costs The AERO company is an industrial subcontractor that produces several families of components for the aerospace sector. This

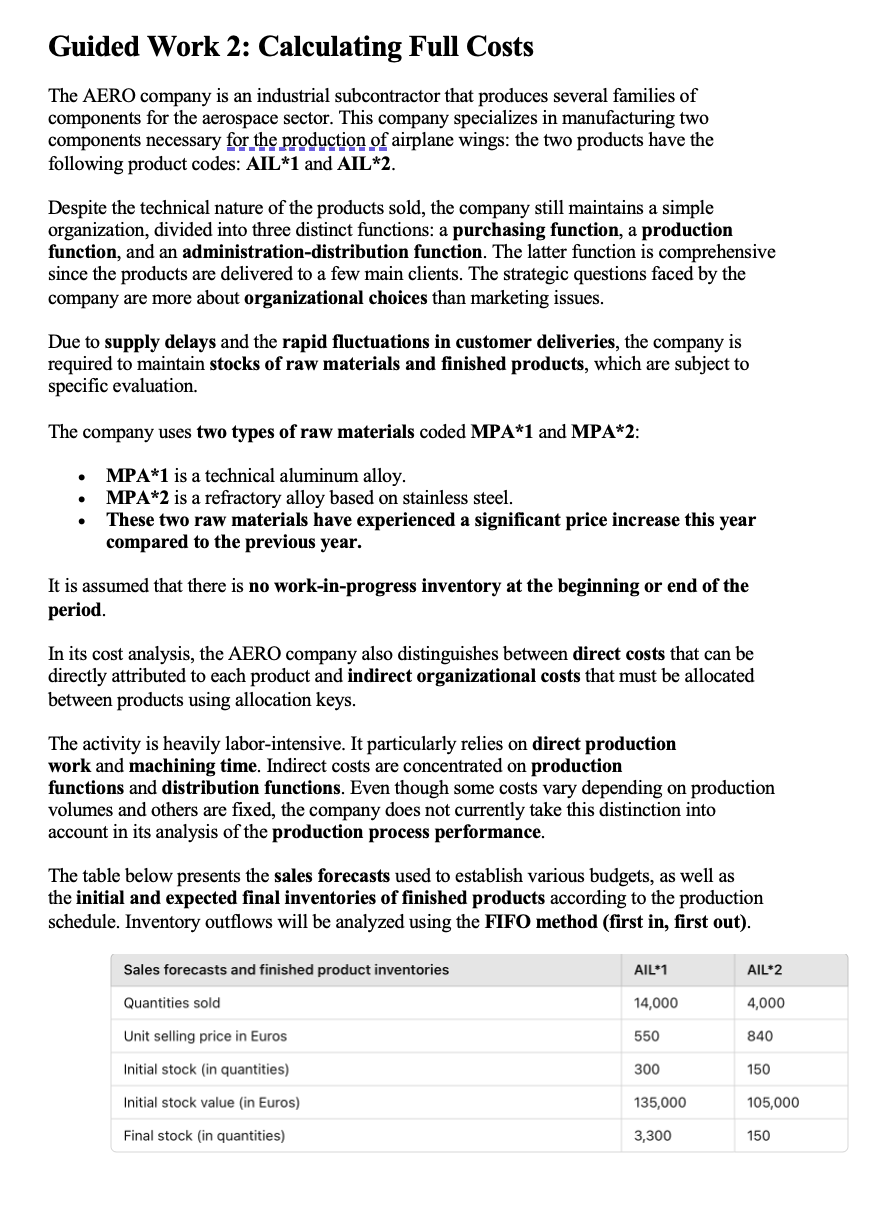

Guided Work : Calculating Full Costs The AERO company is an industrial subcontractor that produces several families of components for the aerospace sector. This company specializes in manufacturing two components necessary for the production of airplane wings: the two products have the following product codes: AIL and AIL Despite the technical nature of the products sold, the company still maintains a simple organization, divided into three distinct functions: a purchasing function, a production function, and an administrationdistribution function. The latter function is comprehensive since the products are delivered to a few main clients. The strategic questions faced by the company are more about organizational choices than marketing issues. Due to supply delays and the rapid fluctuations in customer deliveries, the company is required to maintain stocks of raw materials and finished products, which are subject to specific evaluation. The company uses two types of raw materials coded MPA and MPA: MPAmathbf is a technical aluminum alloy. MPA is a refractory alloy based on stainless steel. These two raw materials have experienced a significant price increase this year compared to the previous year. It is assumed that there is no workinprogress inventory at the beginning or end of the period. In its cost analysis, the AERO company also distinguishes between direct costs that can be directly attributed to each product and indirect organizational costs that must be allocated between products using allocation keys. The activity is heavily laborintensive. It particularly relies on direct production work and machining time. Indirect costs are concentrated on production functions and distribution functions. Even though some costs vary depending on production volumes and others are fixed, the company does not currently take this distinction into account in its analysis of the production process performance. The table below presents the sales forecasts used to establish various budgets, as well as the initial and expected final inventories of finished products according to the production schedule. Inventory outflows will be analyzed using the FIFO method first in first out The technical data for production and machining time are provided in the following table:

Raw Material Stock Policy

The raw material stock policy data are as follows:

Indirect Production Costs

The indirect production costs are divided into fixed and variable costs, but this information is not currently used as the company does not evaluate its breakeven point. However, the total indirect costs are allocated between the two products in proportion to the working time consumed by each.

Overhead Expenses

In addition to purchasing and production functions, AERO has three functional departments:

Research and Development

Marketing

Administrative department accounting financial services, and human resources

These functions do not constitute the company's core business and are therefore considered fixed distribution costs.

The planned overhead expenses for this year are as follows: Tasks to be Completed

Prepare Forecast Documents

Using the available data, you must first prepare the following forecast documents:

Revenue forecast for the period in euros

Production forecast in units.

Forecasts for the consumption and purchasing of the two raw materials used there are no indirect purchasing costs at AERO

Forecast of direct manufacturing labor costs

Refined Accounting Approach

Your initial estimates did not convince management, who now require a more precise accounting approach.

You must adopt the traditional full cost calculation method by considering costs excluding VAT purchasing costs production costs distribution costs

Stock records: Establish stock records for each raw material using the FIFO method First In First Out

Reminder: In this accounting method, raw materials and finished products are withdrawn from inventory according to process constraints and their order of entry into stock.

Each raw material or product is valued at its entry cost when it leaves stock.

Production costs: Calculate both direct and indirect production costs for the two components AIL and AIL

Stock records for components: Create stock records for each component using the FIFO method.

Cost of goods sold COGS: Estimate the cost of goods sold by including overhead costs, allocated in proportion to the revenue generated by each product.

Margin rates: Calculate the margin rates by activity and overall, then provide comments on your results.

Weighted Average Cost method: To smooth out upcoming increases in raw material prices, redo your calculations using the Weighted Average Cost method to reassess the full cost.

What conclusion can you draw?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock