Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(GUN) manufactures gold jewelry in India from gold imported using contracts denominated in USD. Presently the company has no hedging strategy for its market

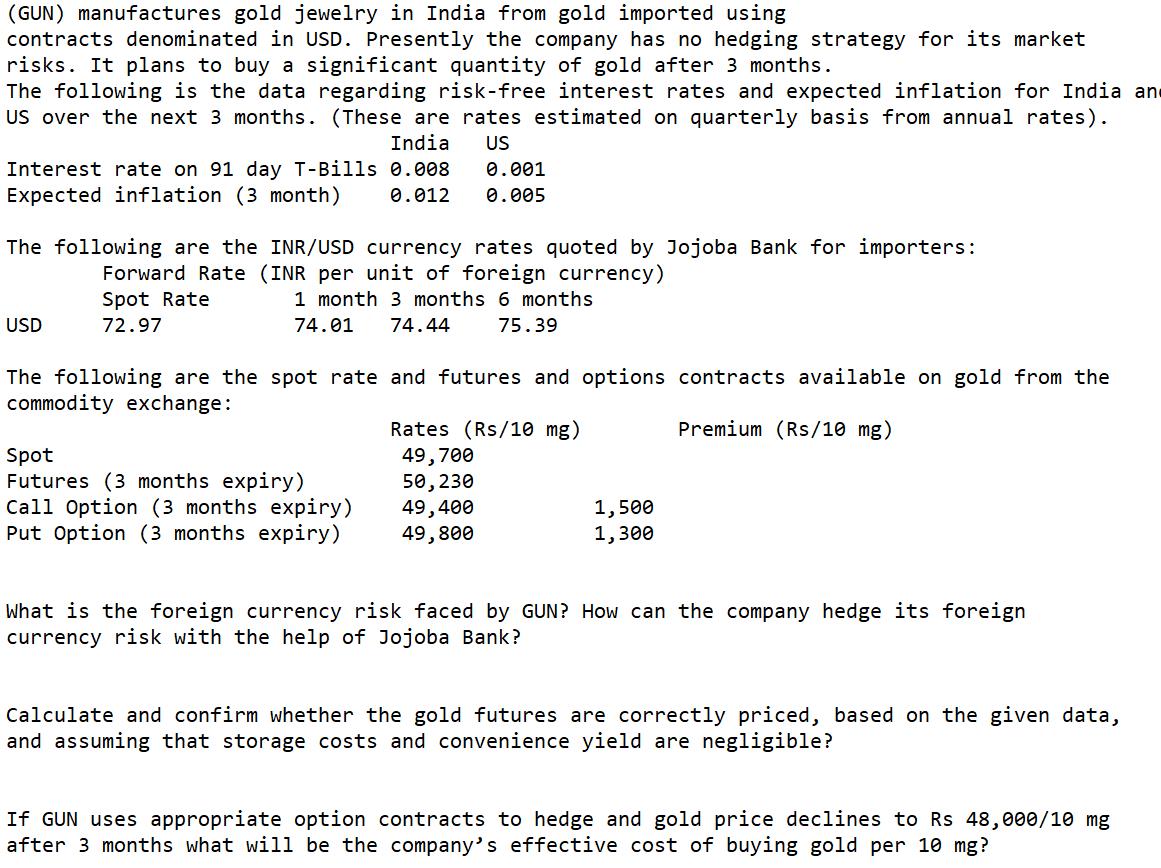

(GUN) manufactures gold jewelry in India from gold imported using contracts denominated in USD. Presently the company has no hedging strategy for its market risks. It plans to buy a significant quantity of gold after 3 months. The following is the data regarding risk-free interest rates and expected inflation for India an US over the next 3 months. (These are rates estimated on quarterly basis from annual rates). India US Interest rate on 91 day T-Bills 0.008 0.001 0.012 0.005 Expected inflation (3 month) The following are the INR/USD currency rates quoted by Jojoba Bank for importers: Forward Rate (INR per unit of foreign currency) 1 month 3 months 6 months 74.01 74.44 75.39 USD Spot Rate 72.97 The following are the spot rate and futures and options contracts available on gold from the commodity exchange: Premium (Rs/10 mg) Spot Futures (3 months expiry) Call Option (3 months expiry) Put Option (3 months expiry) Rates (Rs/10 mg) 49,700 50, 230 49,400 49,800 1,500 1,300 What is the foreign currency risk faced by GUN? How can the company hedge its foreign currency risk with the help of Jojoba Bank? Calculate and confirm whether the gold futures are correctly priced, based on the given data, and assuming that storage costs and convenience yield are negligible? If GUN uses appropriate option contracts to hedge and gold price declines to Rs 48,000/10 mg after 3 months what will be the company's effective cost of buying gold per 10 mg?

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The foreign currency risk faced by GUN is the risk that the value of the USD will change between the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started