Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gunther Company Ltd. produces two types of machinery parts, W and G, both of which require the same raw material in their respective production

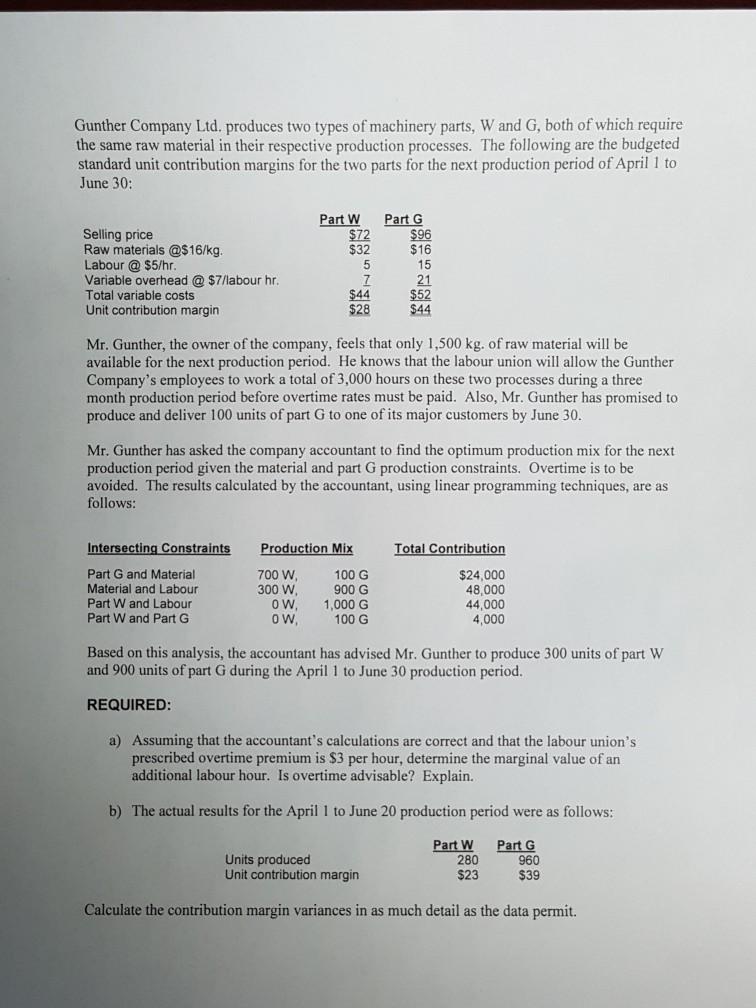

Gunther Company Ltd. produces two types of machinery parts, W and G, both of which require the same raw material in their respective production processes. The following are the budgeted standard unit contribution margins for the two parts for the next production period of April 1 to June 30: Part G $72 $96 $32 $16 Part W Selling price Raw materials @$16/kg. Labour @ $5/hr. Variable overhead @ $7/labour hr. Total variable costs Unit contribution margin 15 7 $44 $28 21 $52 $44 Mr. Gunther, the owner of the company, feels that only 1,500 kg. of raw material will be available for the next production period. He knows that the labour union will allow the Gunther Company's employees to work a total of 3,000 hours on these two processes during a three month production period before overtime rates must be paid. Also, Mr. Gunther has promised to produce and deliver 100 units of part G to one of its major customers by June 30. Mr. Gunther has asked the company accountant to find the optimum production mix for the next production period given the material and part G production constraints. Overtime is to be avoided. The results calculated by the accountant, using linear programming techniques, are as follows: Intersecting Constraints Production Mix Total Contribution Part G and Material Material and Labour Part W and Labour 700 W, 300 W, OW, OW, 100 G 900 G 1,000 G 100 G $24,000 48,000 44,000 4,000 Part W and Part G Based on this analysis, the accountant has advised Mr. Gunther to produce 300 units of part W and 900 units of part G during the April 1 to June 30 production period. REQUIRED: a) Assuming that the accountant's calculations are correct and that the labour union's prescribed overtime premium is $3 per hour, determine the marginal value of an additional labour hour. Is overtime advisable? Explain. b) The actual results for the April 1 to June 20 production period were as follows: Part G Units produced Unit Part W 280 $23 960 tribution margin $39 Calculate the contribution margin variances in as much detail as the data permit.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Machinary Parts Part W Part G Selling Price 72 96 Raw Material 16Kg 32 16 RM Kg 2 1 Labour 5Hr 5 15 Hrs 1 3 Variable OH 7 21 Total Variable Cost 44 52 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started