Question

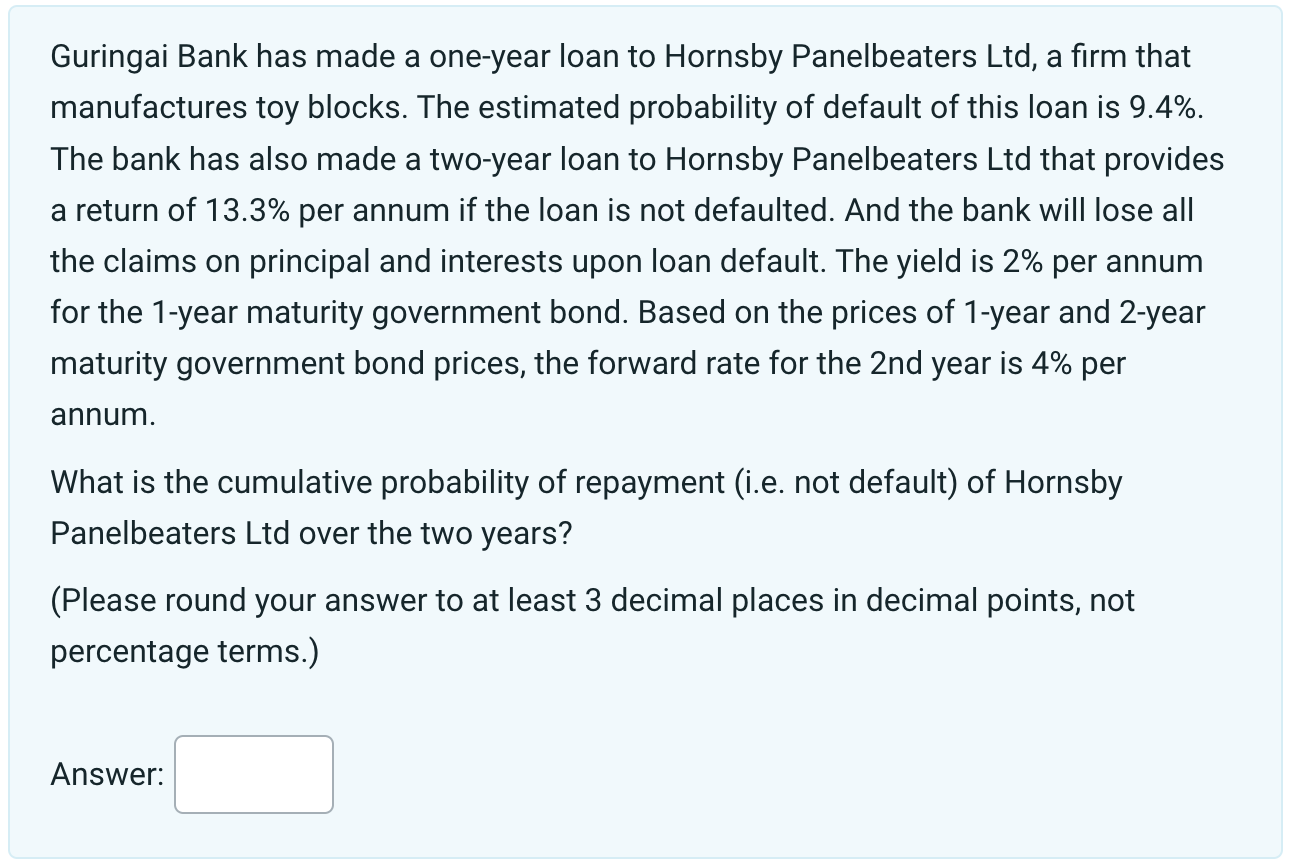

Guringai Bank has made a one-year loan to Hornsby Panelbeaters Ltd, a firm that manufactures toy blocks. The estimated probability of default of this loan

Guringai Bank has made a one-year loan to Hornsby Panelbeaters Ltd, a firm that\ manufactures toy blocks. The estimated probability of default of this loan is

9.4%.\ The bank has also made a two-year loan to Hornsby Panelbeaters Ltd that provides\ a return of

13.3%per annum if the loan is not defaulted. And the bank will lose all\ the claims on principal and interests upon loan default. The yield is

2%per annum\ for the 1-year maturity government bond. Based on the prices of 1-year and 2-year\ maturity government bond prices, the forward rate for the 2 nd year is

4%per\ annum.\ What is the cumulative probability of repayment (i.e. not default) of Hornsby\ Panelbeaters Ltd over the two years?\ (Please round your answer to at least 3 decimal places in decimal points, not\ percentage terms.)\ Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started