Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gustav is considering expanding his business with a new fresh meat food product. Because Gustav leaves on a business trip, he asked you to evaluate

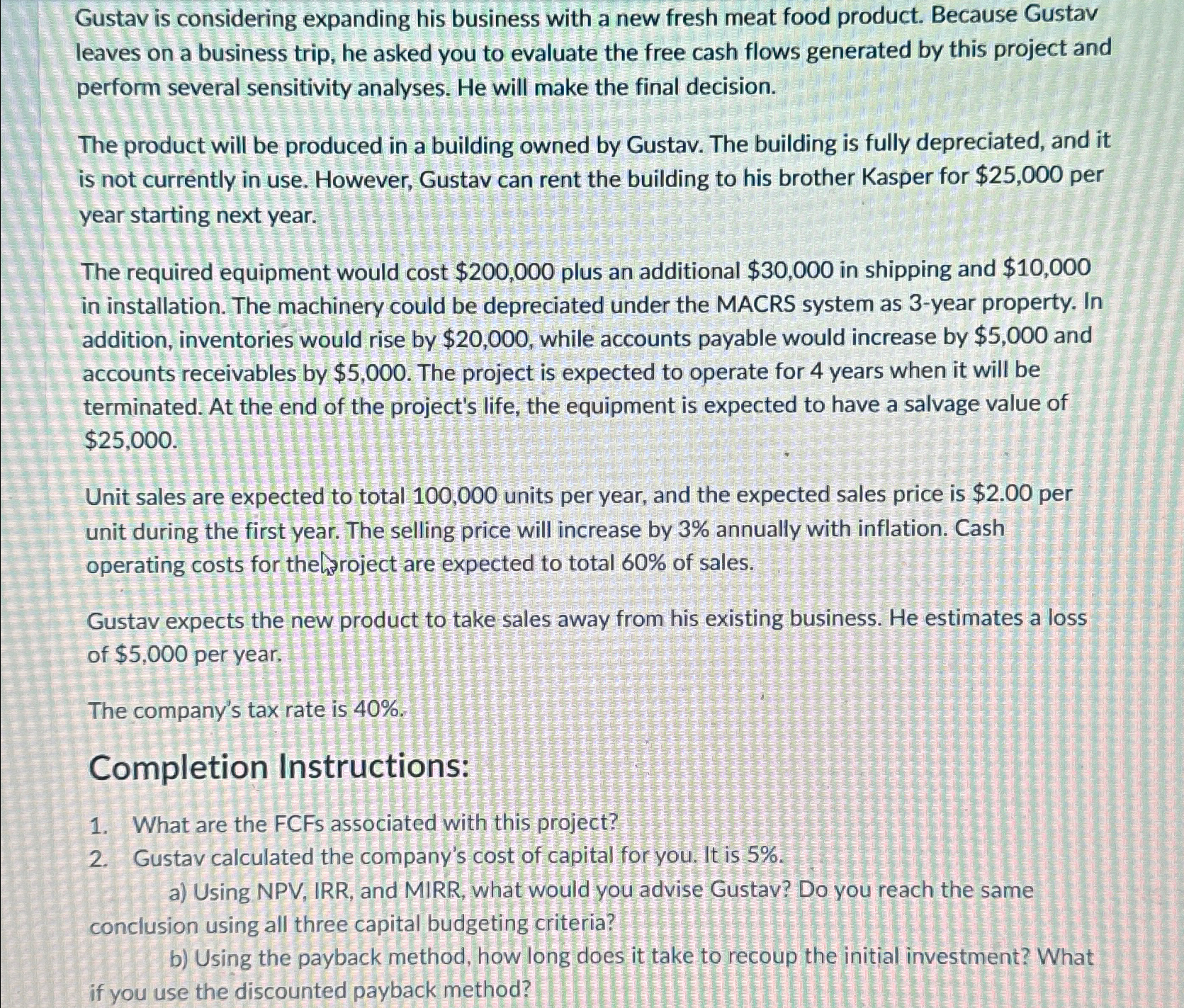

Gustav is considering expanding his business with a new fresh meat food product. Because Gustav leaves on a business trip, he asked you to evaluate the free cash flows generated by this project and perform several sensitivity analyses. He will make the final decision.

The product will be produced in a building owned by Gustav. The building is fully depreciated, and it is not currently in use. However, Gustav can rent the building to his brother Kasper for $ per year starting next year.

The required equipment would cost $ plus an additional $ in shipping and $ in installation. The machinery could be depreciated under the MACRS system as year property. In addition, inventories would rise by $ while accounts payable would increase by $ and accounts receivables by $ The project is expected to operate for years when it will be terminated. At the end of the project's life, the equipment is expected to have a salvage value of $

Unit sales are expected to total units per year, and the expected sales price is $ per unit during the first year. The selling price will increase by annually with inflation. Cash operating costs for thehroject are expected to total of sales.

Gustav expects the new product to take sales away from his existing business. He estimates a loss of $ per year.

The company's tax rate is

Completion Instructions:

Gustav calculated the company's cost of capital for you. It is

a Using NPV IRR, and MIRR, what would you advise Gustav? Do you reach the same conclusion using all three capital budgeting criteria?

b Using the payback method, how long does it take to recoup the initial investment? What if you use the discounted payback method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started