Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Guys, I fell in to a stone wall with these questions, especially 1,2 and 2,3 and 2,4 could I get some help and compare my

Guys, I fell in to a stone wall with these questions, especially 1,2 and 2,3 and 2,4 could I get some help and compare my work please. TIA

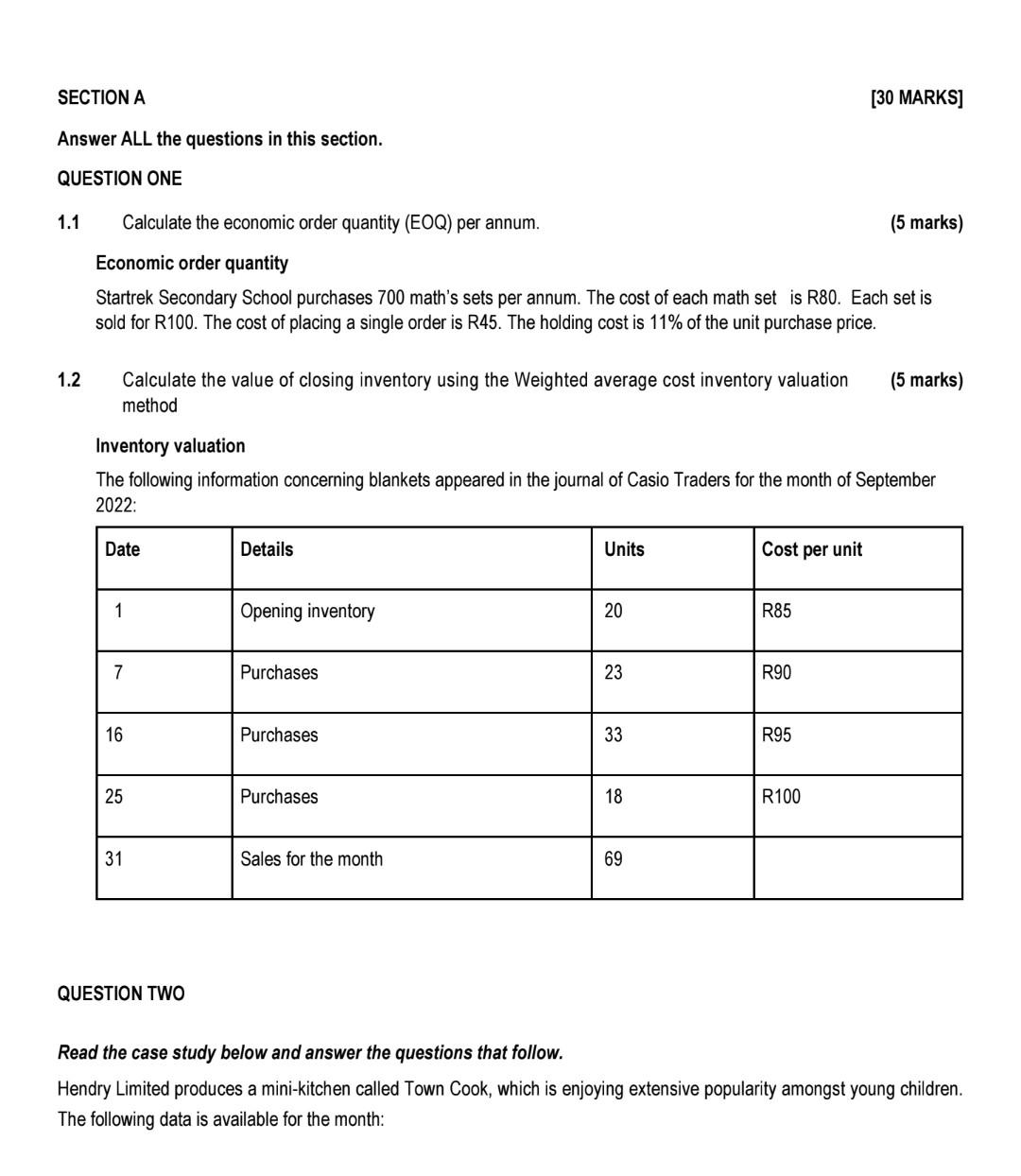

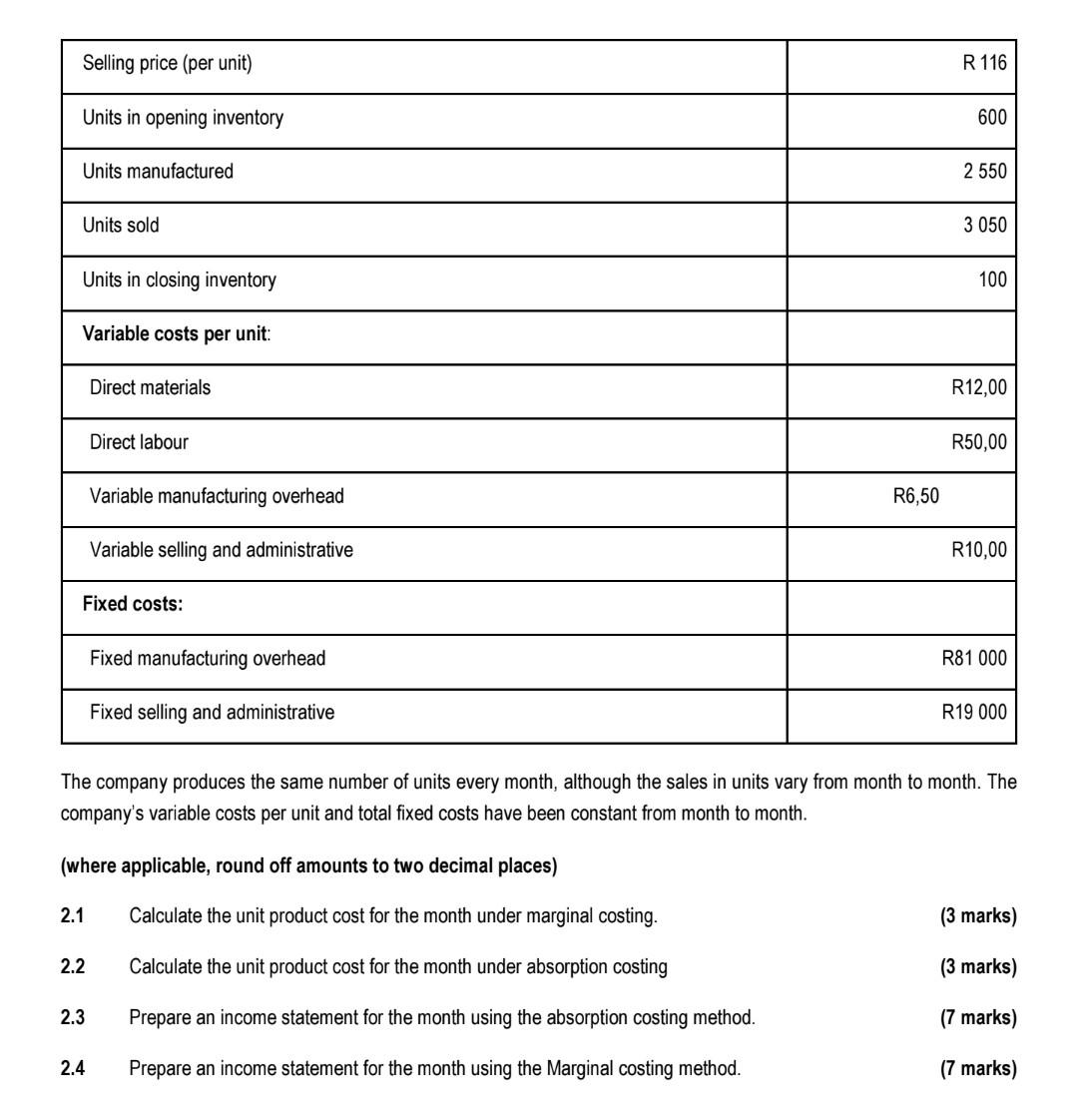

[30 MARKS] Calculate the economic order quantity (EOQ) per annum. (5 marks) Economic order quantity Startrek Secondary School purchases 700 math's sets per annum. The cost of each math set is R80. Each set is sold for R100. The cost of placing a single order is R45. The holding cost is 11% of the unit purchase price. 1.2 Calculate the value of closing inventory using the Weighted average cost inventory valuation (5 marks) method Inventory valuation The following information concerning blankets appeared in the journal of Casio Traders for the month of September 2022: Date Details Units Cost per unit 1 Opening inventory 20 R85 7 Purchases 23 R90 16 Purchases 33 R95 25 Purchases 18 R100 31 Sales for the month 69 QUESTION TWO Read the case study below and answer the questions that follow. Hendry Limited produces a mini-kitchen called Town Cook, which is enjoying extensive popularity amongst young children. The following data is available for the month: SECTION A Answer ALL the questions in this section. QUESTION ONE 1.1 Selling price (per unit) R 116 Units in opening inventory 600 Units manufactured 2 550 Units sold 3 050 Units in closing inventory 100 Variable costs per unit: Direct materials R12,00 Direct labour R50,00 Variable manufacturing overhead Variable selling and administrative R10,00 Fixed costs: Fixed manufacturing overhead R81 000 Fixed selling and administrative R19 000 The company produces the same number of units every month, although the sales in units vary from month to month. The company's variable costs per unit and total fixed costs have been constant from month to month. (where applicable, round off amounts to two decimal places) 2.1 Calculate the unit product cost for the month under marginal costing. (3 marks) (3 marks) 2.2 Calculate the unit product cost for the month under absorption costing 2.3 Prepare an income statement for the month using the absorption costing method. (7 marks) 2.4 Prepare an income statement for the month using the Marginal costing method. (7 marks) R6,50Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started