Guys PLEASE help with the below first year accounting questions. Its an emergency. PLEASE guys!!!!!

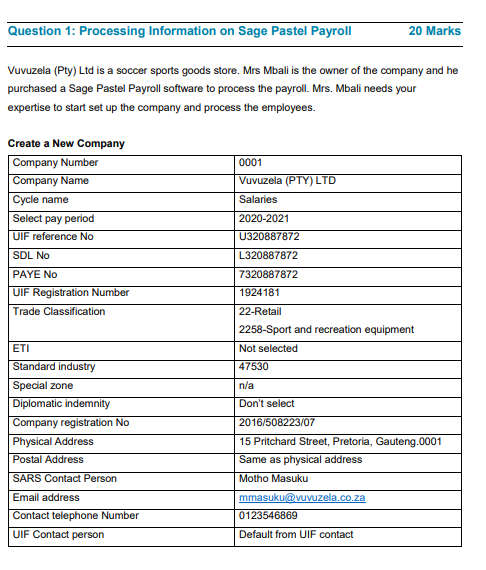

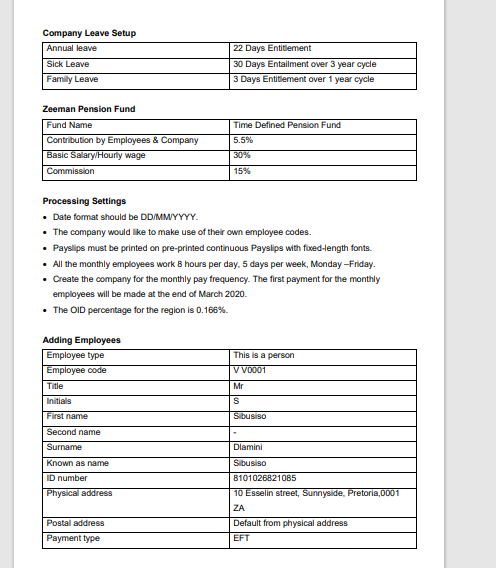

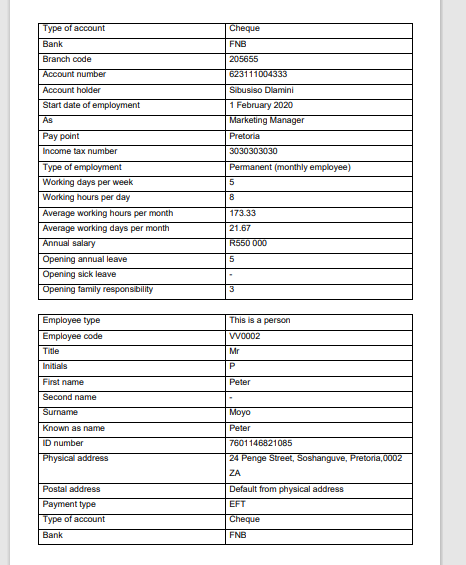

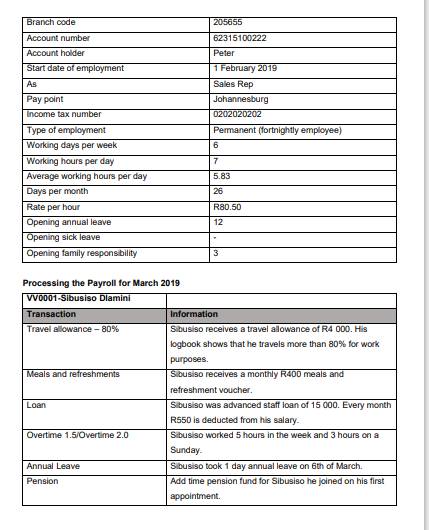

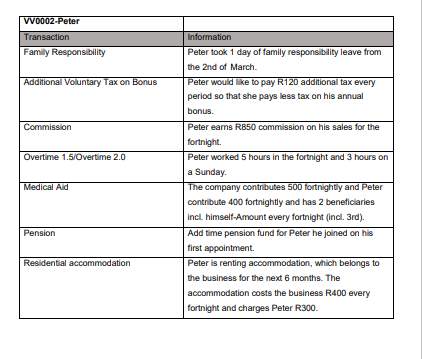

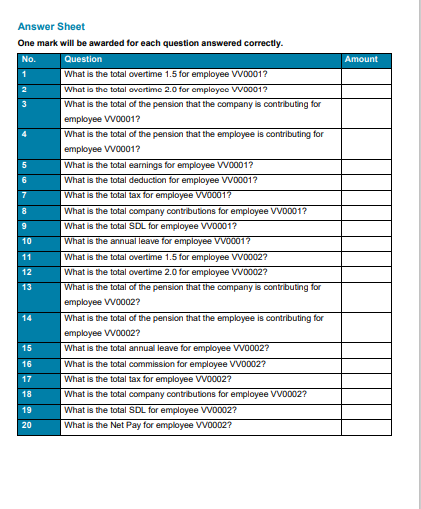

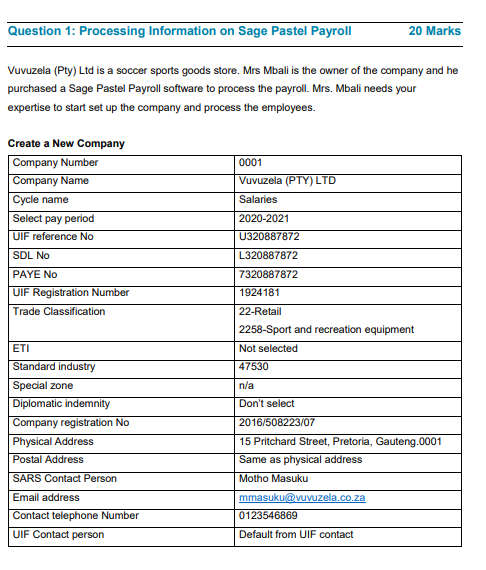

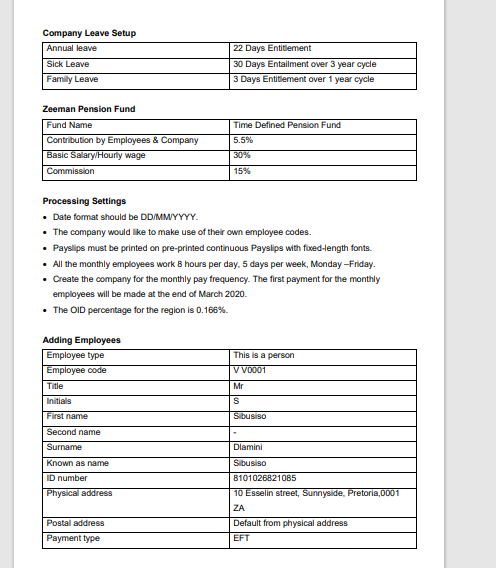

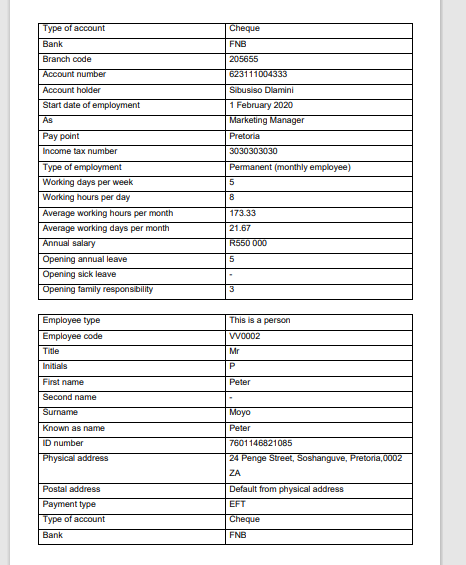

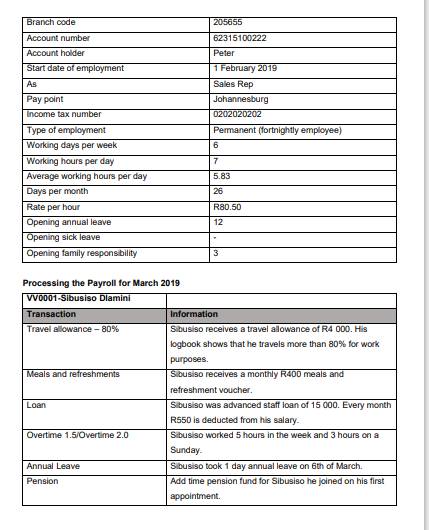

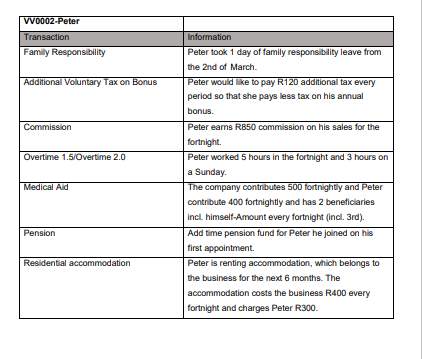

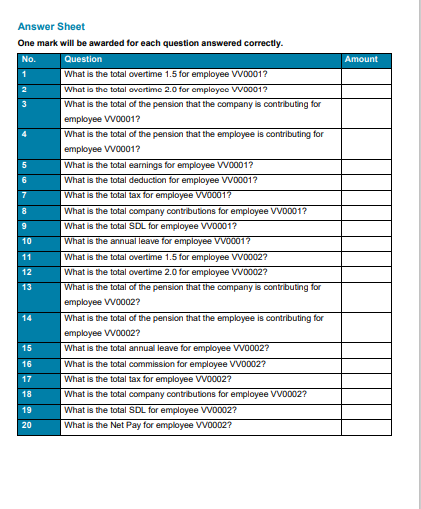

Question 1: Processing Information on Sage Pastel Payroll 20 Marks Vuvuzela (Pty) Ltd is a soccer sports goods store. Mrs Mbali is the owner of the company and he purchased a Sage Pastel Payroll software to process the payroll. Mrs. Mbali needs your expertise to start set up the company and process the employees. Create a New Company Company Number Company Name Cycle name Select pay period UIF reference No 0001 Vuvuzela (PTY) LTD Salaries 2020-2021 U320887872 L320887872 SDL No 7320887872 PAYE No UIF Registration Number Trade Classification 1924181 22-Retail 2258-Sport and recreation equipment Not selected 47530 n/a Don't select ETI Standard industry Special zone Diplomatic indemnity Company registration No Physical Address Postal Address SARS Contact Person 2016/508223/07 15 Pritchard Street, Pretoria, Gauteng.0001 Same as physical address Motho Masuku Email address Contact telephone Number UIF Contact person mmasuku@vuvuzela.co.za 0123546869 Default from UIF contact Company Leave Setup Annual leave Sick Leave Family Leave 22 Days Entitlement 30 Days Entallment over 3 year cycle 3 Days Entitlement over 1 year cycle Zeeman Pension Fund Fund Name Contribution by Employees & Company Basic Salary Hourly wage Commission Time Defined Pension Fund 5.5% 15% Processing Settings Date format should be DD/MM/YYYY. The company would like to make use of their own employee codes. Payslips must be printed on pre-printed continuous Payslips with fixed-length fonts. . All the monthly employees work 8 hours per day, 5 days per week, Monday - Friday. Create the company for the monthly pay frequency. The first payment for the monthly employees will be made at the end of March 2020 The OID percentage for the region is 0.166%. Adding Employees Employee type Employee code Title Initials This is a person V V0001 Mr S First name Sibusiso Second name Surname Dlamini Known as name ID number Physical address Sibusiso 8101026821085 10 Esselin street, Sunnyside, Pretoria, 0001 ZA Default from physical address EFT Postal address Payment type Type of account Bank Branch code Account number Cheque FNB 205655 623111004333 Sibusiso Dlamini 1 February 2020 Marketing Manager Pretoria 3030303030 Permanent (monthly employee) 5 Account holder Start date of employment As Pay point Income tax number Type of employment Working days per week Working hours per day Average working hours per month Average working days per month Annual salary Opening annual leave Opening sick leave Opening family responsibility 8 173.33 21.67 R550 000 5 Employee type Employee code Title This is a person WV0002 Mr Initials P First name Peter Second name Surname Known as name ID number Physical address Moyo Peter 7601146821085 24 Penge Street, Soshanguve, Pretoria, 0002 ZA Postal address Payment type Type of account Bank Default from physical address EFT Cheque FNB Branch code Account number Account holder Start date of employment As 205655 62315100222 Peter 1 February 2019 Sales Rep Johannesburg 0202020202 Permanent (fortnightly employee) 6 7 Pay point Income tax number Type of employment Working days per week Working hours per day Average working hours per day Days per month Rate per hour Opening annual leave Opening sick leave Opening family responsbility 5.83 26 R80.50 12 3 Processing the Payroll for March 2019 WV0001-Sibusiso Dlamini Transaction Information Travel allowance - 80% Sibusiso receives a travel allowance of R4 000. His logbook shows that he travels more than 80% for work purposes. Meals and refreshments Sibusiso receives a monthly R400 meals and refreshment voucher. Loan Sibusiso was advanced staff loan of 15 000. Every month R550 is deducted from his salary. Overtime 1.5/Overtime 2.0 Sibusiso worked 5 hours in the week and 3 hours on a Sunday Annual Leave Sibusiso took 1 day annual leave on 6th of March. Pension Add time pension fund for Sibusiso he joined on his first appointment VV0002-Peter Transaction Family Responsibility Additional Voluntary Tax on Bonus Commission Overtime 1.5/Overtime 2.0 Information Peter took 1 day of family responsibility leave from the 2nd of March Peter would like to pay R120 additional tax every period so that she pays less tax on his annual bonus. Peter earns R850 commission on his sales for the fortnight Peter worked 5 hours in the fortnight and 3 hours on a Sunday The company contributes 500 fortnightly and Peter contribute 400 fortnightly and has 2 beneficiaries incl himself Amount every fortnight (incl. 3rd), Add time pension fund for Peter he joined on his first appointment. Peter is renting accommodation, which belongs to the business for the next 6 months. The accommodation costs the business R400 every fortnight and charges Peter R300. Medical Aid Pension Residential accommodation Amount 2 Answer Sheet One mark will be awarded for each question answered correctly. No. Question 1 What is the total overtime 1.5 for employee VV0001? What is the total overtime 2.0 for employee WV00012 3 What is the total of the pension that the company is contributing for employee WV0001? What is the total of the pension that the employee is contributing for employee WV0001? What is the total earnings for employee WV0001? What is the total deduction for employee VV0001? What is the total tax for employee WV0001? 8 What is the total company contributions for employee VV0001? 9 What is the total SDL for employee VV0001? 10 What is the annual leave for employee VV0001? 11 What is the total overtime 1.5 for employee VV0002? 12 What is the total overtime 2.0 for employee VV0002? 13 What is the total of the pension that the company is contributing for employee WV00027 14 What is the total of the pension that the employee is contributing for employee WV0002? 15 What is the total annual leave for employee WV0002? 16 What is the total commission for employee VV0002? 17 What is the total tax for employee VV0002? 18 What is the total company contributions for employee VVDO02? 19 What is the total SDL for employee VV0002? 20 What is the Net Pay for employee WV0002? Question 1: Processing Information on Sage Pastel Payroll 20 Marks Vuvuzela (Pty) Ltd is a soccer sports goods store. Mrs Mbali is the owner of the company and he purchased a Sage Pastel Payroll software to process the payroll. Mrs. Mbali needs your expertise to start set up the company and process the employees. Create a New Company Company Number Company Name Cycle name Select pay period UIF reference No 0001 Vuvuzela (PTY) LTD Salaries 2020-2021 U320887872 L320887872 SDL No 7320887872 PAYE No UIF Registration Number Trade Classification 1924181 22-Retail 2258-Sport and recreation equipment Not selected 47530 n/a Don't select ETI Standard industry Special zone Diplomatic indemnity Company registration No Physical Address Postal Address SARS Contact Person 2016/508223/07 15 Pritchard Street, Pretoria, Gauteng.0001 Same as physical address Motho Masuku Email address Contact telephone Number UIF Contact person mmasuku@vuvuzela.co.za 0123546869 Default from UIF contact Company Leave Setup Annual leave Sick Leave Family Leave 22 Days Entitlement 30 Days Entallment over 3 year cycle 3 Days Entitlement over 1 year cycle Zeeman Pension Fund Fund Name Contribution by Employees & Company Basic Salary Hourly wage Commission Time Defined Pension Fund 5.5% 15% Processing Settings Date format should be DD/MM/YYYY. The company would like to make use of their own employee codes. Payslips must be printed on pre-printed continuous Payslips with fixed-length fonts. . All the monthly employees work 8 hours per day, 5 days per week, Monday - Friday. Create the company for the monthly pay frequency. The first payment for the monthly employees will be made at the end of March 2020 The OID percentage for the region is 0.166%. Adding Employees Employee type Employee code Title Initials This is a person V V0001 Mr S First name Sibusiso Second name Surname Dlamini Known as name ID number Physical address Sibusiso 8101026821085 10 Esselin street, Sunnyside, Pretoria, 0001 ZA Default from physical address EFT Postal address Payment type Type of account Bank Branch code Account number Cheque FNB 205655 623111004333 Sibusiso Dlamini 1 February 2020 Marketing Manager Pretoria 3030303030 Permanent (monthly employee) 5 Account holder Start date of employment As Pay point Income tax number Type of employment Working days per week Working hours per day Average working hours per month Average working days per month Annual salary Opening annual leave Opening sick leave Opening family responsibility 8 173.33 21.67 R550 000 5 Employee type Employee code Title This is a person WV0002 Mr Initials P First name Peter Second name Surname Known as name ID number Physical address Moyo Peter 7601146821085 24 Penge Street, Soshanguve, Pretoria, 0002 ZA Postal address Payment type Type of account Bank Default from physical address EFT Cheque FNB Branch code Account number Account holder Start date of employment As 205655 62315100222 Peter 1 February 2019 Sales Rep Johannesburg 0202020202 Permanent (fortnightly employee) 6 7 Pay point Income tax number Type of employment Working days per week Working hours per day Average working hours per day Days per month Rate per hour Opening annual leave Opening sick leave Opening family responsbility 5.83 26 R80.50 12 3 Processing the Payroll for March 2019 WV0001-Sibusiso Dlamini Transaction Information Travel allowance - 80% Sibusiso receives a travel allowance of R4 000. His logbook shows that he travels more than 80% for work purposes. Meals and refreshments Sibusiso receives a monthly R400 meals and refreshment voucher. Loan Sibusiso was advanced staff loan of 15 000. Every month R550 is deducted from his salary. Overtime 1.5/Overtime 2.0 Sibusiso worked 5 hours in the week and 3 hours on a Sunday Annual Leave Sibusiso took 1 day annual leave on 6th of March. Pension Add time pension fund for Sibusiso he joined on his first appointment VV0002-Peter Transaction Family Responsibility Additional Voluntary Tax on Bonus Commission Overtime 1.5/Overtime 2.0 Information Peter took 1 day of family responsibility leave from the 2nd of March Peter would like to pay R120 additional tax every period so that she pays less tax on his annual bonus. Peter earns R850 commission on his sales for the fortnight Peter worked 5 hours in the fortnight and 3 hours on a Sunday The company contributes 500 fortnightly and Peter contribute 400 fortnightly and has 2 beneficiaries incl himself Amount every fortnight (incl. 3rd), Add time pension fund for Peter he joined on his first appointment. Peter is renting accommodation, which belongs to the business for the next 6 months. The accommodation costs the business R400 every fortnight and charges Peter R300. Medical Aid Pension Residential accommodation Amount 2 Answer Sheet One mark will be awarded for each question answered correctly. No. Question 1 What is the total overtime 1.5 for employee VV0001? What is the total overtime 2.0 for employee WV00012 3 What is the total of the pension that the company is contributing for employee WV0001? What is the total of the pension that the employee is contributing for employee WV0001? What is the total earnings for employee WV0001? What is the total deduction for employee VV0001? What is the total tax for employee WV0001? 8 What is the total company contributions for employee VV0001? 9 What is the total SDL for employee VV0001? 10 What is the annual leave for employee VV0001? 11 What is the total overtime 1.5 for employee VV0002? 12 What is the total overtime 2.0 for employee VV0002? 13 What is the total of the pension that the company is contributing for employee WV00027 14 What is the total of the pension that the employee is contributing for employee WV0002? 15 What is the total annual leave for employee WV0002? 16 What is the total commission for employee VV0002? 17 What is the total tax for employee VV0002? 18 What is the total company contributions for employee VVDO02? 19 What is the total SDL for employee VV0002? 20 What is the Net Pay for employee WV0002