Question

G&W Machine Shop is evaluating the proposed acquisition of a new milling machine in 2019. The investment at year zero will be $162,000. The milling

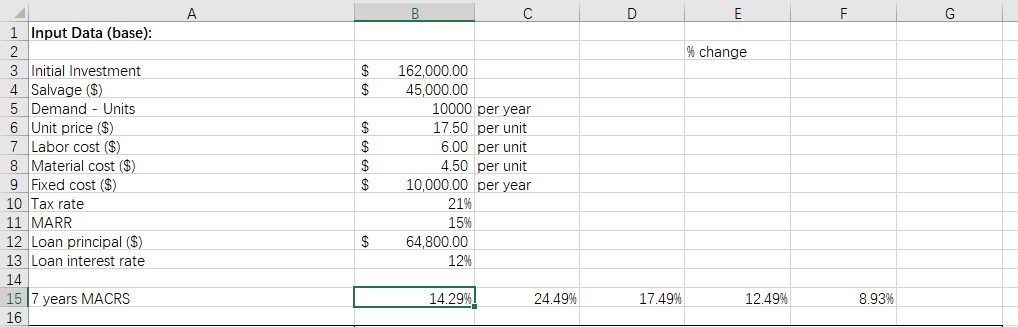

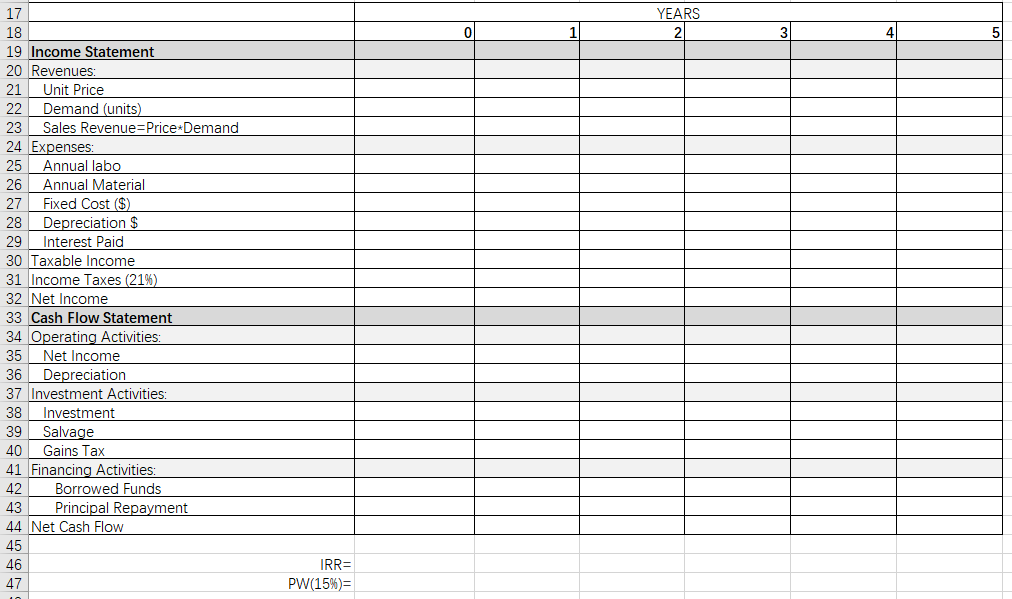

G&W Machine Shop is evaluating the proposed acquisition of a new milling machine in 2019. The investment at year zero will be $162,000. The milling machine has an estimated service life of five years, with a salvage value of $45,000. With this milling machine, the firm will be able to manufacture 10,000 units per year; the unit price is $17.50. However, it requires a specially trained operator to run the machine. This will entail $60,000 in annual labor, $20,000 in annual material expenses, and another $10,000 in annual overhead (power and utility) expenses. The milling machine falls into the seven-year MACRS class. Also, assume that $64,800 of the $162,000 paid for the investment is obtained through debt financing. The loan is to be repaid in equal annual installments at 12% interest over five years. The remaining $97,200 will be provided by equity (e.g., from retained earnings).

Find the year-by-year after-tax net cash flow for the project at a 25% marginal tax rate, and determine the net present worth of the project at the company's MARR of 15% (after tax)

The graph below is an example. Please follow the Excel format to answer the question, thanks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started