Answered step by step

Verified Expert Solution

Question

1 Approved Answer

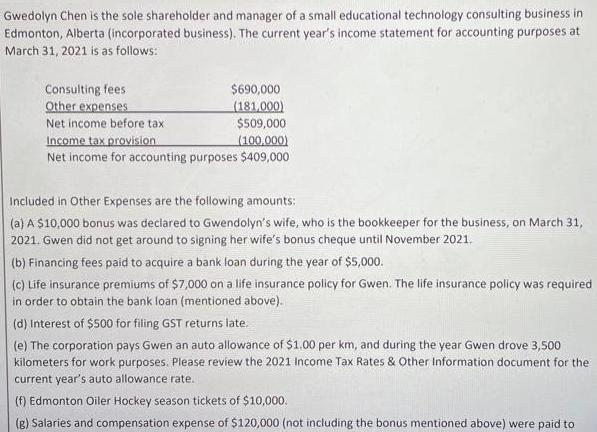

Gwedolyn Chen is the sole shareholder and manager of a small educational technology consulting business in Edmonton, Alberta (incorporated business). The current year's income

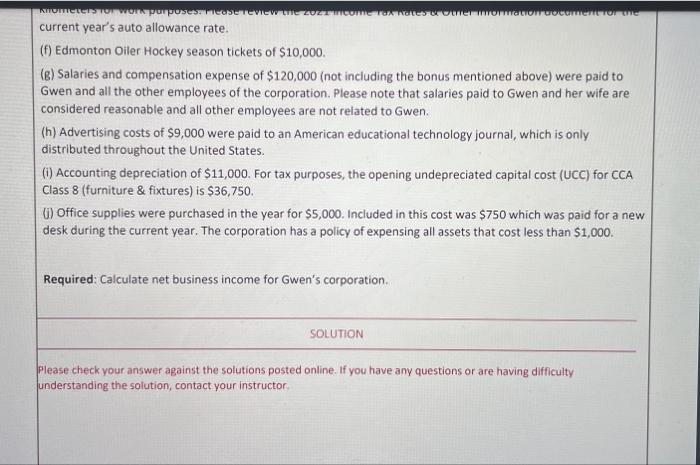

Gwedolyn Chen is the sole shareholder and manager of a small educational technology consulting business in Edmonton, Alberta (incorporated business). The current year's income statement for accounting purposes at March 31, 2021 is as follows: Consulting fees Other expenses $690,000 (181,000) $509,000 Net income before tax Income tax provision Net income for accounting purposes $409,000 (100,000) Included in Other Expenses are the following amounts: (a) A $10,000 bonus was declared to Gwendolyn's wife, who is the bookkeeper for the business, on March 31, 2021. Gwen did not get around to signing her wife's bonus cheque until November 2021. (b) Financing fees paid to acquire a bank loan during the year of $5,000. (c) Life insurance premiums of $7,000 on a life insurance policy for Gwen. The life insurance policy was required in order to obtain the bank loan (mentioned above). (d) Interest of $500 for filing GST returns late. (e) The corporation pays Gwen an auto allowance of $1.00 per km, and during the year Gwen drove 3,500 kilometers for work purposes. Please review the 2021 Income Tax Rates & Other Information document for the current year's auto allowance rate. (f) Edmonton Oiler Hockey season tickets of $10,000. (g) Salaries and compensation expense of $120,000 (not including the bonus mentioned above) were paid to KTOeterTOwor purposesese Teview the 2021Come ra NGSUOer omationoocament Tor ne current year's auto allowance rate. (f) Edmonton Oiler Hockey season tickets of $10,000. (B) Salaries and compensation expense of $120,000 (not including the bonus mentioned above) were paid to Gwen and all the other employees of the corporation. Please note that salaries paid to Gwen and her wife are considered reasonable and all other employees are not related to Gwen. (h) Advertising costs of $9,000 were paid to an American educational technology journal, which is only distributed throughout the United States. (1) Accounting depreciation of $11,000. For tax purposes, the opening undepreciated capital cost (UCC) for CCA Class 8 (furniture & fixtures) is $36,750. G) Office supplies were purchased in the year for $5,000. Included in this cost was $750 which was paid for a new desk during the current year. The corporation has a policy of expensing all assets that cost less than $1,000. Required: Calculate net business income for Gwen's corporation. SOLUTION Please check your answer against the solutions posted online. If you have any questions or are having difficulty understanding the solution, contact your instructor.

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of net business income of Gwens Corporation For the year ended 31032021 Particular Consu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started