Answered step by step

Verified Expert Solution

Question

1 Approved Answer

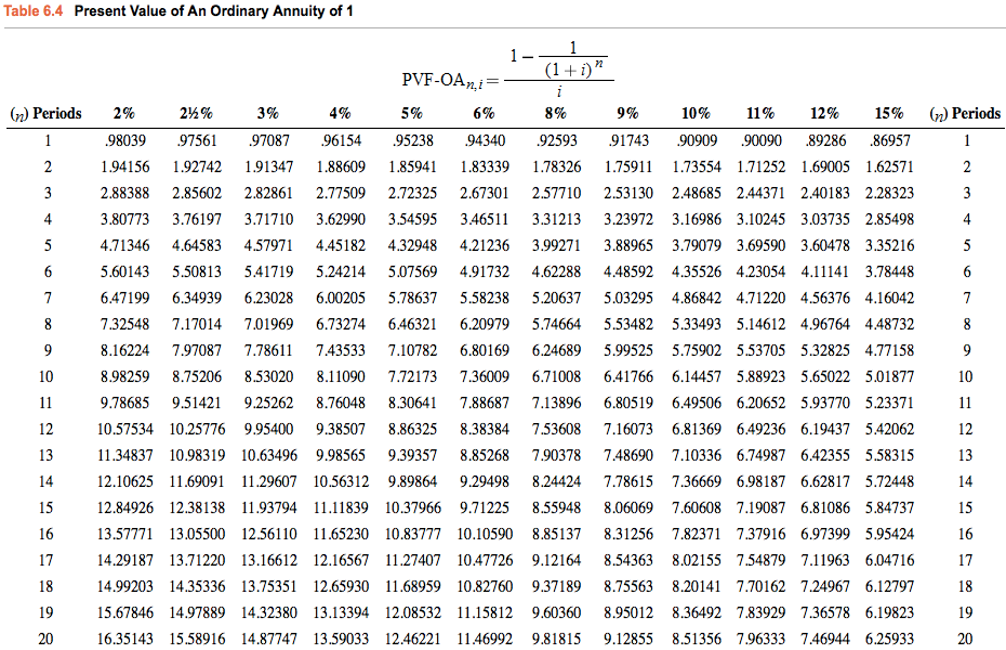

Gwen's Mastercard has a balance due of $16,900 after purchasing a huge vacation. Her plan is to pay off the card with $1,127.27 monthly payments

Gwen's Mastercard has a balance due of $16,900 after purchasing a huge vacation. Her plan is to pay off the card with $1,127.27 monthly payments within 18 months. The first payment is due one month from now.What is the annual interest rate that she will be charged?

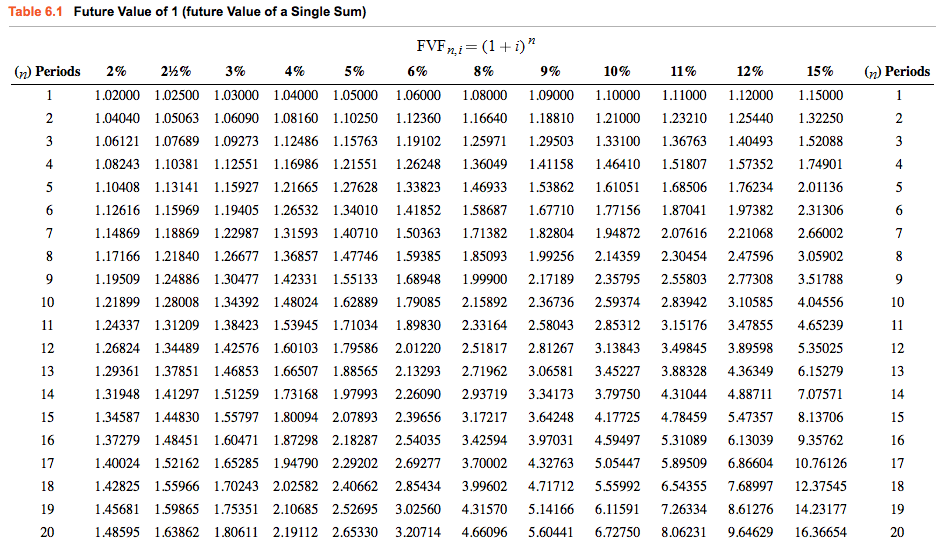

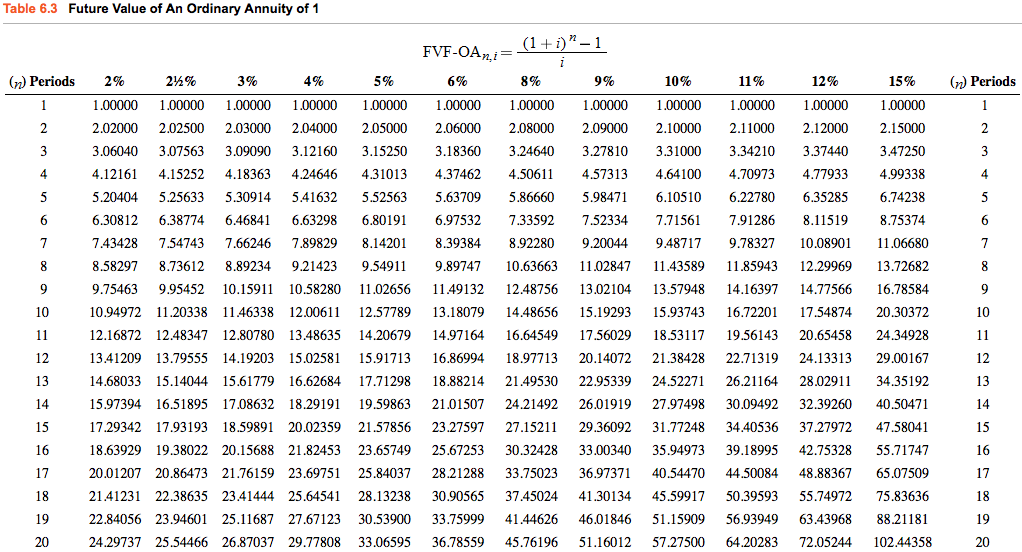

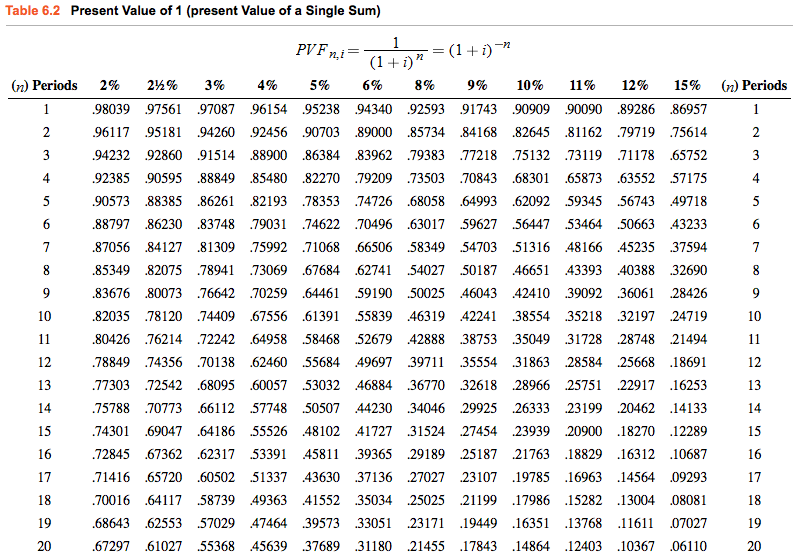

Please Use this Table below.

Table 6.1 Future Value of 1 (future Value of a Single Sum) FVFni=(1+i) n (n) Periods 1 2 2% 2% 3% 4% 5% 1.02000 1.02500 1.03000 1.04000 1.05000 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 6% 1.06000 1.08000 1.16640 8% 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 1.25971 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 1.36049 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 6 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 1.71382 8 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 1.85093 9 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 1.99900 2.15892 9% 10% 1.09000 1.10000 1.18810 1.21000 1.23210 1.25440 1.32250 1.29503 1.33100 1.36763 1.40493 1.52088 1.41158 1.46410 1.51807 1.57352 1.74901 1.46933 1.53862 1.61051 1.68506 1.76234 2.01136 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 1.82804 1.94872 2.07616 2.21068 2.66002 1.99256 2.14359 2.30454 2.47596 3.05902 2.17189 2.35795 2.55803 2.77308 3.51788 11% 1.11000 12% 15% (n) Periods 1.12000 1.15000 1 2 3 4 5 6 7 8 9 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 2.33164 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 2.51817 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 2.71962 2.36736 2.59374 2.83942 3.10585 4.04556 2.58043 2.85312 3.15176 3.47855 4.65239 2.81267 3.13843 3.49845 3.06581 3.45227 10 11 3.89598 5.35025 12 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 2.93719 15 16 17 18 220 19 1.45681 1.59865 1.75351 2.10685 2.52695 20 1.48595 1.63862 1.80611 2.19112 2.65330 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 1.40024 1.52162 1.65285 1.94790 2.29202 2.69277 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 3.02560 3.20714 3.17217 3.42594 3.34173 3.79750 3.64248 4.17725 3.97031 4.59497 3.70002 3.99602 4.71712 4.31570 5.14166 4.66096 5.60441 3.88328 4.36349 6.15279 4.31044 4.88711 7.07571 4.78459 5.47357 8.13706 5.31089 6.13039 9.35762 4.32763 5.05447 5.89509 6.86604 10.76126 5.55992 6.54355 7.68997 12.37545 6.11591 7.26334 8.61276 14.23177 6.72750 8.06231 9.64629 16.36654 13 14 15 16 17 18 19 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started