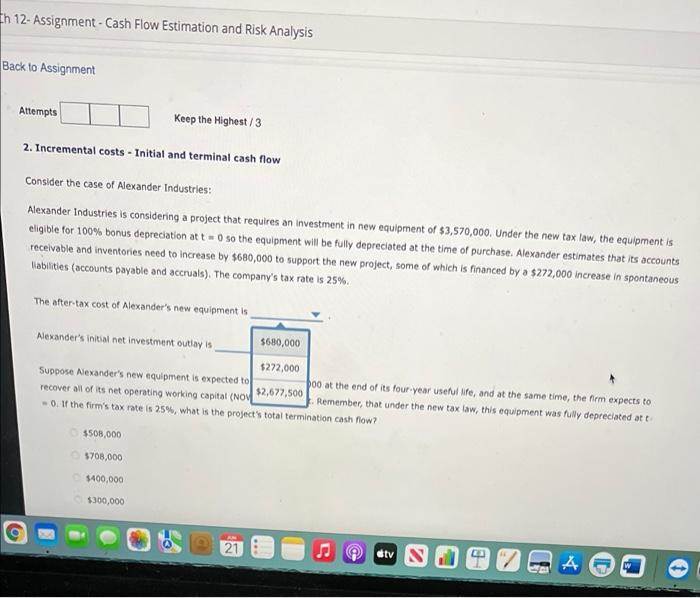

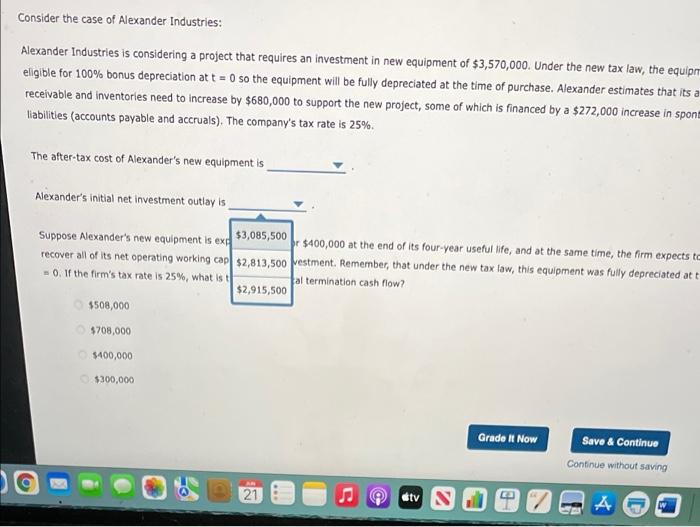

h 12-Assignment-Cash Flow Estimation and Risk Analysis Back to Assignment Attempts Keep the Highest/3 2. Incremental costs-Initial and terminal cash flow Consider the case of Alexander Industries: Alexander Industries is considering a project that requires an investment in new equipment of $3,570,000. Under the new tax law, the equipment is eligible for 100% bonus depreciation at t=0 so the equipment will be fully depreciated at the time of purchase. Alexander estimates that its accounts receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spontaneous liabilities (accounts payable and accruals). The company's tax rate is 25%. The after-tax cost of Alexander's new equipment is Alexander's initial net investment outlay is $508,000 $708,000 $400,000 $300,000 $2,677,500 Suppose Alexander's new equipment is expected to recover all of its net operating working capital (NOV -0. If the firm's tax rate is 25%, what is the project's total termination cash flow? $680,000 $272,000 21 000 at the end of its four-year useful life, and at the same time, the firm expects to Remember, that under the new tax law, this equipment was fully depreciated at t S tv S A Consider the case of Alexander Industries: Alexander Industries is considering a project that requires an investment in new equipment of $3,570,000. Under the new tax law, the equipm eligible for 100% bonus depreciation at t=0 so the equipment will be fully depreciated at the time of purchase. Alexander estimates that its a receivable and inventories need to increase by $680,000 to support the new project, some of which is financed by a $272,000 increase in spont liabilities (accounts payable and accruals). The company's tax rate is 25%. The after-tax cost of Alexander's new equipment is Alexander's initial net investment outlay is Suppose Alexander's new equipment is exp recover all of its net operating working cap 0. If the firm's tax rate is 25%, what is t $508,000 $708,000 $400,000 $300,000 $3,085,500 or $400,000 at the end of its four-year useful life, and at the same time, the firm expects to $2,813,500 vestment. Remember, that under the new tax law, this equipment was fully depreciated at t al termination cash flow? $2,915,500 21 tv N Grade It Now Save & Continue Continue without saving