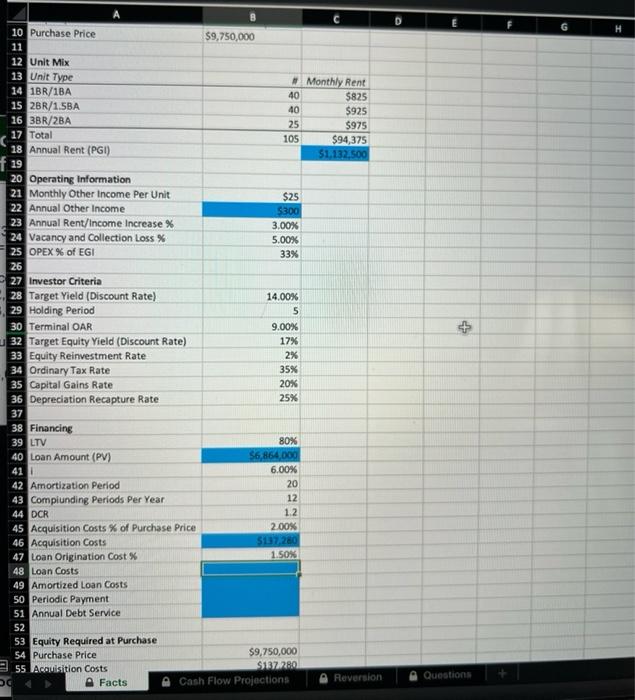

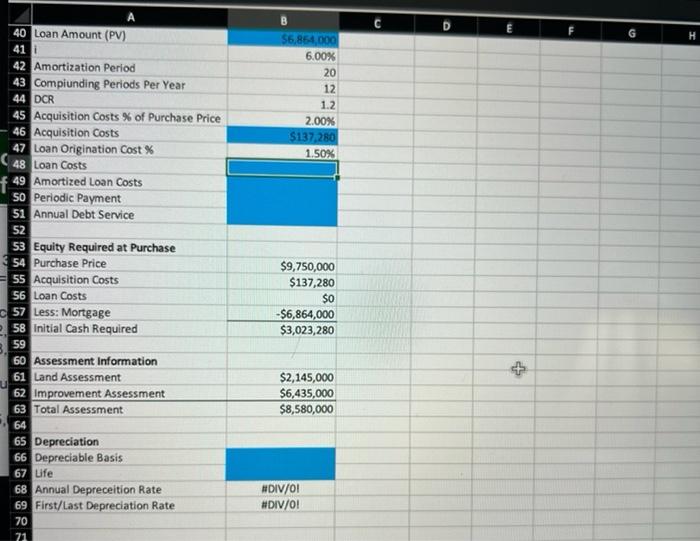

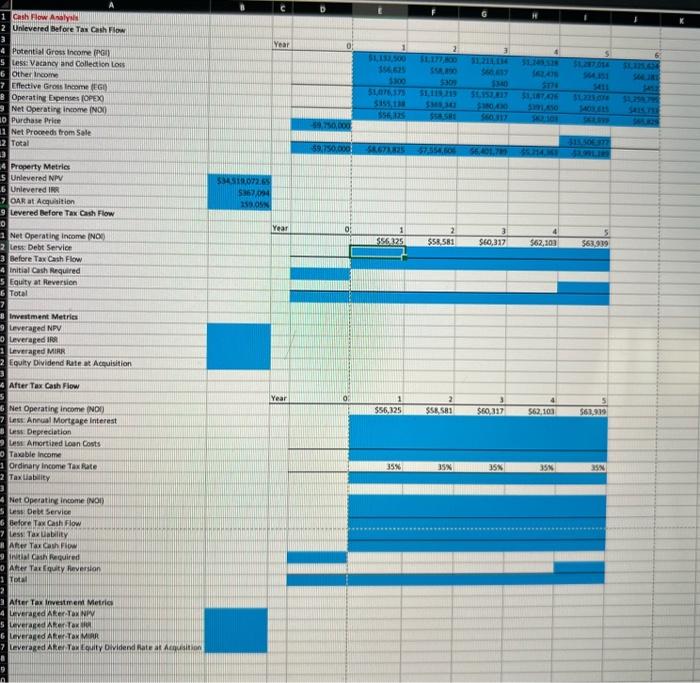

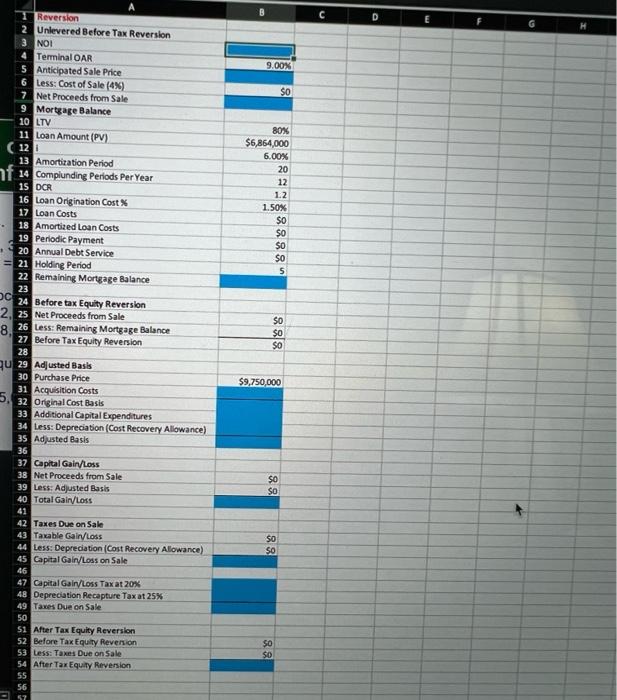

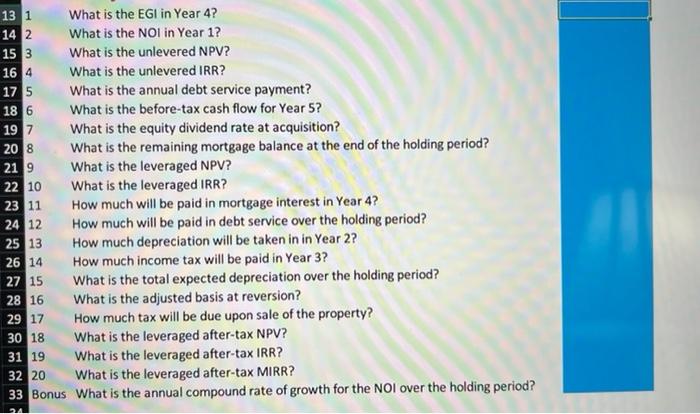

H $9,750,000 10 Purchase Price 11 12 Unit Mix 13 Unit Type 14 1BR/1BA 15 2BR/1.5BA 16 3BR/2BA 17 Total 18 Annual Rent (PGI) #Monthly Rent 40 $825 40 $925 25 $975 105 $94,375 $1.132.500 f 19 + + 20 Operating Information 21 Monthly Other Income Per Unit $25 22 Annual Other Income $300 23 Annual Rent/Income Increase % 3.00% 24 Vacancy and Collection Loss % 5.00% 25 OPEX % of EGI 33% 26 27 Investor Criteria 28 Target Yield (Discount Rate) 14.00% 29 Holding Period 5 30 Terminal OAR 9.00% 32 Target Equity Yield (Discount Rate) 17% 33 Equity Reinvestment Rate 2% 34 Ordinary Tax Rate 35% 35 Capital Gains Rate 20% 36 Depreciation Recapture Rate 25% 37 38 Financing 39 LTV 80% 40 Loan Amount (PV) $6,864,00 41 6.00% 42 Amortization Period 20 43 Complunding Periods Per Year 12 44 DCR 1.2 45 Acquisition Costs % of Purchase Price 2.00% 46 Acquisition Costs $137,280 47 Loan Origination Cost % 1.50% 48 Loan Costs 49 Amortized Loan Costs 50 Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price $9,750,000 55 Acquisition Costs S187280 DG A Facts Cash Flow Projections Reversion Questions C D E F G $6,864,000 6.00% 20 12 1.2 2.00% $137,280 1.50% 40 Loan Amount (PV) 41 i 42 Amortization Period 43 Compiunding Periods Per Year 44 DCR 45 Acquisition Costs % of Purchase Price 46 Acquisition Costs 47 Loan Origination Cost % C 48 Loan Costs f49 Amortized Loan Costs SO Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price 55 Acquisition Costs 56 Loan Costs 57 Less: Mortgage 58 initial Cash Required 59 60 Assessment Information 61 Land Assessment 62 Improvement Assessment 63 Total Assessment 64 65 Depreciation 66 Depreciable Basis 67 ufe 68 Annual Depreceition Rate 69 First/Last Depreciation Rate 70 71 $9,750,000 $137,280 $0 -$6,864,000 $3,023,280 + $2,145,000 $6,435,000 $8,580,000 #DIV/0! #DIV/0! C G Year O 2 3 5 1 51. 10.500 144.62 100 51,076, 5309 : 31,00 S 10 SAN $5612 SSSR 59.750,000 3110 59.750.000 SATZS 57,554,30 56.012 1 Cash Flow Analysis 2 Unlevered Before Tax Cash Flow 3 4 Potential Gross income 5 Les Vacancy and Collection Lor 6 Other Incom 7 Effective Gross income (EGI Operating Expenses (OPEXO 3 Net Operating income INDO 10 Purchase Price 12 Net Proceeds from Sale 12 Total 13 4 Property Metrics 5 Unlevered NPV 6 Unlevered IRR OAR at Acquisition 9 levered Before Tax Cash Flow 0 Net Operating Income INCO 2 Less Debt Service 3 Before Tax Cash Flow 4 Initial Cash Required 5 Equity at Reversion 6 Total 7 Investment Metrics 9 Leveraged NPV Leveragedir Leveraged MERR 2 Equity Dividend Rate at Acquisition 3307269 5367,094 150.00 Year 556325 $58581 S60,312 562,103 $6,999 After Tax Cash Flow Year O 1 $56,125 2 SSR.581 $60,397 562,103 $61,919 35 BSN 35 35 SN 16 Net Operating income INDO 7 Les Annual Mortgage Interest Less Depreciation Les Amortired Loan Costs Taxable income Ordinary income Tax Rate 2 Taxability 3 4 Net Operating income INO Less Debt Service 6 Before Tax Cash Flow 7 Less Tax ability Afer Tax Cash Flow INC Required Atter Tarquity Reversion 1 Total 2 1 After Tax Investment Metro 4 Leveraged Aker TONE Leveraged Aker 6 Laveraged 7 Leveraged Aren Taxiquity Dividendate al Auton 8 MRR AL C D F 9.00% $0 80% $6,864,000 6.00% 20 12 12 1.50% 8888 $ SO $0 5 883 $0 Reversion 2 Unlevered Before Tax Reversion 3 NOI 4 Terminal OAR 5 Anticipated Sale Price 6 Less: Cost of Sale (4%) 7 Net Proceeds from Sale 9 Mortgage Balance 10 LTV 11 Loan Amount (PV) 12 13 Amortization Period af 14 complunding Periods Per Year 15 DCR 16 Loan Origination Cost 17 Loan Costs 18 Amortized Loan Costs 19 Periodic Payment 20 Annual Debt Service =21 Holding Period 22 Remaining Mortgage Balance 23 OC 24 Before tax Equity Reversion 2, 2s Net Proceeds from Sale 8. 26 Less: Remaining Mortgage Balance 27 Before Tax Equity Reversion 28 qu 29 Adjusted Basis 30 Purchase Price 31 Acquisition Costs 32 Original Cost Basis 33 Additional Capital Expenditures 34 Less: Depreciation (Cost Recovery Allowance) 35 Adjusted Basis 36 37 Capital Gain/Loss 38 Net Proceeds from Sale 39 Less: Adjusted Basis 40 Total Gain/Loss 41 42 Taxes Due on Sale 43 Taxable Gain/Loss 44 Less: Depreciation (Cost Recovery Allowance) 45 Capital Gain/Loss on Sale 46 47 Capital Gain/Loss Taxat 20% 48 Depreciation Recapture Tax at 25% 49 Taxes Due on Sale 50 51 After Tax Equity Reversion 52 Before Tax Equity Revenion 53 less: Taxes Due on Sale 54 After Tax Equity Reversion 55 56 $9,750,000 $ $ 88 SO SO SO $0 13 1 What is the EGI in Year 4? 14 2 What is the NOI in Year 1? 15 3 What is the unlevered NPV? 16 4 What is the unlevered IRR? 175 What is the annual debt service payment? 18 6 What is the before-tax cash flow for Year 5? 19 7 What is the equity dividend rate at acquisition? 20 8 What is the remaining mortgage balance at the end of the holding period? 219 What is the leveraged NPV? 22 10 What is the leveraged IRR? 23 11 How much will be paid in mortgage interest in Year 4? 24 12 How much will be paid in debt service over the holding period? 25 13 How much depreciation will be taken in in Year 2? 26 14 How much income tax will be paid in Year 3? 27 15 What is the total expected depreciation over the holding period? 28 16 What is the adjusted basis at reversion? 29 17 How much tax will be due upon sale of the property? 30 18 What is the leveraged after-tax NPV? 31 19 What is the leveraged after-tax IRR? 32 20 What is the leveraged after-tax MIRR? 33 Bonus What is the annual compound rate of growth for the NOI over the holding period? 24 H $9,750,000 10 Purchase Price 11 12 Unit Mix 13 Unit Type 14 1BR/1BA 15 2BR/1.5BA 16 3BR/2BA 17 Total 18 Annual Rent (PGI) #Monthly Rent 40 $825 40 $925 25 $975 105 $94,375 $1.132.500 f 19 + + 20 Operating Information 21 Monthly Other Income Per Unit $25 22 Annual Other Income $300 23 Annual Rent/Income Increase % 3.00% 24 Vacancy and Collection Loss % 5.00% 25 OPEX % of EGI 33% 26 27 Investor Criteria 28 Target Yield (Discount Rate) 14.00% 29 Holding Period 5 30 Terminal OAR 9.00% 32 Target Equity Yield (Discount Rate) 17% 33 Equity Reinvestment Rate 2% 34 Ordinary Tax Rate 35% 35 Capital Gains Rate 20% 36 Depreciation Recapture Rate 25% 37 38 Financing 39 LTV 80% 40 Loan Amount (PV) $6,864,00 41 6.00% 42 Amortization Period 20 43 Complunding Periods Per Year 12 44 DCR 1.2 45 Acquisition Costs % of Purchase Price 2.00% 46 Acquisition Costs $137,280 47 Loan Origination Cost % 1.50% 48 Loan Costs 49 Amortized Loan Costs 50 Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price $9,750,000 55 Acquisition Costs S187280 DG A Facts Cash Flow Projections Reversion Questions C D E F G $6,864,000 6.00% 20 12 1.2 2.00% $137,280 1.50% 40 Loan Amount (PV) 41 i 42 Amortization Period 43 Compiunding Periods Per Year 44 DCR 45 Acquisition Costs % of Purchase Price 46 Acquisition Costs 47 Loan Origination Cost % C 48 Loan Costs f49 Amortized Loan Costs SO Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price 55 Acquisition Costs 56 Loan Costs 57 Less: Mortgage 58 initial Cash Required 59 60 Assessment Information 61 Land Assessment 62 Improvement Assessment 63 Total Assessment 64 65 Depreciation 66 Depreciable Basis 67 ufe 68 Annual Depreceition Rate 69 First/Last Depreciation Rate 70 71 $9,750,000 $137,280 $0 -$6,864,000 $3,023,280 + $2,145,000 $6,435,000 $8,580,000 #DIV/0! #DIV/0! C G Year O 2 3 5 1 51. 10.500 144.62 100 51,076, 5309 : 31,00 S 10 SAN $5612 SSSR 59.750,000 3110 59.750.000 SATZS 57,554,30 56.012 1 Cash Flow Analysis 2 Unlevered Before Tax Cash Flow 3 4 Potential Gross income 5 Les Vacancy and Collection Lor 6 Other Incom 7 Effective Gross income (EGI Operating Expenses (OPEXO 3 Net Operating income INDO 10 Purchase Price 12 Net Proceeds from Sale 12 Total 13 4 Property Metrics 5 Unlevered NPV 6 Unlevered IRR OAR at Acquisition 9 levered Before Tax Cash Flow 0 Net Operating Income INCO 2 Less Debt Service 3 Before Tax Cash Flow 4 Initial Cash Required 5 Equity at Reversion 6 Total 7 Investment Metrics 9 Leveraged NPV Leveragedir Leveraged MERR 2 Equity Dividend Rate at Acquisition 3307269 5367,094 150.00 Year 556325 $58581 S60,312 562,103 $6,999 After Tax Cash Flow Year O 1 $56,125 2 SSR.581 $60,397 562,103 $61,919 35 BSN 35 35 SN 16 Net Operating income INDO 7 Les Annual Mortgage Interest Less Depreciation Les Amortired Loan Costs Taxable income Ordinary income Tax Rate 2 Taxability 3 4 Net Operating income INO Less Debt Service 6 Before Tax Cash Flow 7 Less Tax ability Afer Tax Cash Flow INC Required Atter Tarquity Reversion 1 Total 2 1 After Tax Investment Metro 4 Leveraged Aker TONE Leveraged Aker 6 Laveraged 7 Leveraged Aren Taxiquity Dividendate al Auton 8 MRR AL C D F 9.00% $0 80% $6,864,000 6.00% 20 12 12 1.50% 8888 $ SO $0 5 883 $0 Reversion 2 Unlevered Before Tax Reversion 3 NOI 4 Terminal OAR 5 Anticipated Sale Price 6 Less: Cost of Sale (4%) 7 Net Proceeds from Sale 9 Mortgage Balance 10 LTV 11 Loan Amount (PV) 12 13 Amortization Period af 14 complunding Periods Per Year 15 DCR 16 Loan Origination Cost 17 Loan Costs 18 Amortized Loan Costs 19 Periodic Payment 20 Annual Debt Service =21 Holding Period 22 Remaining Mortgage Balance 23 OC 24 Before tax Equity Reversion 2, 2s Net Proceeds from Sale 8. 26 Less: Remaining Mortgage Balance 27 Before Tax Equity Reversion 28 qu 29 Adjusted Basis 30 Purchase Price 31 Acquisition Costs 32 Original Cost Basis 33 Additional Capital Expenditures 34 Less: Depreciation (Cost Recovery Allowance) 35 Adjusted Basis 36 37 Capital Gain/Loss 38 Net Proceeds from Sale 39 Less: Adjusted Basis 40 Total Gain/Loss 41 42 Taxes Due on Sale 43 Taxable Gain/Loss 44 Less: Depreciation (Cost Recovery Allowance) 45 Capital Gain/Loss on Sale 46 47 Capital Gain/Loss Taxat 20% 48 Depreciation Recapture Tax at 25% 49 Taxes Due on Sale 50 51 After Tax Equity Reversion 52 Before Tax Equity Revenion 53 less: Taxes Due on Sale 54 After Tax Equity Reversion 55 56 $9,750,000 $ $ 88 SO SO SO $0 13 1 What is the EGI in Year 4? 14 2 What is the NOI in Year 1? 15 3 What is the unlevered NPV? 16 4 What is the unlevered IRR? 175 What is the annual debt service payment? 18 6 What is the before-tax cash flow for Year 5? 19 7 What is the equity dividend rate at acquisition? 20 8 What is the remaining mortgage balance at the end of the holding period? 219 What is the leveraged NPV? 22 10 What is the leveraged IRR? 23 11 How much will be paid in mortgage interest in Year 4? 24 12 How much will be paid in debt service over the holding period? 25 13 How much depreciation will be taken in in Year 2? 26 14 How much income tax will be paid in Year 3? 27 15 What is the total expected depreciation over the holding period? 28 16 What is the adjusted basis at reversion? 29 17 How much tax will be due upon sale of the property? 30 18 What is the leveraged after-tax NPV? 31 19 What is the leveraged after-tax IRR? 32 20 What is the leveraged after-tax MIRR? 33 Bonus What is the annual compound rate of growth for the NOI over the holding period? 24