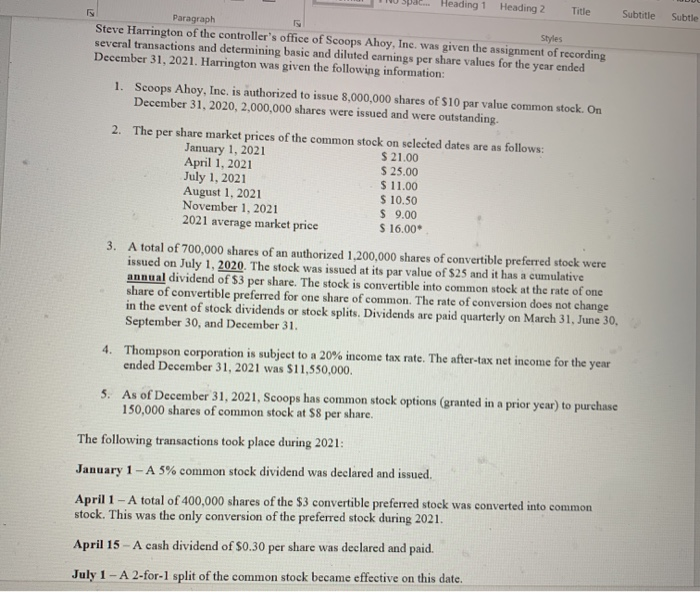

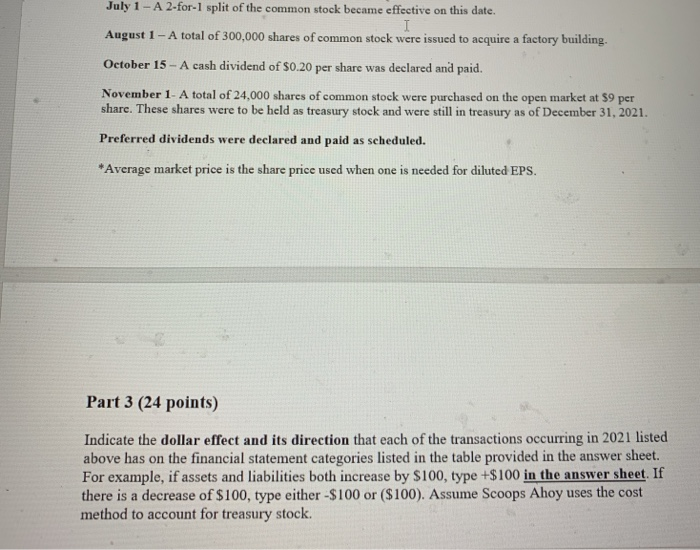

H a e Heading 1 Heading 2 Title Subtitle Subtle Paragraph Styles Steve Harrington of the controller's office of Scoops Ahoy, Inc. was given the assignment of recording several transactions and determining basic and diluted earnings per share values for the year ended December 31, 2021. Harrington was given the following information: 1. Scoops Ahoy, Inc. is authorized to issue 8,000,000 shares of S10 par value common stock. On December 31, 2020, 2,000,000 shares were issued and were outstanding. 2. The per share market prices of the common stock on selected dates are as follows: January 1, 2021 $ 21.00 April 1, 2021 $ 25.00 July 1, 2021 $ 11.00 August 1, 2021 S 10.50 November 1, 2021 $9.00 2021 average market price $ 16.00 3. A total of 700,000 shares of an authorized 1.200,000 shares of convertible preferred stock were issued on July 1, 2020. The stock was issued at its par value of $25 and it has a cumulative annual dividend of $3 per share. The stock is convertible into common stock at the rate of one share of convertible preferred for one share of common. The rate of conversion does not change in the event of stock dividends or stock splits. Dividends are paid quarterly on March 31, June 30, September 30, and December 31. 4. Thompson corporation is subject to a 20% income tax rate. The after-tax net income for the year ended December 31, 2021 was $11,550,000. 5. As of December 31, 2021, Scoops has common stock options (granted in a prior year) to purchase 150,000 shares of common stock at $8 per share. The following transactions took place during 2021: January 1-A 5% common stock dividend was declared and issued. April 1 - A total of 400,000 shares of the $3 convertible preferred stock was converted into common stock. This was the only conversion of the preferred stock during 2021. April 15 - A cash dividend of $0.30 per share was declared and paid. July 1-A2-for-1 split of the common stock became effective on this date. July 1 - A 2-for-1 split of the common stock became effective on this date. August 1 - A total of 300,000 shares of common stock were issued to acquire a factory building. October 15 - A cash dividend of $0.20 per share was declared and paid. November 1- A total of 24,000 shares of common stock were purchased on the open market at $9 per share. These shares were to be held as treasury stock and were still in treasury as of December 31, 2021. Preferred dividends were declared and paid as scheduled. *Average market price is the share price used when one is needed for diluted EPS. Part 3 (24 points) Indicate the dollar effect and its direction that each of the transactions occurring in 2021 listed above has on the financial statement categories listed in the table provided in the answer sheet. For example, if assets and liabilities both increase by $100, type +$100 in the answer sheet. If there is a decrease of $100, type either -$100 or ($100). Assume Scoops Ahoy uses the cost method to account for treasury stock. H a e Heading 1 Heading 2 Title Subtitle Subtle Paragraph Styles Steve Harrington of the controller's office of Scoops Ahoy, Inc. was given the assignment of recording several transactions and determining basic and diluted earnings per share values for the year ended December 31, 2021. Harrington was given the following information: 1. Scoops Ahoy, Inc. is authorized to issue 8,000,000 shares of S10 par value common stock. On December 31, 2020, 2,000,000 shares were issued and were outstanding. 2. The per share market prices of the common stock on selected dates are as follows: January 1, 2021 $ 21.00 April 1, 2021 $ 25.00 July 1, 2021 $ 11.00 August 1, 2021 S 10.50 November 1, 2021 $9.00 2021 average market price $ 16.00 3. A total of 700,000 shares of an authorized 1.200,000 shares of convertible preferred stock were issued on July 1, 2020. The stock was issued at its par value of $25 and it has a cumulative annual dividend of $3 per share. The stock is convertible into common stock at the rate of one share of convertible preferred for one share of common. The rate of conversion does not change in the event of stock dividends or stock splits. Dividends are paid quarterly on March 31, June 30, September 30, and December 31. 4. Thompson corporation is subject to a 20% income tax rate. The after-tax net income for the year ended December 31, 2021 was $11,550,000. 5. As of December 31, 2021, Scoops has common stock options (granted in a prior year) to purchase 150,000 shares of common stock at $8 per share. The following transactions took place during 2021: January 1-A 5% common stock dividend was declared and issued. April 1 - A total of 400,000 shares of the $3 convertible preferred stock was converted into common stock. This was the only conversion of the preferred stock during 2021. April 15 - A cash dividend of $0.30 per share was declared and paid. July 1-A2-for-1 split of the common stock became effective on this date. July 1 - A 2-for-1 split of the common stock became effective on this date. August 1 - A total of 300,000 shares of common stock were issued to acquire a factory building. October 15 - A cash dividend of $0.20 per share was declared and paid. November 1- A total of 24,000 shares of common stock were purchased on the open market at $9 per share. These shares were to be held as treasury stock and were still in treasury as of December 31, 2021. Preferred dividends were declared and paid as scheduled. *Average market price is the share price used when one is needed for diluted EPS. Part 3 (24 points) Indicate the dollar effect and its direction that each of the transactions occurring in 2021 listed above has on the financial statement categories listed in the table provided in the answer sheet. For example, if assets and liabilities both increase by $100, type +$100 in the answer sheet. If there is a decrease of $100, type either -$100 or ($100). Assume Scoops Ahoy uses the cost method to account for treasury stock