Answered step by step

Verified Expert Solution

Question

1 Approved Answer

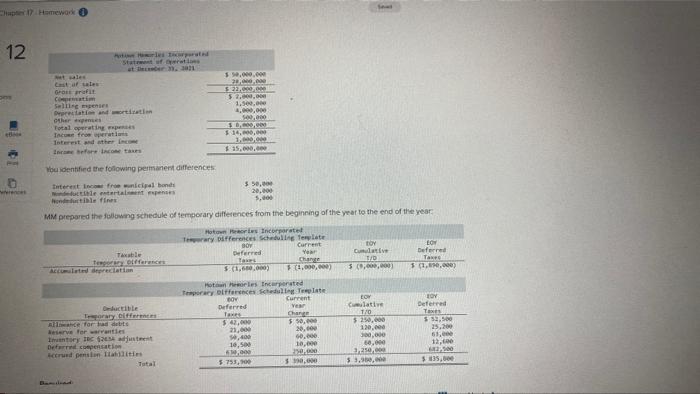

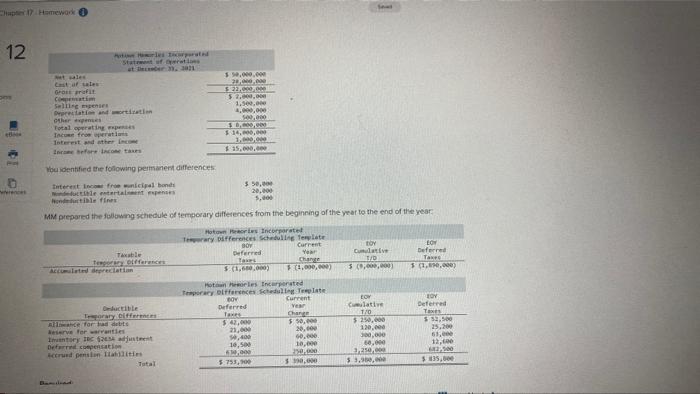

h Chap Homework 12 ht State of at 10 les Last af te Grafit Com Selling me Deprecatoriai Other : Total print Income from per

h

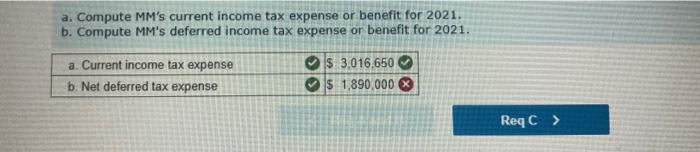

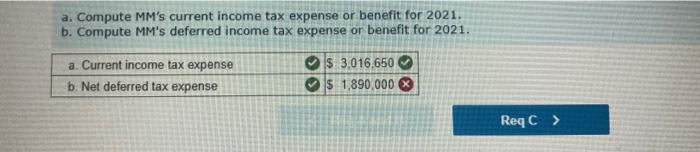

Chap Homework 12 ht State of at 10 les Last af te Grafit Com Selling me Deprecatoriai Other : Total print Income from per 20.00 $22. 52 1.5. 1.000.000 500,000 S , $14.000 You dentified the following permanent differences titrext fewnicipal hande lettres Hondurile fines $ 50, 20.000 5.00 MM prepared the following schedule of temporary differences from the beginning of the year to the end of the year Moto Mories Incorporate Try fferences Schuttelee BO Current TOY LO The Deferred Year dat Tau Deferred Chart TID Taxe $ 1.000 (1,000,000) 59,000,000 31.07 Cuctie Lory Different Refror haddette ere for warranties Intory 12 de Deer compensati ccrued pension Titis Total Hoteles Encorporated Terry blences scheduling plate BOY Current Deferred Ver Tave Change $ 4,000 550.000 21.000 20.000 406 50.00 10,500 10,000 50,000 30. 5.753,500 30,00 LOV Cum lative 1/0 $250.000 120.000 60,000 2.250.000 5 %. TOY Deferred Taxes $52.00 25,200 61, 12. $ 35,00 a. Compute MM's current income tax expense or benefit for 2021. b. Compute MM's deferred Income tax expense or benefit for 2021. a. Current income tax expense b. Net deferred tax expense $ 3,016,650 $ 1,890,000 ReqC >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started