Answered step by step

Verified Expert Solution

Question

1 Approved Answer

h Could you please solve all problems and provide me with a brief explanation for each one as well. 45 Module 3 Homework Declan, Inc.

h

Could you please solve all problems and provide me with a brief explanation for each one as well.

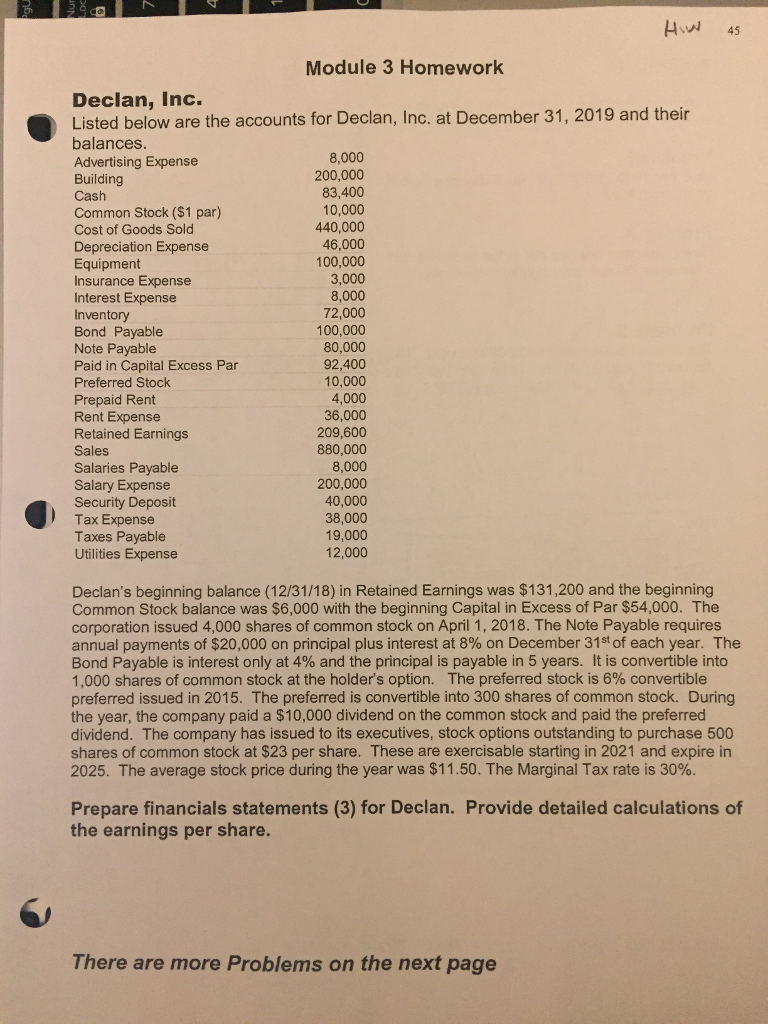

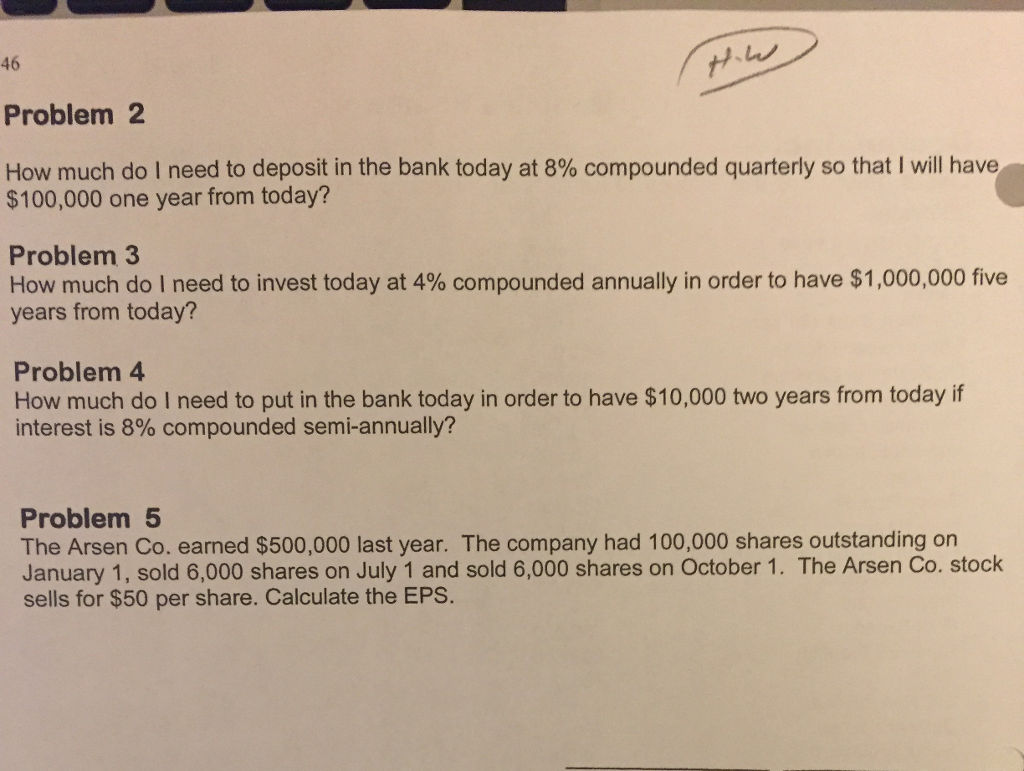

45 Module 3 Homework Declan, Inc. Listed below are the accounts for Declan, Inc. at December 31, 2019 and their balances Advertising Expense Building Cash Common Stock ($1 par) Cost of Goods Sold Depreciation Expense Equipment Insurance Expense Interest Expense Inventory Bond Payable Note Payable Paid in Capital Excess Par Preferred Stock Prepaid Rent Rent Expense Retained Earnings 8,000 200,000 83,400 10,000 440,000 46,000 100,000 3,000 8,000 72,000 100,000 80,000 92,400 10,000 4,000 36,000 209,600 880,000 8,000 200,000 40,000 38,000 19,000 12,000 es Salaries Payable Salary Expense Security Deposit Tax Expense Taxes Payable Utilities Expense Declan's beginning balance (12/31/18) in Retained Earnings was $131,200 and the beginning Common Stock balance was $6,000 with the beginning Capital in Excess of Par $54,000. The corporation issued 4,000 shares of common stock on April 1, 2018. The Note Payable requires annual payments of $20,000 on principal plus interest at 8% on December 31st of each year. The Bond Payable is interest only at 4% and the principal is payable in 5 years. It is convertible into 1,000 shares of common stock at the holder's option. The preferred stock is 6% convertible preferred issued in 2015. The preferred is convertible into 300 shares of common stock. During the year, the company paid a $10,000 dividend on the common stock and paid the preferred dividend. The company has issued to its executives, stock options outstanding to purchase 500 shares of common stock at $23 per share. These are exercisable starting in 2021 and expire in 2025. The average stock price during the year was $11.50. The Marginal Tax rate is 30%. Prepare financials statements (3) for Declan. Provide detailed calculations of the earnings per share. There are more Problems on the next page 46 Problem 2 How much do I need to deposit in the bank today at 8% compounded quarterly so that I will have $100,000 one year from today? Problem 3 How much do I need to invest today at 4% compounded annually in order to have $1,000,000 five years from today? Problem 4 How much do I need to put in the bank today in order to have $10,000 two years from today if interest is 8% compounded semi-annually? Problem 5 The Arsen Co. earned $500,000 last year. The company had 100,000 shares outstanding on January 1, sold 6,000 shares on July 1 and sold 6,000 shares on October 1. The Arsen Co. stock sells for $50 per share. Calculate the EPSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started