Answered step by step

Verified Expert Solution

Question

1 Approved Answer

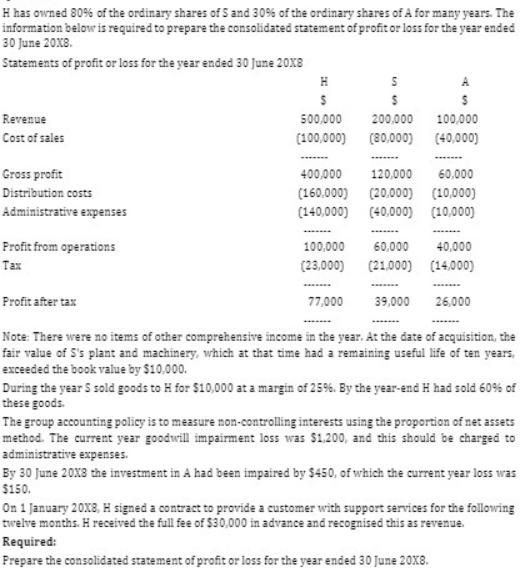

H has owned 80% of the ordinary shares of 5 and 30% of the ordinary shares of A for many years. The information below

H has owned 80% of the ordinary shares of 5 and 30% of the ordinary shares of A for many years. The information below is required to prepare the consolidated statement of profit or loss for the year ended 30 June 20x8. Statements of profit or loss for the year ended 30 June 20X8 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Profit from operations Tax H S S $ 500,000 200,000 (100,000) (80,000) 400,000 120,000 60,000 (160.000) (20,000) (10,000) (10,000) (140,000) (40,000) 100,000 60,000 (23,000) (21,000) 39,000 A S 100,000 (40,000) 40,000 (14,000) Profit after tax 77,000 Note: There were no items of other comprehensive income in the year. At the date of acquisition, the fair value of 5's plant and machinery, which at that time had a remaining useful life of ten years, exceeded the book value by $10,000. 26,000 During the year S sold goods to H for $10,000 at a margin of 25%. By the year-end H had sold 60% of these goods. The group accounting policy is to measure non-controlling interests using the proportion of net assets method. The current year goodwill impairment loss was $1,200, and this should be charged to administrative expenses. By 30 June 2013 the investment in A had been impaired by $450, of which the current year loss was $150. Required: Prepare the consolidated statement of profit or loss for the year ended 30 June 20X8. On 1 January 20X8, H signed a contract to provide a customer with support services for the following twelve months. H received the full fee of $30,000 in advance and recognised this as revenue.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each section of the consolidated statement of profit or loss and explain the calculations Revenue The consolidated revenue includes th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started