Answered step by step

Verified Expert Solution

Question

1 Approved Answer

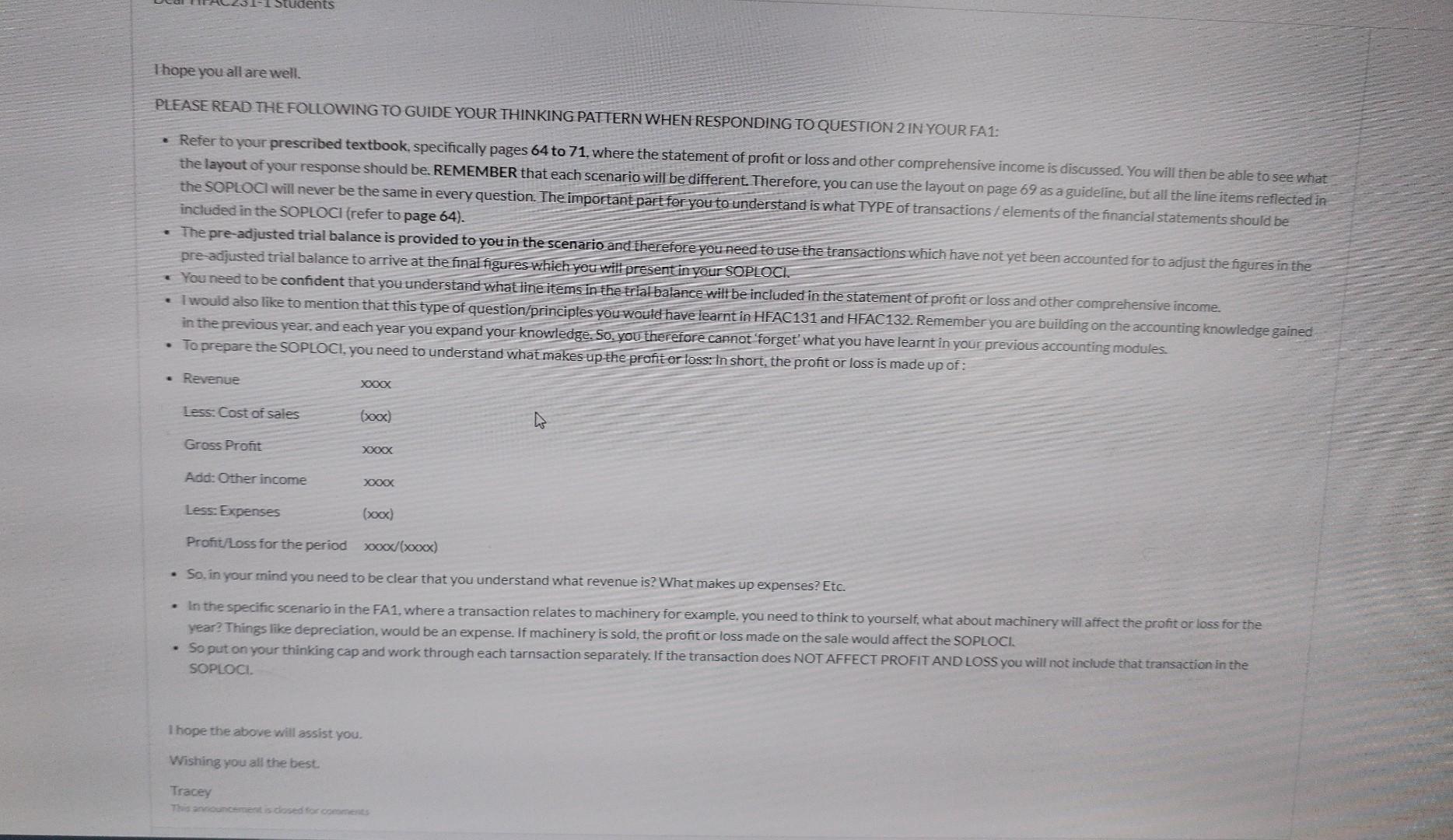

H I Thope you all are well. PLEASE READ THE FOULOWING TO GUIDE YOUR THINKING PATTERN WHENRESPONDING TO QUESTION 2 IN YOUR FA1: - Refer

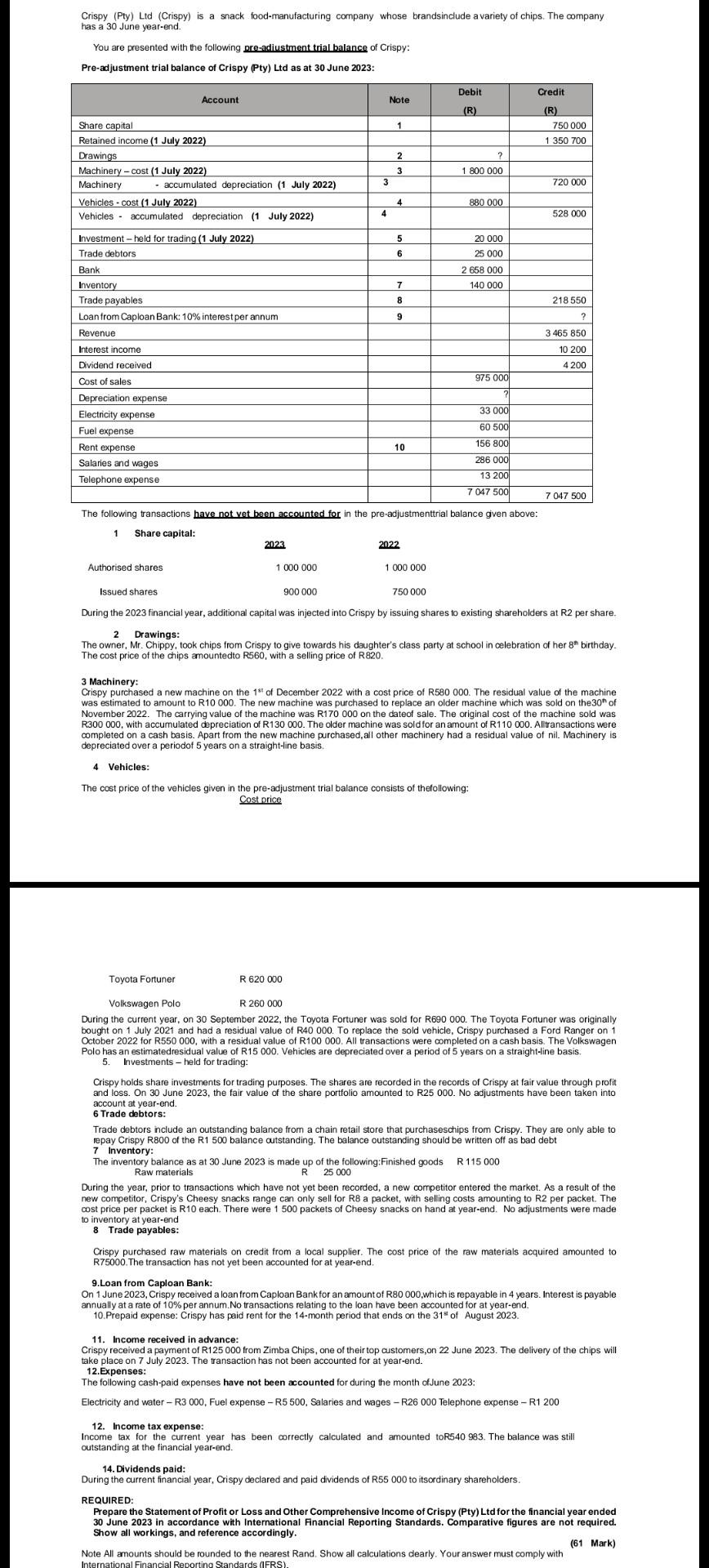

H I Thope you all are well. PLEASE READ THE FOULOWING TO GUIDE YOUR THINKING PATTERN WHENRESPONDING TO QUESTION 2 IN YOUR FA1: - Refer to your prescribed textbook, specifically pages 64 to 71, where the statement of profit or loss and other comprehensive income is discussed. You will then be able to see what the layout of your response should be. REMEMBER that each scenario will be different. Therefore, you can use the layout on page 69 as a guideline, but all the line items reflected in included in the SOPLOCl (refer to page 64). - The pre-adjusted trial balance is provided to you in the scenario and therefore youneed to use the transactions which have not yet been accounted for to adjust the figures in the pre adjusted trial balance to arrive at the final figureswhiehyouw will present in your SOPLOCL. - You need to be confident that you understand what line items in the trial balance wilt be included in the statement of profit or loss and other comprehensive income. - I would also like to mention that this type of question/principles yous would have learnt in HFAC131 and HFAC132. Remember you are building on the accounting knowledge gained in the previous year. and each year you expand your knowledge. 50 , you therefore cannot ' forget' what you have learnt in your previous accounting modules. - To prepare the SOPLOCl, you need to understand what makes up the profit or loss: In short, the profit or loss is made up of: - So, in your mind you need to be clear that you understand what revenue is? What makes up expenses? Etc. - In the specific scenario in the FA1, where a transaction relates to machinery for example, you need to think to yourself, what about machinery will affect the profit or loss for the year? Things like depreciation, would be an expense. If machinery is sold, the profit or loss made on the sale would affect the SOPLOCI. - So put on your thinking cap and work through each tarnsaction separately. If the transaction does NOT AFFECT PROFIT AND LOSS You will not include that transaction in the SOPLOCl. 1 hope the above will assist you. Wishing you all the best. Tracey H I Thope you all are well. PLEASE READ THE FOULOWING TO GUIDE YOUR THINKING PATTERN WHENRESPONDING TO QUESTION 2 IN YOUR FA1: - Refer to your prescribed textbook, specifically pages 64 to 71, where the statement of profit or loss and other comprehensive income is discussed. You will then be able to see what the layout of your response should be. REMEMBER that each scenario will be different. Therefore, you can use the layout on page 69 as a guideline, but all the line items reflected in included in the SOPLOCl (refer to page 64). - The pre-adjusted trial balance is provided to you in the scenario and therefore youneed to use the transactions which have not yet been accounted for to adjust the figures in the pre adjusted trial balance to arrive at the final figureswhiehyouw will present in your SOPLOCL. - You need to be confident that you understand what line items in the trial balance wilt be included in the statement of profit or loss and other comprehensive income. - I would also like to mention that this type of question/principles yous would have learnt in HFAC131 and HFAC132. Remember you are building on the accounting knowledge gained in the previous year. and each year you expand your knowledge. 50 , you therefore cannot ' forget' what you have learnt in your previous accounting modules. - To prepare the SOPLOCl, you need to understand what makes up the profit or loss: In short, the profit or loss is made up of: - So, in your mind you need to be clear that you understand what revenue is? What makes up expenses? Etc. - In the specific scenario in the FA1, where a transaction relates to machinery for example, you need to think to yourself, what about machinery will affect the profit or loss for the year? Things like depreciation, would be an expense. If machinery is sold, the profit or loss made on the sale would affect the SOPLOCI. - So put on your thinking cap and work through each tarnsaction separately. If the transaction does NOT AFFECT PROFIT AND LOSS You will not include that transaction in the SOPLOCl. 1 hope the above will assist you. Wishing you all the best. Tracey

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started