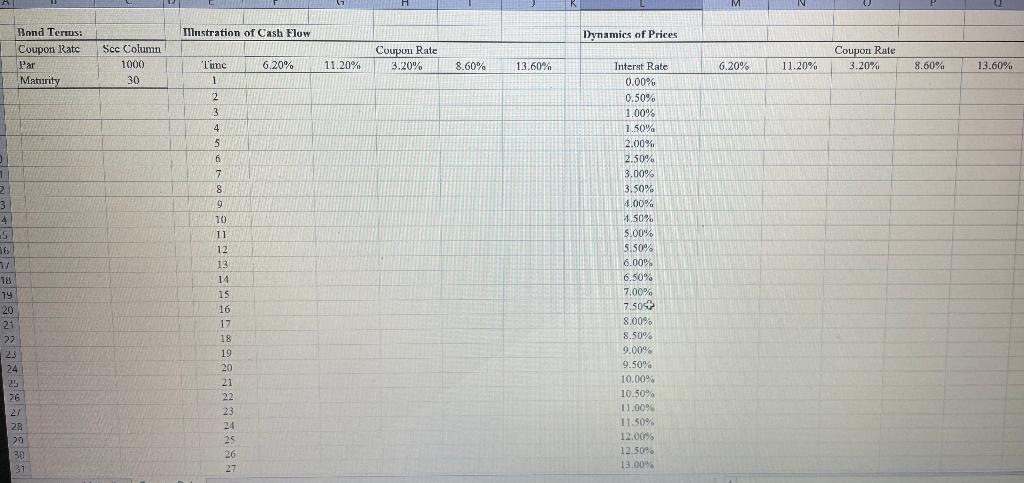

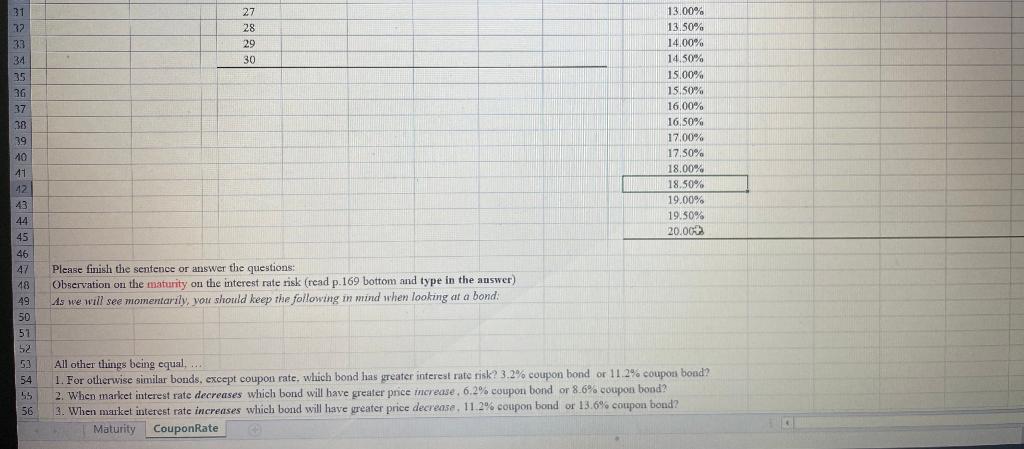

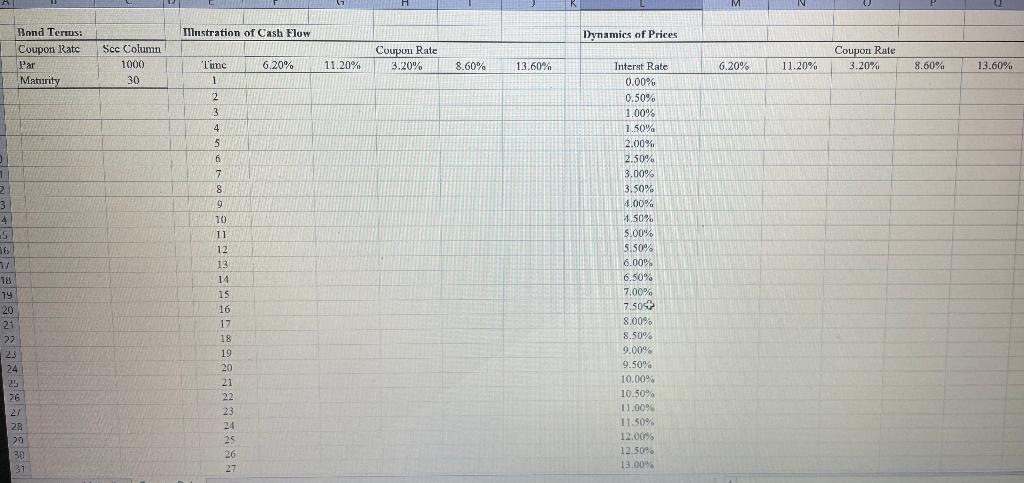

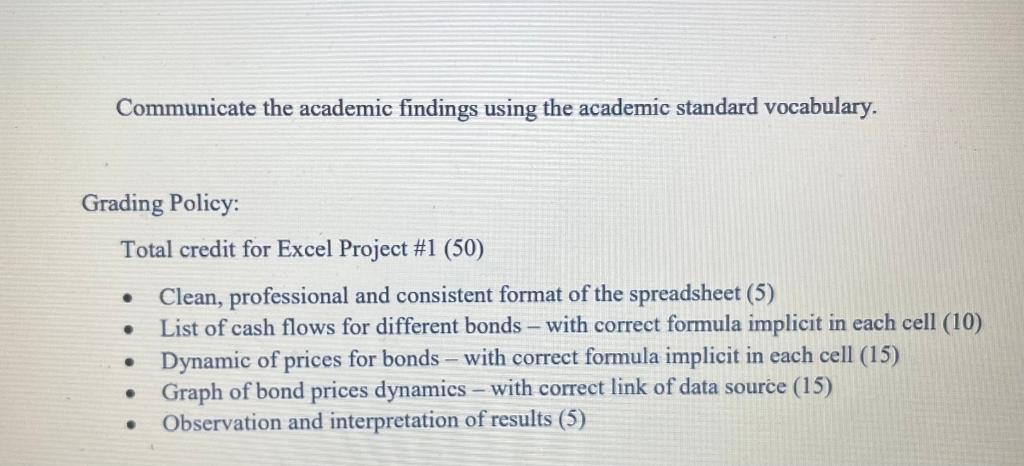

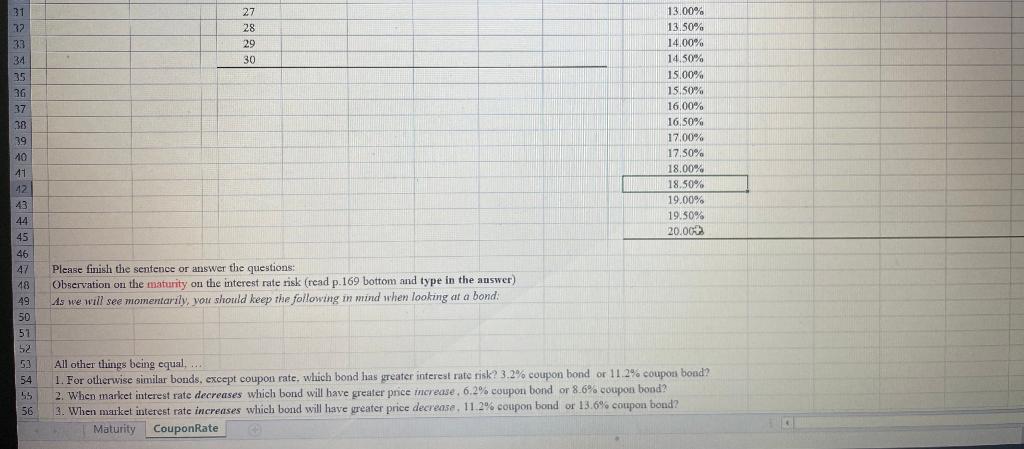

H M N Tllustration of Cash Flow Dynamics of Prices Bond Teruus: Coupon Rate Par Maturity Scc Column 1000 30 Coupon Rate 3.20% Coupon Rate 3.20% 6.20% 11.20% 8.60% 13.60% 6.20% 11.20% 8.60% 13.60% Tinc 1 2 3 3 4 4 5 6 7 8 9 1 2 3 4 56 Interst Rate 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 1.50% 5.00% 5.50 6.00% 6.50% 7.00% 7.50 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.0096 11.50% 12.00% 12.50 13.00% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 18 79 20 25 22 23 24 25 26 27 28 20 30 31 Communicate the academic findings using the academic standard vocabulary. Grading Policy: Total credit for Excel Project #1 (50) Clean, professional and consistent format of the spreadsheet (5) List of cash flows for different bonds with correct formula implicit in each cell (10) Dynamic of prices for bonds with correct formula implicit in each cell (15) Graph of bond prices dynamics with correct link of data source (15) Observation and interpretation of results (5) 27 28 29 30 31 32 33 34 35 36 37 38 39 10 41 42 43 44 45 46 47 48 49 50 57 52 13.00% 13.50% 14.00% 14.50% 15.00% 15.50% 16,00% 16.50% 17.00% % 18.00% 18.50% 19.00% 19.50% 20.00 Please finish the sentence or answer the questions: Observation on the maturity on the interest rate risk (read p.169 bottom and type in the answer) As we will see momentarily, you should keep the following in mind when looking at a bond: 53 54 55 56 All other things being equal, 1. For otherwise similar bonds, except coupon rate, which bond has greater interest rate risk? 3.2% coupon bond or 11.2% coupou bond? 2. When market interest rate decreases which bond will have greater price increase. 6.2% coupon bond or 8.6% coupon bood? 3. When market interest rate increases which bond will have greater price decrease. 11.2% coupon bond or 13.6% coupon bond? Maturity Coupon Rate 4 H M N Tllustration of Cash Flow Dynamics of Prices Bond Teruus: Coupon Rate Par Maturity Scc Column 1000 30 Coupon Rate 3.20% Coupon Rate 3.20% 6.20% 11.20% 8.60% 13.60% 6.20% 11.20% 8.60% 13.60% Tinc 1 2 3 3 4 4 5 6 7 8 9 1 2 3 4 56 Interst Rate 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 1.50% 5.00% 5.50 6.00% 6.50% 7.00% 7.50 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.0096 11.50% 12.00% 12.50 13.00% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 18 79 20 25 22 23 24 25 26 27 28 20 30 31 Communicate the academic findings using the academic standard vocabulary. Grading Policy: Total credit for Excel Project #1 (50) Clean, professional and consistent format of the spreadsheet (5) List of cash flows for different bonds with correct formula implicit in each cell (10) Dynamic of prices for bonds with correct formula implicit in each cell (15) Graph of bond prices dynamics with correct link of data source (15) Observation and interpretation of results (5) 27 28 29 30 31 32 33 34 35 36 37 38 39 10 41 42 43 44 45 46 47 48 49 50 57 52 13.00% 13.50% 14.00% 14.50% 15.00% 15.50% 16,00% 16.50% 17.00% % 18.00% 18.50% 19.00% 19.50% 20.00 Please finish the sentence or answer the questions: Observation on the maturity on the interest rate risk (read p.169 bottom and type in the answer) As we will see momentarily, you should keep the following in mind when looking at a bond: 53 54 55 56 All other things being equal, 1. For otherwise similar bonds, except coupon rate, which bond has greater interest rate risk? 3.2% coupon bond or 11.2% coupou bond? 2. When market interest rate decreases which bond will have greater price increase. 6.2% coupon bond or 8.6% coupon bood? 3. When market interest rate increases which bond will have greater price decrease. 11.2% coupon bond or 13.6% coupon bond? Maturity Coupon Rate 4