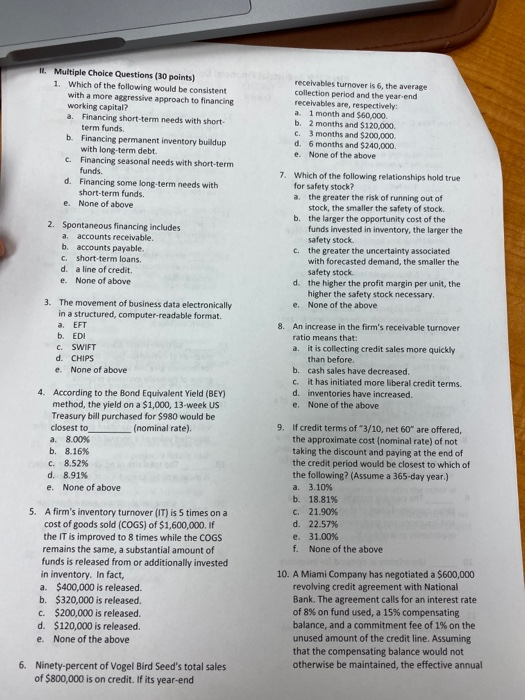

H. Multiple Choice Questions (30 points) 1. Which of the following would be consistent with a more aggressive approach to financing working capital? a Financing short-term needs with short- term funds. b. Financing permanent inventory buildup with long-term debt. c. Financing seasonal needs with short-term funds. d. Financing some long-term needs with short-term funds. e. None of above receivables turnover is 6, the average collection period and the year-end receivables are respectively a. 1 month and $60,000. b. 2 months and $120,000 c. 3 months and $200,000 d. 6 months and $240,000 e. None of the above 2. Spontaneous financing includes a. accounts receivable. b accounts payable. C short-term loans. d a line of credit. e. None of above 7. Which of the following relationships hold true for safety stock? a. the greater the risk of running out of stock, the smaller the safety of stock. b. the larger the opportunity cost of the funds invested in inventory, the larger the safety stock. c. the greater the uncertainty associated with forecasted demand, the smaller the safety stock. d. the higher the profit margin per unit, the higher the safety stock necessary. e. None of the above 8. 3. The movement of business data electronically in a structured, computer-readable format. a. EFT b. EDI C. SWIFT d. CHIPS e. None of above An increase in the firm's receivable turnover ratio means that: a. it is collecting credit sales more quickly than before. b. cash sales have decreased. c. It has initiated more liberal credit terms. d. inventories have increased. e. None of the above 4. According to the Bond Equivalent Yield (BEY) method, the yield on a $1,000, 13-week US Treasury bill purchased for $980 would be closest to (nominal rate). a. 8.00% b. 8.16% C. 8.52% d. 8.91% e. None of above 9. If credit terms of "3/10, net 60 are offered, the approximate cost (nominal rate) of not taking the discount and paying at the end of the credit period would be closest to which of the following? (Assume a 365-day year.) a. 3.108 b. 18.81% c. 21.90% d. 22.57% e. 31.00% f. None of the above 5. A firm's inventory turnover (IT) is 5 times on a cost of goods sold (COGS) of $1,600,000. If the IT is improved to 8 times while the COGS remains the same, a substantial amount of funds is released from or additionally invested in inventory. In fact, a. $400,000 is released. b. $320,000 is released. C. $200,000 is released. d. $120,000 is released. e. None of the above 10. A Miami Company has negotiated a $600,000 revolving credit agreement with National Bank. The agreement calls for an interest rate of 8% on fund used, a 15% compensating balance, and a commitment fee of 1% on the unused amount of the credit line. Assuming that the compensating balance would not otherwise be maintained, the effective annual 6. Ninety-percent of Vogel Bird Seed's total sales of $800,000 is on credit. If its year-end