Answered step by step

Verified Expert Solution

Question

1 Approved Answer

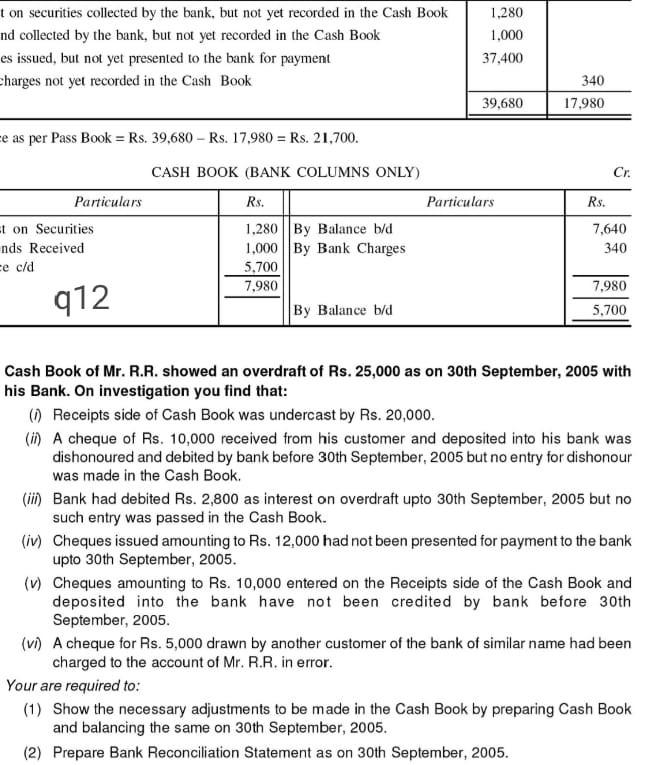

h t on securities collected by the bank, but not yet recorded in the Cash Book nd collected by the bank, but not yet recorded

h

t on securities collected by the bank, but not yet recorded in the Cash Book nd collected by the bank, but not yet recorded in the Cash Book es issued, but not yet presented to the bank for payment charges not yet recorded in the Cash Book 1.280 1,000 37.400 340 17.980 39.680 e as per Pass Book = Rs. 39.680 - Rs. 17.980 = Rs. 21.700. Cr. Particulars Rs. Particulars Et on Securities nds Received ce c/d CASH BOOK (BANK COLUMNS ONLY) Rs. 1.280 ||By Balance b/d 1,000 By Bank Charges 5,700 7,980 By Balance b/d 7,640 340 q12 7,980 5,700 Cash Book of Mr. R.R. showed an overdraft of Rs. 25,000 as on 30th September, 2005 with his Bank. On investigation you find that: (0) Receipts side of Cash Book was undercast by Rs. 20,000. (i) A cheque of Rs. 10,000 received from his customer and deposited into his bank was dishonoured and debited by bank before 30th September, 2005 but no entry for dishonour was made in the Cash Book. (ii) Bank had debited Rs. 2,800 as interest on overdraft upto 30th September, 2005 but no such entry was passed in the Cash Book. (iv) Cheques issued amounting to Rs. 12,000 had not been presented for payment to the bank upto 30th September, 2005. (1) Cheques amounting to Rs. 10,000 entered on the Receipts side of the Cash Book and deposited into the bank have not been credited by bank before 30th September, 2005. (vi) A cheque for Rs. 5,000 drawn by another customer of the bank of similar name had been charged to the account of Mr. R.R. in error. Your are required to: (1) Show the necessary adjustments to be made in the Cash Book by preparing Cash Book and balancing the same on 30th September, 2005. (2) Prepare Bank Reconciliation Statement as on 30th September, 2005Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started