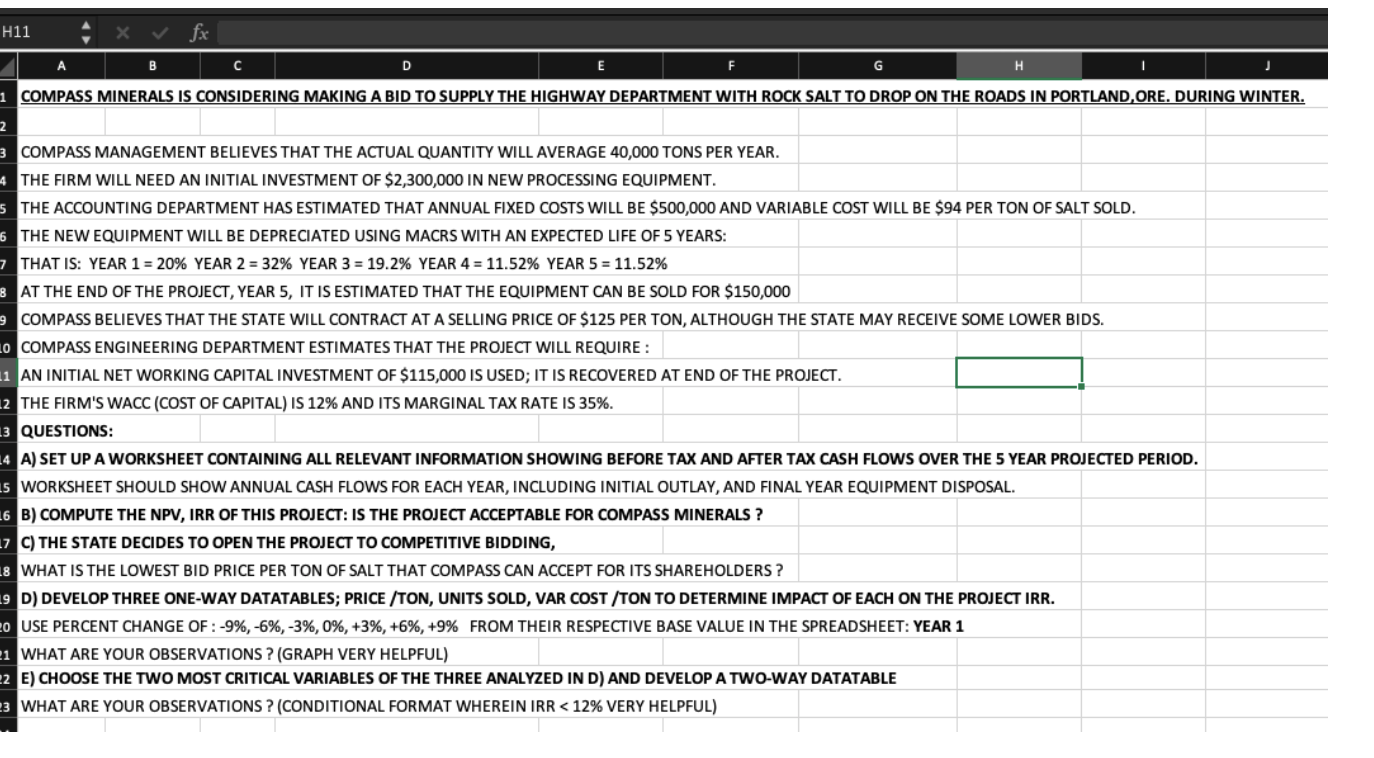

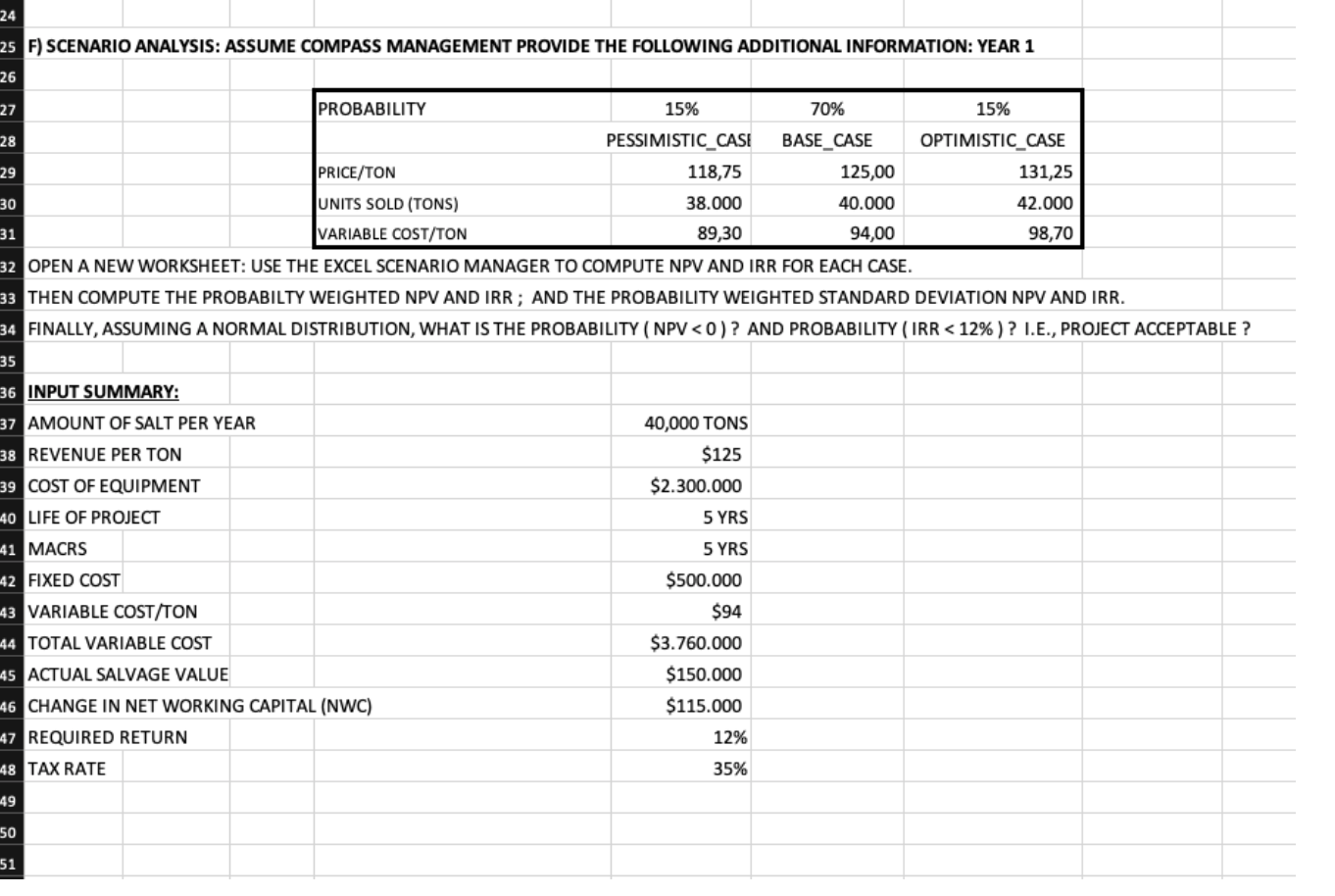

H11 fx A B D G 1 COMPASS MINERALS IS CONSIDERING MAKING A BID TO SUPPLY THE HIGHWAY DEPARTMENT WITH ROCK SALT TO DROP ON THE ROADS IN PORTLAND, ORE. DURING WINTER. 2 3 COMPASS MANAGEMENT BELIEVES THAT THE ACTUAL QUANTITY WILL AVERAGE 40,000 TONS PER YEAR. 4 THE FIRM WILL NEED AN INITIAL INVESTMENT OF $2,300,000 IN NEW PROCESSING EQUIPMENT. 5 THE ACCOUNTING DEPARTMENT HAS ESTIMATED THAT ANNUAL FIXED COSTS WILL BE $500,000 AND VARIABLE COST WILL BE $94 PER TON OF SALT SOLD. 6 THE NEW EQUIPMENT WILL BE DEPRECIATED USING MACRS WITH AN EXPECTED LIFE OF 5 YEARS: 7 THAT IS: YEAR 1 = 20% YEAR 2 = 32% YEAR 3 = 19.2% YEAR 4 = 11.52% YEAR 5 = 11.52% 8 AT THE END OF THE PROJECT, YEAR 5, IT IS ESTIMATED THAT THE EQUIPMENT CAN BE SOLD FOR $150,000 9 COMPASS BELIEVES THAT THE STATE WILL CONTRACT AT A SELLING PRICE OF $125 PER TON, ALTHOUGH THE STATE MAY RECEIVE SOME LOWER BIDS. LO COMPASS ENGINEERING DEPARTMENT ESTIMATES THAT THE PROJECT WILL REQUIRE : 1 AN INITIAL NETWORKING CAPITAL INVESTMENT OF $115,000 IS USED; IT IS RECOVERED AT END OF THE PROJECT. 12 THE FIRM'S WACC (COST OF CAPITAL) IS 12% AND ITS MARGINAL TAX RATE IS 35%. 13 QUESTIONS: 4 A) SET UP A WORKSHEET CONTAINING ALL RELEVANT INFORMATION SHOWING BEFORE TAX AND AFTER TAX CASH FLOWS OVER THE 5 YEAR PROJECTED PERIOD. 5 WORKSHEET SHOULD SHOW ANNUAL CASH FLOWS FOR EACH YEAR, INCLUDING INITIAL OUTLAY, AND FINAL YEAR EQUIPMENT DISPOSAL. 16 B) COMPUTE THE NPV, IRR OF THIS PROJECT: IS THE PROJECT ACCEPTABLE FOR COMPASS MINERALS ? 7 C) THE STATE DECIDES TO OPEN THE PROJECT TO COMPETITIVE BIDDING, 8 WHAT IS THE LOWEST BID PRICE PER TON OF SALT THAT COMPASS CAN ACCEPT FOR ITS SHAREHOLDERS? 9 D) DEVELOP THREE ONE-WAY DATATABLES; PRICE /TON, UNITS SOLD, VAR COST/TON TO DETERMINE IMPACT OF EACH ON THE PROJECT IRR. 20 USE PERCENT CHANGE OF:-9%, -6%, -3%, 0%, +3%, +6%, +9% FROM THEIR RESPECTIVE BASE VALUE IN THE SPREADSHEET: YEAR 1 1 WHAT ARE YOUR OBSERVATIONS ? (GRAPH VERY HELPFUL) 2 E) CHOOSE THE TWO MOST CRITICAL VARIABLES OF THE THREE ANALYZED IN D) AND DEVELOP A TWO-WAY DATATABLE 3 WHAT ARE YOUR OBSERVATIONS ? (CONDITIONAL FORMAT WHEREIN IRR