Answered step by step

Verified Expert Solution

Question

1 Approved Answer

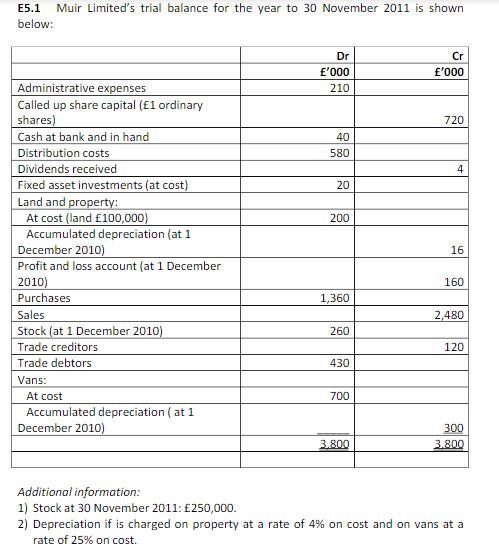

E5.1 Muir Limited's trial balance for the year to 30 November 2011 is shown below: Administrative expenses Called up share capital (1 ordinary shares)

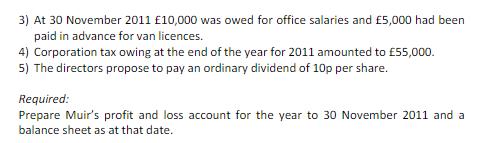

E5.1 Muir Limited's trial balance for the year to 30 November 2011 is shown below: Administrative expenses Called up share capital (1 ordinary shares) Cash at bank and in hand Distribution costs Dividends received Fixed asset investments (at cost) Land and property: At cost (land 100,000) Accumulated depreciation (at 1 December 2010) Profit and loss account (at 1 December 2010) Purchases Sales Stock (at 1 December 2010) Trade creditors Trade debtors Vans: At cost Accumulated depreciation (at 1 December 2010) Dr '000 210 40 580 20 200 1,360 260 430 700 3,800 Cr '000 720 4 16 160 2,480 120 300 3.800 Additional information: 1) Stock at 30 November 2011: 250,000. 2) Depreciation if is charged on property at a rate of 4% on cost and on vans at a rate of 25% on cost. 3) At 30 November 2011 10,000 was owed for office salaries and 5,000 had been paid in advance for van licences. 4) Corporation tax owing at the end of the year for 2011 amounted to 55,000. 5) The directors propose to pay an ordinary dividend of 10p per share. Required: Prepare Muir's profit and loss account for the year to 30 November 2011 and a balance sheet as at that date.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Profit and loss account For the year ended 30 November 2011 Sales 2480 Less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started