Answered step by step

Verified Expert Solution

Question

1 Approved Answer

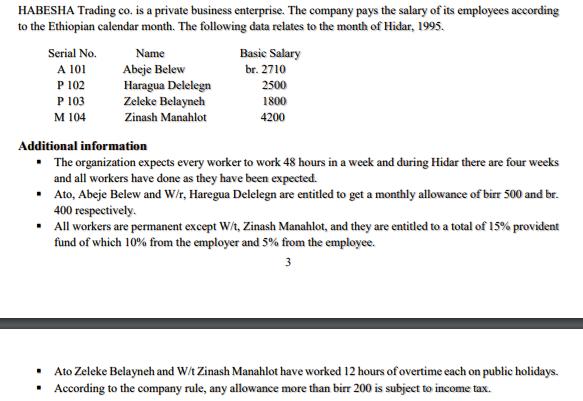

HABESHA Trading co. is a private business enterprise. The company pays the salary of its employees according to the Ethiopian calendar month. The following

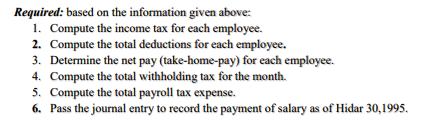

HABESHA Trading co. is a private business enterprise. The company pays the salary of its employees according to the Ethiopian calendar month. The following data relates to the month of Hidar, 1995. . Serial No. A 101 P 102 . P 103 M 104 Name Abeje Belew Haragua Delelegn Zeleke Belayneh Zinash Manahlot Basic Salary br. 2710 2500 1800 Additional information . The organization expects every worker to work 48 hours in a week and during Hidar there are four weeks and all workers have done as they have been expected. Ato, Abeje Belew and W/r, Haregua Delelegn are entitled to get a monthly allowance of birr 500 and br. 400 respectively. . All workers are permanent except W/t, Zinash Manahlot, and they are entitled to a total of 15% provident fund of which 10% from the employer and 5% from the employee. 3 4200 Ato Zeleke Belayneh and W/t Zinash Manahlot have worked 12 hours of overtime each on public holidays. According to the company rule, any allowance more than birr 200 is subject to income tax. Required: based on the information given above: 1. Compute the income tax for each employee. 2. Compute the total deductions for each employee. 3. Determine the net pay (take-home-pay) for each employee. 4. Compute the total withholding tax for the month. 5. Compute the total payroll tax expense. 6. Pass the journal entry to record the payment of salary as of Hidar 30,1995.

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to solve this problem 1 Compute the income tax for each employee Abeje Belew Basi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started