Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Auto Supply Company is engaged in merchandising both at its home office in Cebu City and its branch in Toledo City. Selected accounts taken

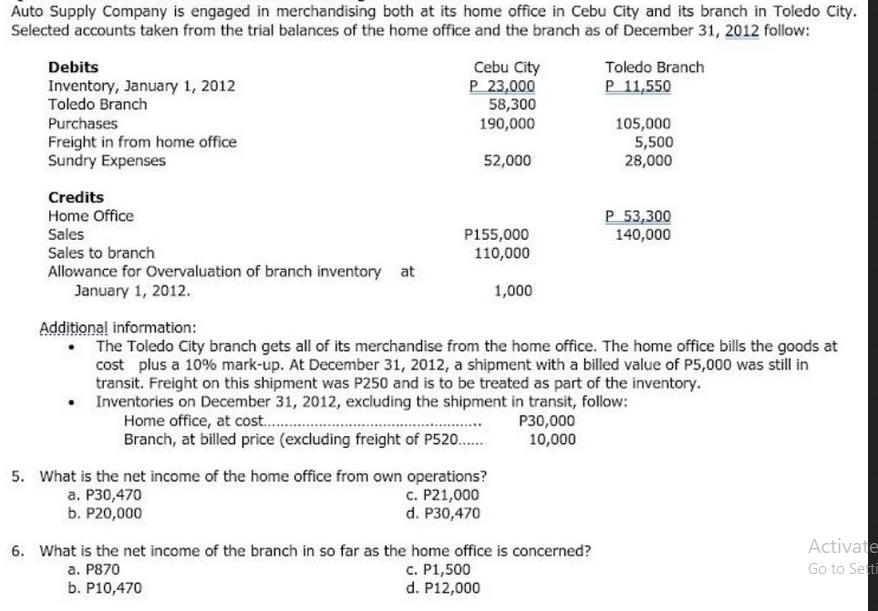

Auto Supply Company is engaged in merchandising both at its home office in Cebu City and its branch in Toledo City. Selected accounts taken from the trial balances of the home office and the branch as of December 31, 2012 follow: Debits Inventory, January 1, 2012 Toledo Branch Purchases Freight in from home office Sundry Expenses Credits Home Office Sales Sales to branch Allowance for Overvaluation of branch inventory at January 1, 2012. . Cebu City P 23,000 58,300 190,000 52,000 P155,000 110,000 1,000 Home office, at cost............. Branch, at billed price (excluding freight of P520....... a. P30,470 b. P20,000 Additional information: The Toledo City branch gets all of its merchandise from the home office. The home office bills the goods at cost plus a 10% mark-up. At December 31, 2012, a shipment with a billed value of P5,000 was still in transit. Freight on this shipment was P250 and is to be treated as part of the inventory. Inventories on December 31, 2012, excluding the shipment in transit, follow: P30,000 10,000 5. What is the net income of the home office from own operations? c. P21,000 d. P30,470 6. What is the net income of the branch in so far as the home office is concerned? a. P870 b. P10,470 Toledo Branch P 11,550 c. P1,500 d. P12,000 105,000 5,500 28,000 P 53,300 140,000 Activate Go to Setti

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Step 14 We shall write the following journal entries for the 6 nos transactions given Cr Date 20220404 Date 20220406 Date 20220410 Date 20220414 Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started