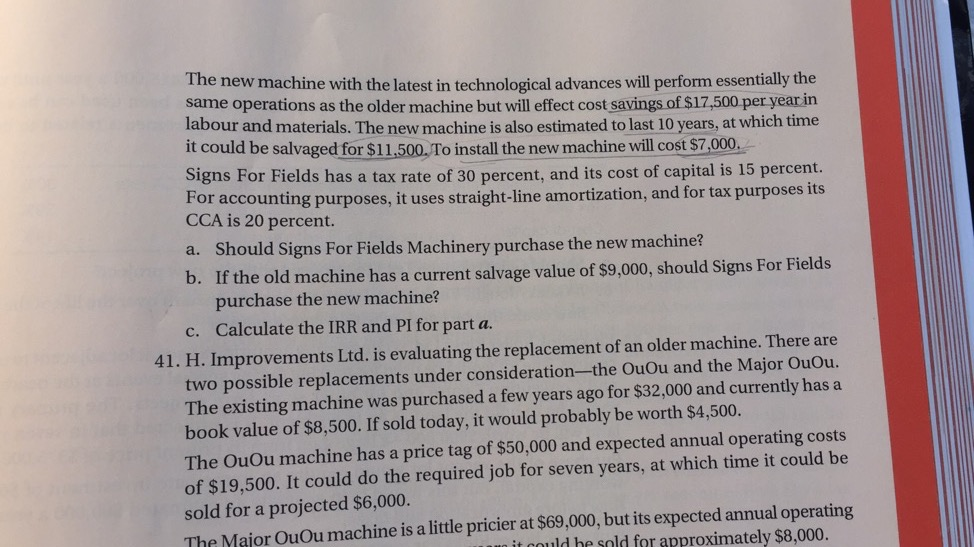

had been deducted growth and to 7.000 per year would In arriving at EBIT, amortization expenses of $140,000 per year had been ded g. Expenditures on capital assets would be necessary to allow for growth replace worn-out equipment. MacLean estimated that $200,000 per vea be required in years 1-5, with $80,000 per year thereafter. h. The income tax rate for both firms was expected to remain at 30 percent. i. Ontario Corporation used 13 percent as its cost of equity and had a weighted average cost of capital of 11 percent. Compute the price MacLean should recommend that Ontario Corporation offer to pay for each of Target Firm's shares. 49. Signs For Fields Machinery Ltd. is considering the replacement of some technologically obsolete machinery with the purchase of a new machine for $72.000 Although the older machine has no market value, it could be expected to perform the required operation for another 10 years. The older machine has an unamortized capital cost of $27,000. 21000 +2ooo The Capital Budgeting Process The new machine with the latest in technological advances will perform essentially the same operations as the older machine but will effect cost savings of $17,500 per year in labour and materials. The new machine is also estimated to last 10 years, at which time it could be salvaged for $11,500. To install the new machine will cost $7,000. Signs For Fields has a tax rate of 30 percent, and its cost of capital is 15 percent. For accounting purposes, it uses straight-line amortization, and for tax purposes its CCA is 20 percent. a. Should Signs For Fields Machinery purchase the new machine? b. If the old machine has a current salvage value of $9,000, should Signs For Fields purchase the new machine? c. Calculate the IRR and PI for part a. 41. H. Improvements Ltd. is evaluating the replacement of an older machine. There are two possible replacements under consideration-the OuOu and the Major OuOu. The existing machine was purchased a few years ago for $32,000 and currently has a book value of $8,500. If sold today, it would probably be worth $4,500. The OuOu machine has a price tag of $50,000 and expected annual operating costs of $19,500. It could do the required job for seven years, at which time it could be sold for a projected $6,000. The Major OuOu machine is a little pricier at $69,000, but its expected annual operating it could be sold for approximately $8,000