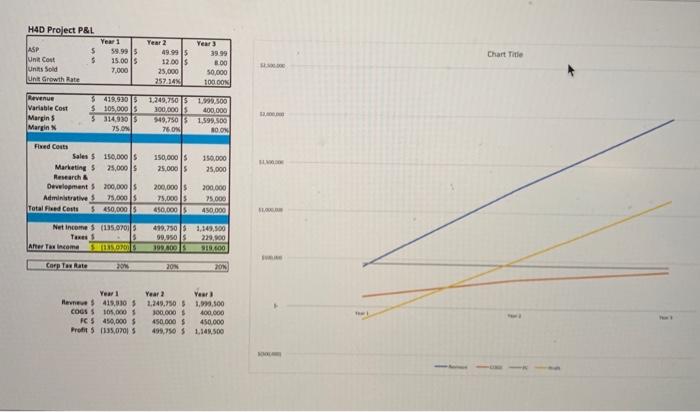

HAD Project P&L Year 3 ASP unit Cont units Sold un Growth Rate Chart Title Years 59.995 15.00 15 7.000 5 Year 2 49.95 12.00 $ 25,000 257.14% 39.99 8.00 50.000 100 DON Revenue Variable Cost Margins Margin 3415,9305 $ 105,000 $ 3 314005 1:249.750 1.500 300.000 $ 400,000 49.750 1.599.500 76. BOON 75.0 150,000 $ 25.000 10.000 25,000 Fixed Costs Sales $ 150,000 $ Marketing 5 25,000 $ Research Development $ 200,000 Administratives 25.000 Total Fleed Coats $ 450,000 200,000 $ 75,000 $ 450,000 200.000 75.000 450,000 NO. Net Income $ (135.070 Tanes Ane Tax income 419.750 151.149.500 99.950 229.00 199.00 S600 OLOSET Carp Tax Rate 20N NOE Year Year 1 Havneve $ 419,00 5 COGS 105,000 FC $ 450,000 $ Profit $ 135,07015 Year 2 1.249.750 17.500 300.000 400.000 450.000 450.000 499,750 $ 1.149.500 Using the spreadsheet provided as a link in the Quiz Instructions and remembering the lecture from Week 11, please provide answers to the following questions. (Assume all parts of this question are to be evaluated independently of each other.) Show answers in whole dollar amounts only, rounded to the nearest dollar. Do not use dollar signs ($) or display decimal cents (.00) but do use commas. What is the After-Tax Income for Year 2 if you can sell 10,000 more units, by dropping the price to $45 per unit? a. b. What is the After-Tax Income for Year 3 if you can sell 15,000 more units, by spending more $20,000 more on advertising? C. What is the After-Tax Income for Year 2 if you can redesign your product to lower the cost per unit by two more dollars? d. What happens to your 3 year projections (After Tax Income, end of Year 3), if the government corporate Tax Rate is dropped to 10%, starting in Year 2? e. What happens to the P&L in Year 1, if your design/test labs use $5,000 more in electricity than planned? (Answer should be expressed in terms of how much MORE more money do you lose? Using the same reference information in Question 2 above, please answer the following for the business: (Again all questions are independent and calculations for each part should be made based on the original unmodified spreadsheet). What is the After-Tax Income if, in year 2, you have a factory equipment failure and the manufacturing line is down for 4 weeks out of 50? (Assume the repairs will cost you $10,000, and 50 weeks of production in a year) a. b. What happens to your Margin % in Year 3, if a new competitor comes into the market and begins selling at $29.99, starting in May of that year (forcing you to match on price) Remember do not use % or in your response C. What happens to your After Tax Income in year 3, if corporate taxes go up to 30% at the beginning of that year