had to post in sections so you could see the questions

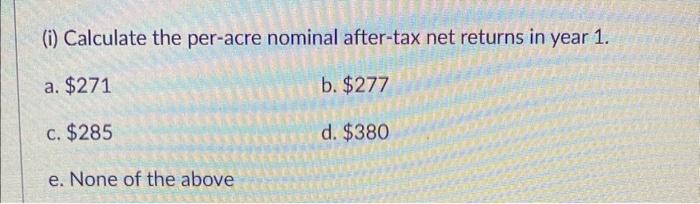

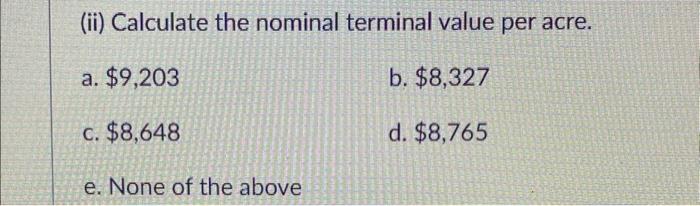

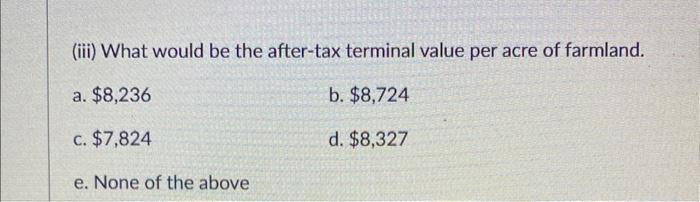

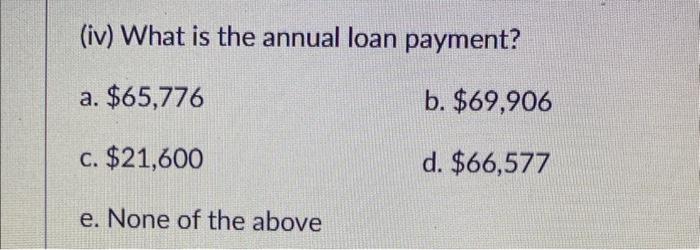

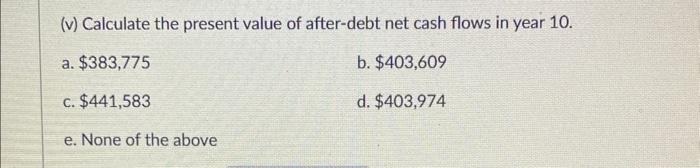

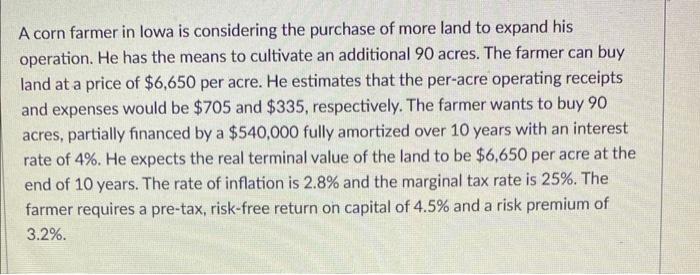

A corn farmer in lowa is considering the purchase of more land to expand his operation. He has the means to cultivate an additional 90 acres. The farmer can buy land at a price of $6,650 per acre. He estimates that the per-acre operating receipts and expenses would be $705 and $335, respectively. The farmer wants to buy 90 acres, partially financed by a $540,000 fully amortized over 10 years with an interest rate of 4%. He expects the real terminal value of the land to be $6,650 per acre at the end of 10 years. The rate of inflation is 2.8% and the marginal tax rate is 25%. The farmer requires a pre-tax, risk-free return on capital of 4.5% and a risk premium of 3.2%. (i) Calculate the per-acre nominal after-tax net returns in year 1. a. $271 b. $277 c. $285 d. $380 e. None of the above (ii) Calculate the nominal terminal value per acre. a. $9,203 b. $8,327 c. $8,648 d. $8,765 e. None of the above (iii) What would be the after-tax terminal value per acre of farmland. a. $8,236 b. $8,724 c. $7,824 d. $8,327 e. None of the above (iv) What is the annual loan payment? a. $65,776 b. $69,906 c. $21,600 d. $66,577 e. None of the above (v) Calculate the present value of after-debt net cash flows in year 10. a. $383,775 b. $403,609 c. $441,583 d. $403,974 e. None of the above A corn farmer in lowa is considering the purchase of more land to expand his operation. He has the means to cultivate an additional 90 acres. The farmer can buy land at a price of $6,650 per acre. He estimates that the per-acre operating receipts and expenses would be $705 and $335, respectively. The farmer wants to buy 90 acres, partially financed by a $540,000 fully amortized over 10 years with an interest rate of 4%. He expects the real terminal value of the land to be $6,650 per acre at the end of 10 years. The rate of inflation is 2.8% and the marginal tax rate is 25%. The farmer requires a pre-tax, risk-free return on capital of 4.5% and a risk premium of 3.2%. (i) Calculate the per-acre nominal after-tax net returns in year 1. a. $271 b. $277 c. $285 d. $380 e. None of the above (ii) Calculate the nominal terminal value per acre. a. $9,203 b. $8,327 c. $8,648 d. $8,765 e. None of the above (iii) What would be the after-tax terminal value per acre of farmland. a. $8,236 b. $8,724 c. $7,824 d. $8,327 e. None of the above (iv) What is the annual loan payment? a. $65,776 b. $69,906 c. $21,600 d. $66,577 e. None of the above (v) Calculate the present value of after-debt net cash flows in year 10. a. $383,775 b. $403,609 c. $441,583 d. $403,974 e. None of the above