Answered step by step

Verified Expert Solution

Question

1 Approved Answer

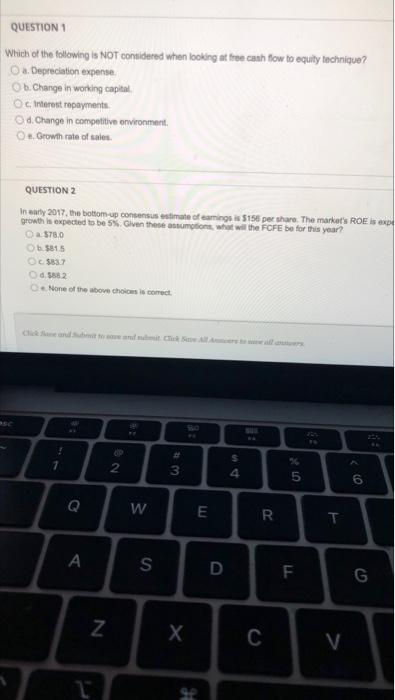

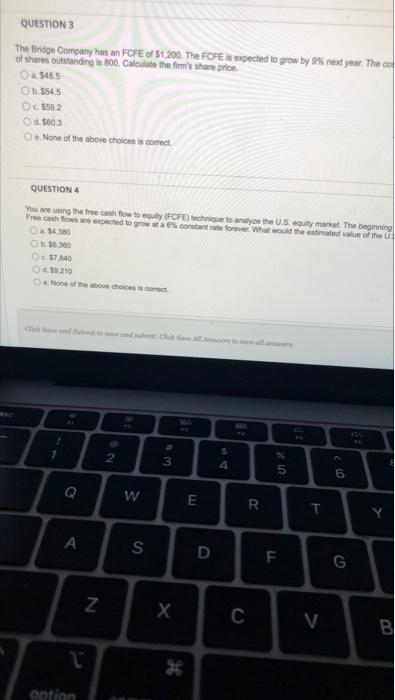

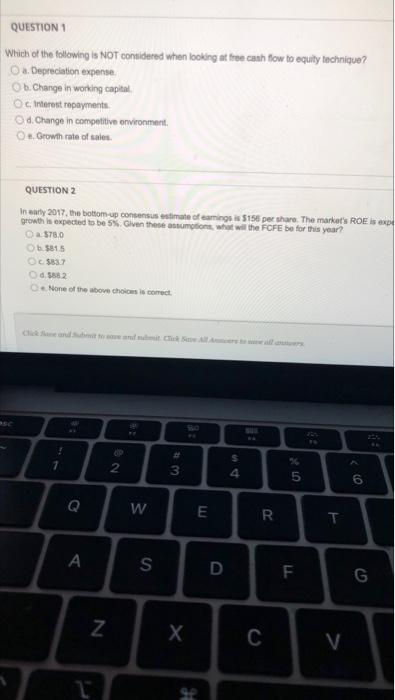

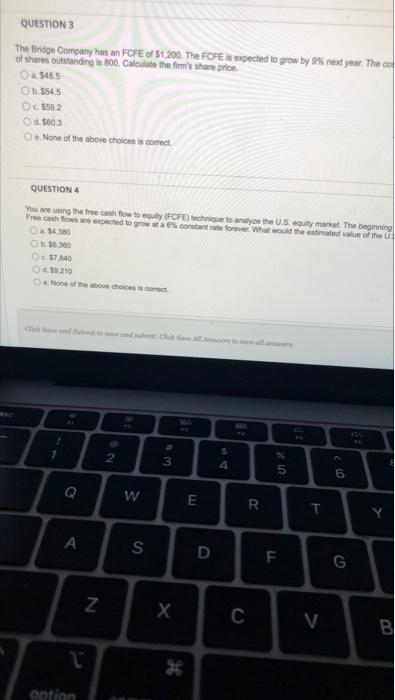

Had to take four pictures for these to make sure images were clear and close up. QUESTION 1 Which of the following is NOT considered

Had to take four pictures for these to make sure images were clear and close up.

QUESTION 1 Which of the following is NOT considered when looking at free cash flow to equity technique ? O a Depreciation expense b. Change in working capital c. Interest repayments d. Change in competitive environment O Growth rate of talen QUESTION 2 In early 2017, the bottom-up consensus estimate of earnings is $150 per share. The market's ROE is ex growth is expected to be 5%. Given the motions, what will the FCFE be for this year? Da $78,0 5815 5837 d5882 None of the above choice is correct 8: : 1 OP 2 3 $ 4 5 6 W E R T S D F G N C V ge -o cash flow to equity technique? rings is $136 per share. The market's ROE expected to be 10% while the long-term expected earnings What will the FCFE be for this year? S 5 6 7 8 9 0 R. T Y U 0 G H K QUESTION 3 The Bridge Company has an FCFE of $1.200. The FCFE Spected to grow by 9% next year. The of shares outstanding is 300. Calculate the firm's share price a 548.5 1.5545 Oc5592 d.5803 e None of the above choice is correct QUESTION 4 You are using the tree cash flow to OFE technique to the U.S. equity. The beginning Froeshows are expected to growce What would the estimated value of the 380 56.30 57.340 10210 None of the above the 80 1 $ 2 3 5 0. 6 Q W m R T A S D F G N z V B option OFE to grow by the cost of cost and the level of debt is 57000. The number technique to start the begin FORE120, and their teoretum constant for What would the deserFOFE? 5 6 7 8 L 9 0 R T Y U F G H J L V 00 B N M command

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started