Answered step by step

Verified Expert Solution

Question

1 Approved Answer

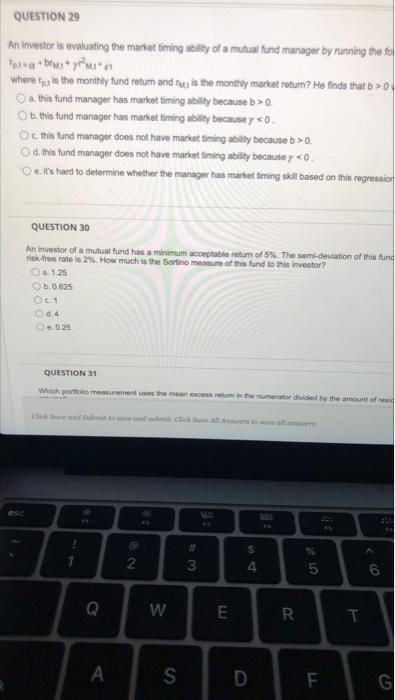

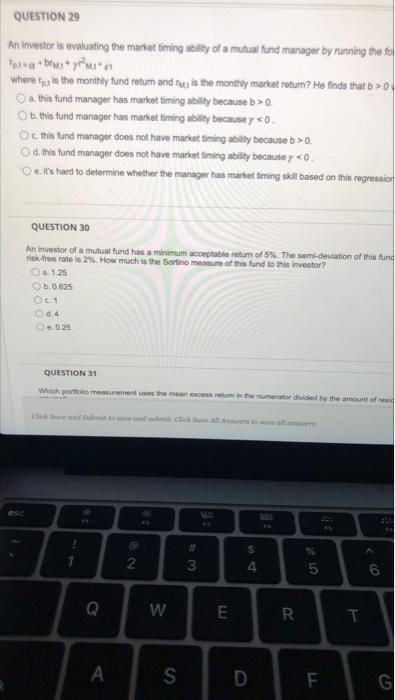

Had to take multiple puctures up close enough to be clear. QUESTION 29 An investor is evaluating the market timing ability of a mutual fund

Had to take multiple puctures up close enough to be clear.

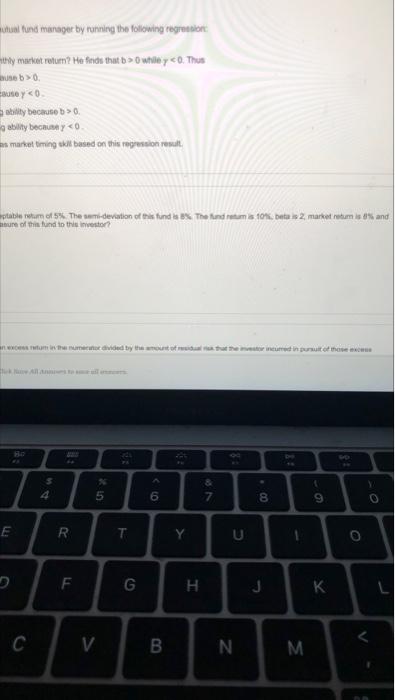

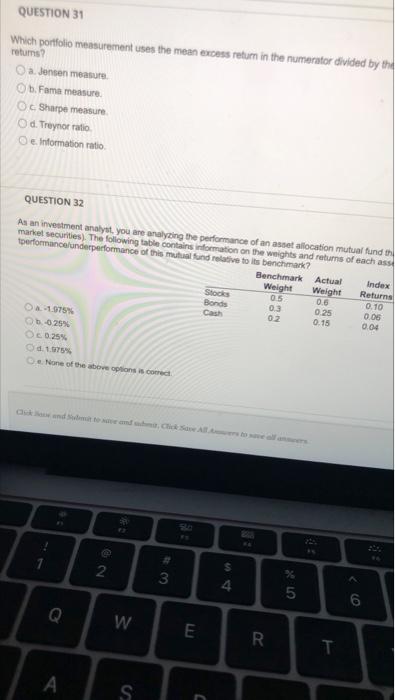

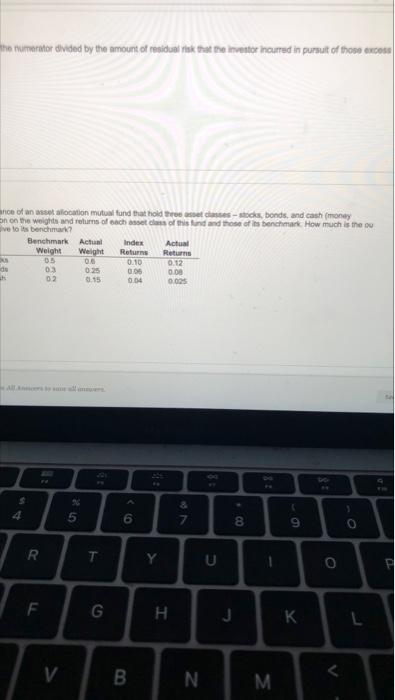

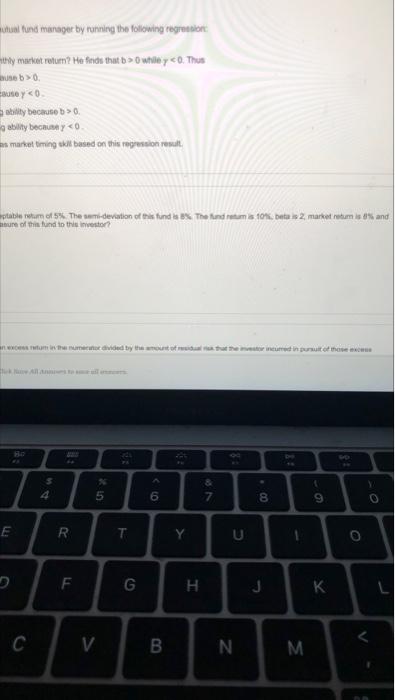

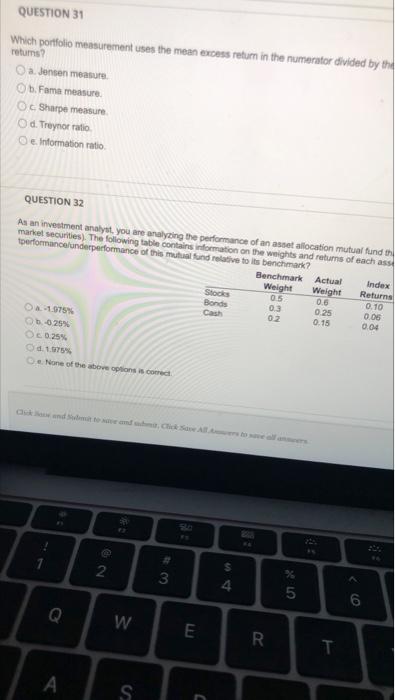

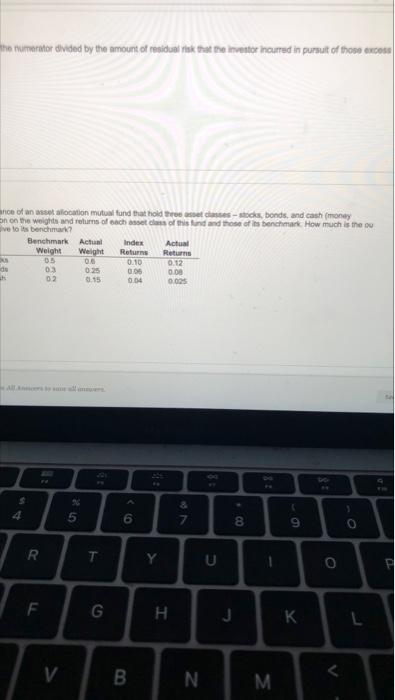

QUESTION 29 An investor is evaluating the market timing ability of a mutual fund manager by running the fol *** bimy where for is the monthly fund retum and tu, is the monthly market retur? He finds that b>0 O a this fund manager has market timing ability because b>0. b. this fund manager has market timing ability because y Q. Od this fund manager does not have market timing ability because y Owiley Buy 0 ability becay 0 es market timing kill based on this regression result tablertam ots The um.deviation of this fund la o The Androma 1016. Data az, market rutum sand, of tund in ances with vided by the most of the curred in pursuit of the & 5 4 5 6 8 9 E R. T Y U O F G J C V B N . QUESTION 31 Which portfolio measurement uses the mean excess return in the numerator divided by the retums? a. Jensen measure Oh. Fama measure Oc Sharpe measure Od. Treynot ratio O e Information ratio QUESTION 32 As an investment analyst, you are analyzing the performance of an asset allocation mutual fund the market securities). The following table contains information on the weights and retums of each assi performance underperformance of this mutual fund relative to its benchmark? Benchmark Actual Index Weight Weight Returns Stocks 05 06 0.10 Bonds 03 025 0.06 Cash 02 0.15 0.04 O&1575% OD-25% OC 0.25% d. 17% None of the above options is corred wanita Alam N 2 s 3 4 5 @ 6 Q W E R. T S c the numerator divided by the amount of residual risk that the investor incurred in pursuit of the ance of an location mutual fund that holde stocks, bonds and cash money on on the weights and returns of each assets of this fun and one of its benchmark How much is the ve to its benchmark Benchmark Actual Index Weight Weight Returns Returns 05 0.10 0.12 du 03 0.25 006 . 02 0.15 0.04 0.025 Actual w 28 4 5 6 & 7 3 0 00 8 9 R T Y U 0 F. G . J K V B 0 O a this fund manager has market timing ability because b>0. b. this fund manager has market timing ability because y Q. Od this fund manager does not have market timing ability because y Owiley Buy 0 ability becay 0 es market timing kill based on this regression result tablertam ots The um.deviation of this fund la o The Androma 1016. Data az, market rutum sand, of tund in ances with vided by the most of the curred in pursuit of the & 5 4 5 6 8 9 E R. T Y U O F G J C V B N . QUESTION 31 Which portfolio measurement uses the mean excess return in the numerator divided by the retums? a. Jensen measure Oh. Fama measure Oc Sharpe measure Od. Treynot ratio O e Information ratio QUESTION 32 As an investment analyst, you are analyzing the performance of an asset allocation mutual fund the market securities). The following table contains information on the weights and retums of each assi performance underperformance of this mutual fund relative to its benchmark? Benchmark Actual Index Weight Weight Returns Stocks 05 06 0.10 Bonds 03 025 0.06 Cash 02 0.15 0.04 O&1575% OD-25% OC 0.25% d. 17% None of the above options is corred wanita Alam N 2 s 3 4 5 @ 6 Q W E R. T S c the numerator divided by the amount of residual risk that the investor incurred in pursuit of the ance of an location mutual fund that holde stocks, bonds and cash money on on the weights and returns of each assets of this fun and one of its benchmark How much is the ve to its benchmark Benchmark Actual Index Weight Weight Returns Returns 05 0.10 0.12 du 03 0.25 006 . 02 0.15 0.04 0.025 Actual w 28 4 5 6 & 7 3 0 00 8 9 R T Y U 0 F. G . J K V B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started