Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Had to yowe multiple pictures so theyd be close enough to stay clear. QUESTION 21 Which of the following would not normally be a reason

Had to yowe multiple pictures so theyd be close enough to stay clear.

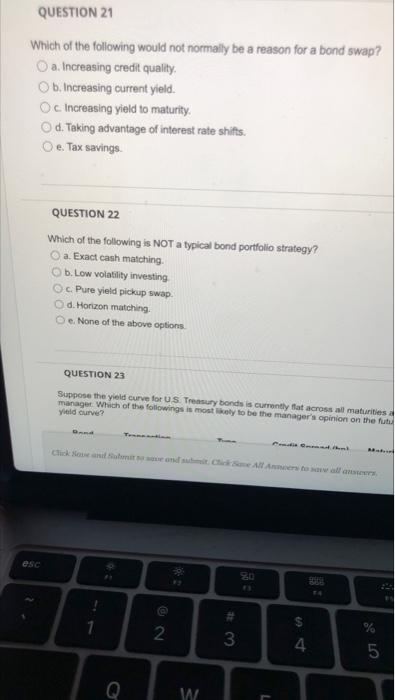

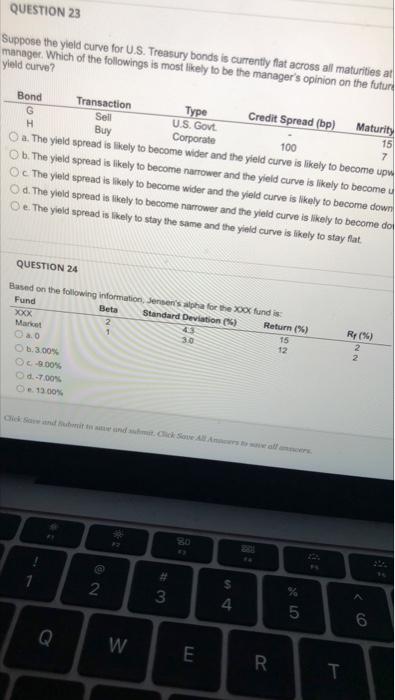

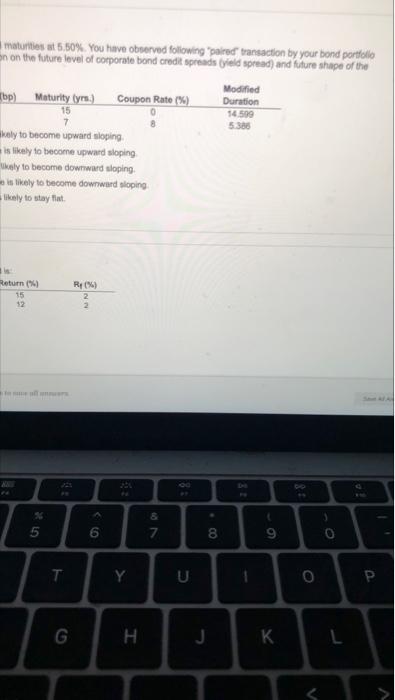

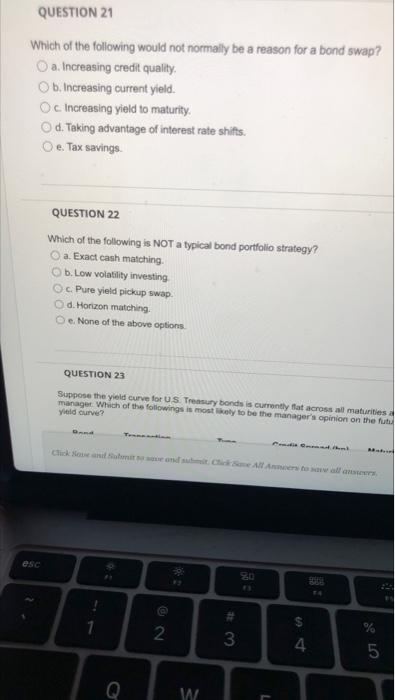

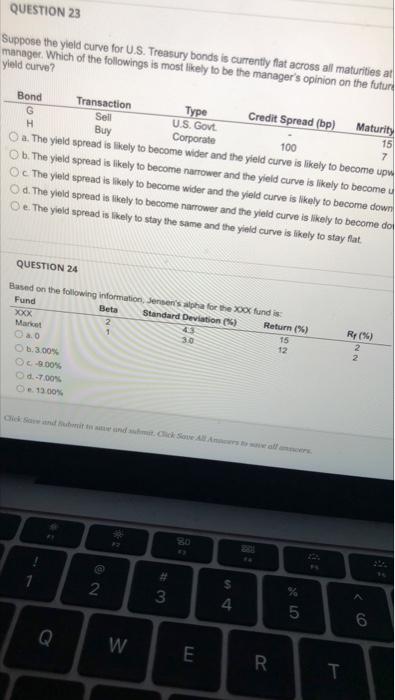

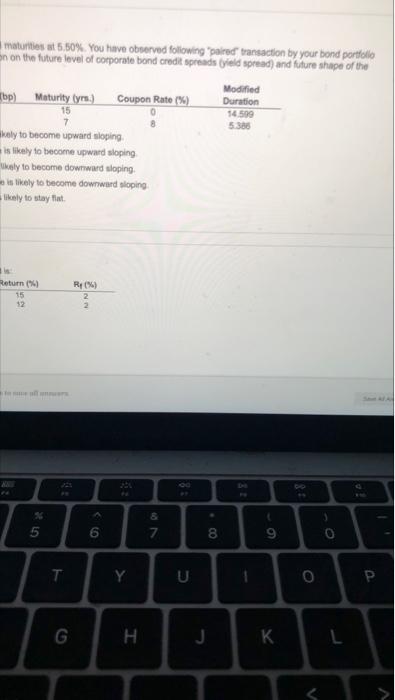

QUESTION 21 Which of the following would not normally be a reason for a bond swap? a. Increasing credit quality b. Increasing current yield Oc Increasing yield to maturity Od. Taking advantage of interest rate shifts. Oe. Tax savings QUESTION 22 Which of the following is NOT a typical bond portfolio strategy? a. Exact cash matching b. Low volatility investing Oc Pure yield pickup swap d. Horizon matching e None of the above options QUESTION 23 Suppose the yield curve for US Treasury bonds is currently fat across all maturities manager Which of the following is mostly to be the manager's opinion on the fut yield ourve? esc 90 : 1 NO 2 3 4 5 Q w L QUESTION 23 Suppose the yield curve for US Treasury bonds is currently flat across all maturities at manager. Which of the followings is most likely to be the manager's opinion on the future yield curve? G H Sell Bond Transaction Type Credit Spread (bp) Maturity U.S. Govt 15 Buy Corporate 100 7 1. The yield spread is likely to become wider and the yield curve is likely to become up b. The yield spread is likely to become narrower and the yield curve is likely to become u c The yield spread is likely to become wider and the yield curve is likely to become down d. The yield spread is ikely to become narrower and the yield curve is likely to become do Oe. The yield spread is likely to stay the same and the yield curve is likely to stay flat. QUESTION 24 Based on the following information, Jensen's ha for the Xox fund is Fund Beta Standard Deviation (%) Return (%) OOK 15 Market 12 ao 1.3.00 OG-5.00% 6.-7.00% O. 19.00 Rr (6) 2 Click Save and the Sowe 3. 2 3 4 5 6 W E R T 15 maturities at 5,50%. You have observed following paired transaction by your bond portfolio on on the future level of corporate bond credit spreads yield spread) and future shape of the Modified bp) Maturity lyra) Coupon Rate (%) Duration 14.599 5.386 kely to become upward sloping is likely to become upward sloping kely to become downward sloping. is likely to become downward sloping likely to stay flat Return (1) 15 12 RX) 2 2 23 ou & 7 5 6 00 8 9 0 T Y U O G H J L QUESTION 21 Which of the following would not normally be a reason for a bond swap? a. Increasing credit quality b. Increasing current yield Oc Increasing yield to maturity Od. Taking advantage of interest rate shifts. Oe. Tax savings QUESTION 22 Which of the following is NOT a typical bond portfolio strategy? a. Exact cash matching b. Low volatility investing Oc Pure yield pickup swap d. Horizon matching e None of the above options QUESTION 23 Suppose the yield curve for US Treasury bonds is currently fat across all maturities manager Which of the following is mostly to be the manager's opinion on the fut yield ourve? esc 90 : 1 NO 2 3 4 5 Q w L QUESTION 23 Suppose the yield curve for US Treasury bonds is currently flat across all maturities at manager. Which of the followings is most likely to be the manager's opinion on the future yield curve? G H Sell Bond Transaction Type Credit Spread (bp) Maturity U.S. Govt 15 Buy Corporate 100 7 1. The yield spread is likely to become wider and the yield curve is likely to become up b. The yield spread is likely to become narrower and the yield curve is likely to become u c The yield spread is likely to become wider and the yield curve is likely to become down d. The yield spread is ikely to become narrower and the yield curve is likely to become do Oe. The yield spread is likely to stay the same and the yield curve is likely to stay flat. QUESTION 24 Based on the following information, Jensen's ha for the Xox fund is Fund Beta Standard Deviation (%) Return (%) OOK 15 Market 12 ao 1.3.00 OG-5.00% 6.-7.00% O. 19.00 Rr (6) 2 Click Save and the Sowe 3. 2 3 4 5 6 W E R T 15 maturities at 5,50%. You have observed following paired transaction by your bond portfolio on on the future level of corporate bond credit spreads yield spread) and future shape of the Modified bp) Maturity lyra) Coupon Rate (%) Duration 14.599 5.386 kely to become upward sloping is likely to become upward sloping kely to become downward sloping. is likely to become downward sloping likely to stay flat Return (1) 15 12 RX) 2 2 23 ou & 7 5 6 00 8 9 0 T Y U O G H J L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started