Answered step by step

Verified Expert Solution

Question

1 Approved Answer

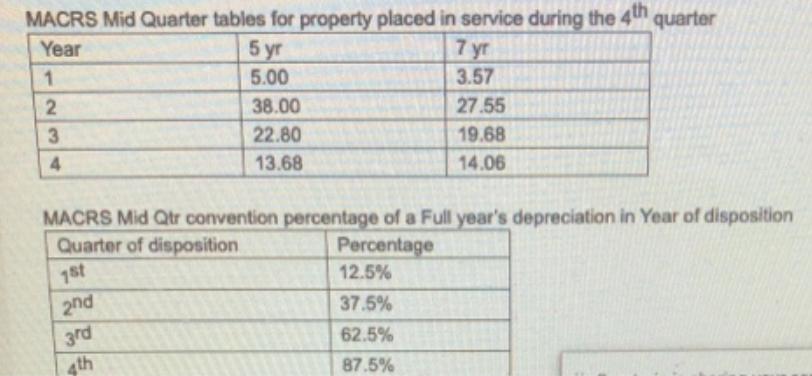

Hadley's Bakery purchased appliances (5 year property) in quarter 4 of Year 1. The original cost of the appliances was $22,000 and she did

Hadley's Bakery purchased appliances (5 year property) in quarter 4 of Year 1. The original cost of the appliances was $22,000 and she did NOT use bonus depreciation or Section 179 expensing in the year of purchase. The mid-quarter oonvention has been used for the calculation of depreciation. If Hadley sells the appliances in April of Year 4, she will be able to deduc MACRS Mid Quarter tables for property placed in service during the 2nd quarter Year 5 yr 5.00 7 yr 3.57 38.00 27.55 3. 22 80 19.68 4. 13.68 14.06 MACRS Mid Quarter tables for property placed in service during the 4th quarter 7 yr 5 yr 5.00 Year 3.57 38.00 27.55 22.80 19.68 4. 13.68 14.06 MACRS Mid Qtr convention percentage of a Full year's depreciation in Year of disposition Quarter of disposition Percentage 1st 12.5% 2nd 3rd 4th 37.5% 62.5% 87.5% 23 Hadley's Bakery purchased appliances (5 year property) in quarter 4 of Year 1. The original cost of the appliances was $22,000 and she did NOT use bonus depreciation or Section 179 expensing in the year of purchase. The mid-quarter oonvention has been used for the calculation of depreciation. If Hadley sells the appliances in April of Year 4, she will be able to deduc MACRS Mid Quarter tables for property placed in service during the 2nd quarter Year 5 yr 5.00 7 yr 3.57 38.00 27.55 3. 22 80 19.68 4. 13.68 14.06 MACRS Mid Quarter tables for property placed in service during the 4th quarter 7 yr 5 yr 5.00 Year 3.57 38.00 27.55 22.80 19.68 4. 13.68 14.06 MACRS Mid Qtr convention percentage of a Full year's depreciation in Year of disposition Quarter of disposition Percentage 1st 12.5% 2nd 3rd 4th 37.5% 62.5% 87.5% 23 Hadley's Bakery purchased appliances (5 year property) in quarter 4 of Year 1. The original cost of the appliances was $22,000 and she did NOT use bonus depreciation or Section 179 expensing in the year of purchase. The mid-quarter oonvention has been used for the calculation of depreciation. If Hadley sells the appliances in April of Year 4, she will be able to deduc MACRS Mid Quarter tables for property placed in service during the 2nd quarter Year 5 yr 5.00 7 yr 3.57 38.00 27.55 3. 22 80 19.68 4. 13.68 14.06 MACRS Mid Quarter tables for property placed in service during the 4th quarter 7 yr 5 yr 5.00 Year 3.57 38.00 27.55 22.80 19.68 4. 13.68 14.06 MACRS Mid Qtr convention percentage of a Full year's depreciation in Year of disposition Quarter of disposition Percentage 1st 12.5% 2nd 3rd 4th 37.5% 62.5% 87.5% 23 Hadley's Bakery purchased appliances (5 year property) in quarter 4 of Year 1. The original cost of the appliances was $22,000 and she did NOT use bonus depreciation or Section 179 expensing in the year of purchase. The mid-quarter oonvention has been used for the calculation of depreciation. If Hadley sells the appliances in April of Year 4, she will be able to deduc MACRS Mid Quarter tables for property placed in service during the 2nd quarter Year 5 yr 5.00 7 yr 3.57 38.00 27.55 3. 22 80 19.68 4. 13.68 14.06 MACRS Mid Quarter tables for property placed in service during the 4th quarter 7 yr 5 yr 5.00 Year 3.57 38.00 27.55 22.80 19.68 4. 13.68 14.06 MACRS Mid Qtr convention percentage of a Full year's depreciation in Year of disposition Quarter of disposition Percentage 1st 12.5% 2nd 3rd 4th 37.5% 62.5% 87.5% 23

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information available in the question we can calculate the Depreciation expense in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started