Answered step by step

Verified Expert Solution

Question

1 Approved Answer

HADM 1210 Lecture Outline Chapter 4 1. Key outcome for the chapter is to expand your understanding of accrual basis accounting and the adjustments

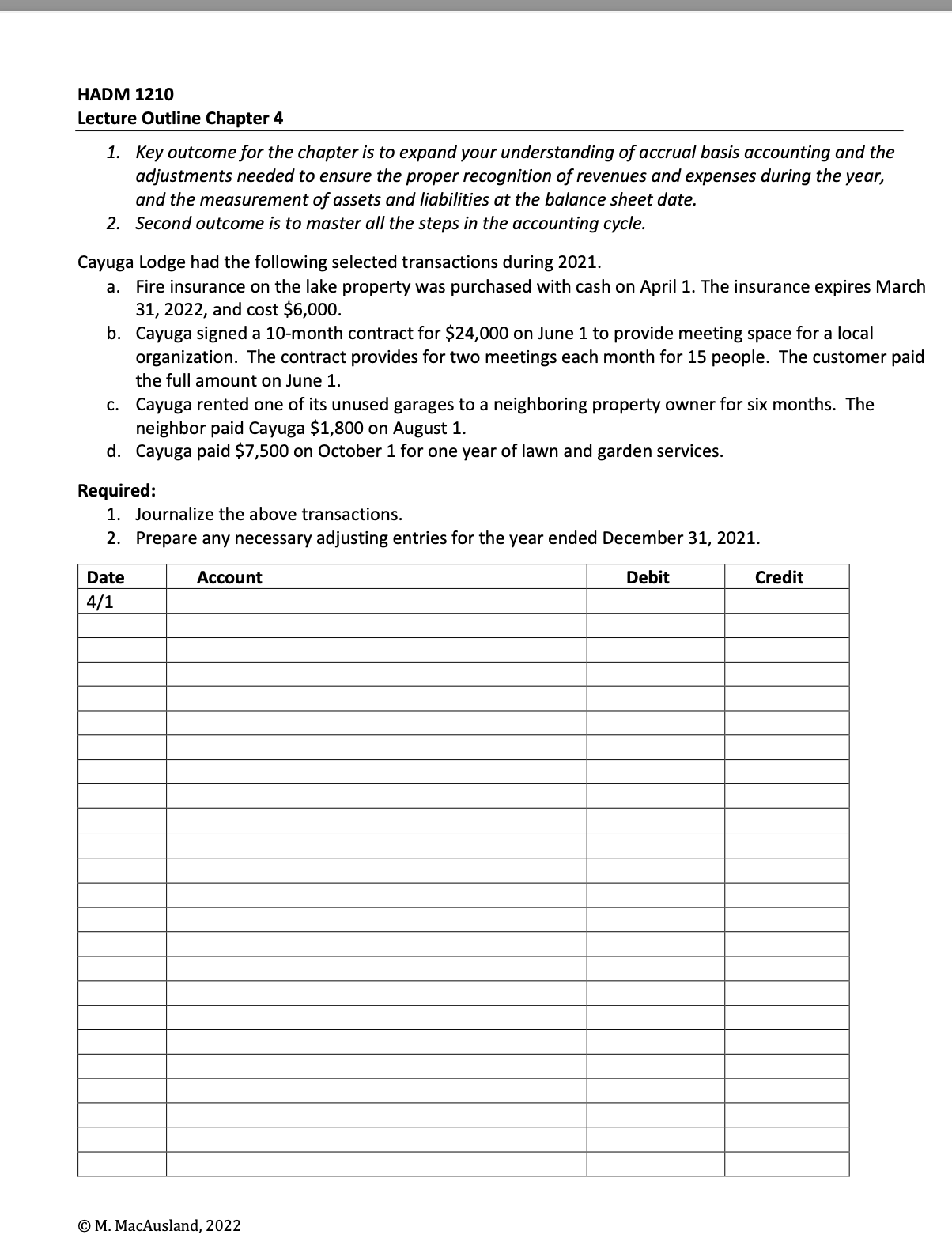

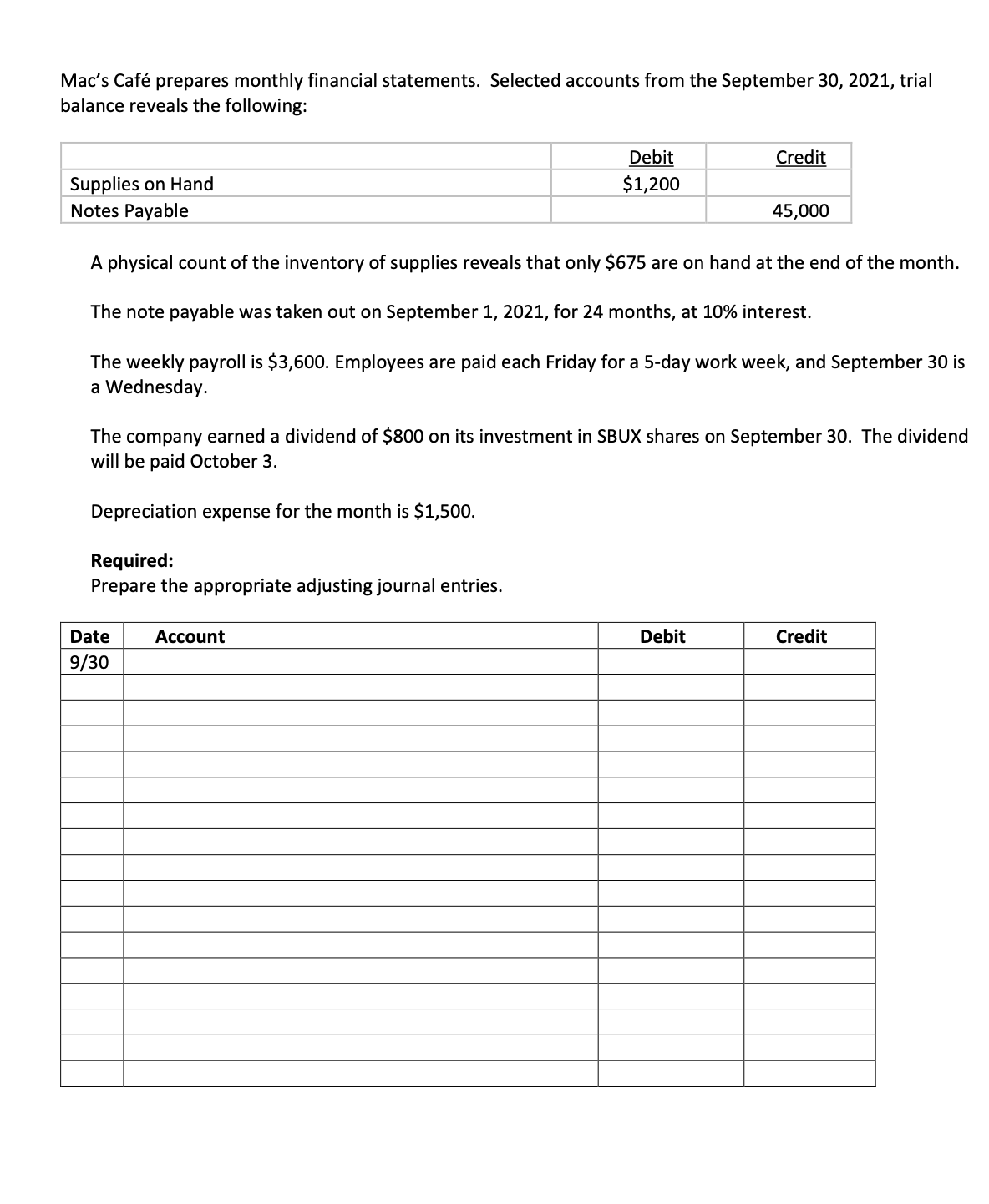

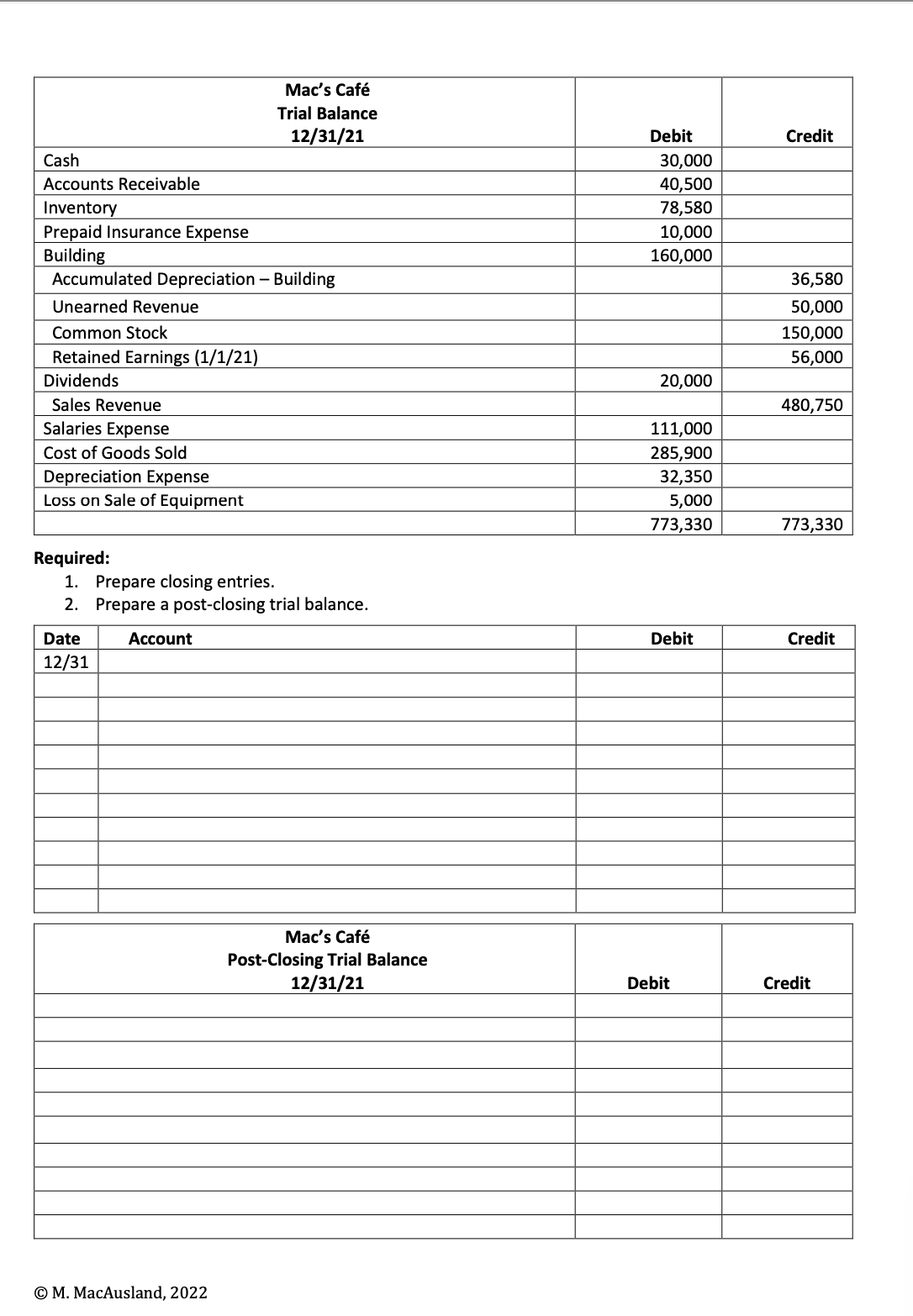

HADM 1210 Lecture Outline Chapter 4 1. Key outcome for the chapter is to expand your understanding of accrual basis accounting and the adjustments needed to ensure the proper recognition of revenues and expenses during the year, and the measurement of assets and liabilities at the balance sheet date. 2. Second outcome is to master all the steps in the accounting cycle. Cayuga Lodge had the following selected transactions during 2021. a. Fire insurance on the lake property was purchased with cash on April 1. The insurance expires March 31, 2022, and cost $6,000. b. Cayuga signed a 10-month contract for $24,000 on June 1 to provide meeting space for a local organization. The contract provides for two meetings each month for 15 people. The customer paid the full amount on June 1. c. Cayuga rented one of its unused garages to a neighboring property owner for six months. The neighbor paid Cayuga $1,800 on August 1. d. Cayuga paid $7,500 on October 1 for one year of lawn and garden services. Required: 1. Journalize the above transactions. 2. Prepare any necessary adjusting entries for the year ended December 31, 2021. Date 4/1 Account M. MacAusland, 2022 Debit Credit Mac's Caf prepares monthly financial statements. Selected accounts from the September 30, 2021, trial balance reveals the following: Supplies on Hand Notes Payable Debit $1,200 Credit 45,000 A physical count of the inventory of supplies reveals that only $675 are on hand at the end of the month. The note payable was taken out on September 1, 2021, for 24 months, at 10% interest. The weekly payroll is $3,600. Employees are paid each Friday for a 5-day work week, and September 30 is a Wednesday. The company earned a dividend of $800 on its investment in SBUX shares on September 30. The dividend will be paid October 3. Depreciation expense for the month is $1,500. Required: Prepare the appropriate adjusting journal entries. Date 9/30 Account Debit Credit Mac's Caf Trial Balance 12/31/21 Debit Credit Cash Accounts Receivable Inventory 30,000 40,500 78,580 Prepaid Insurance Expense 10,000 Building 160,000 Accumulated Depreciation - Building 36,580 Unearned Revenue 50,000 Common Stock 150,000 Retained Earnings (1/1/21) 56,000 Dividends 20,000 Sales Revenue 480,750 Salaries Expense Cost of Goods Sold Depreciation Expense Loss on Sale of Equipment 111,000 285,900 32,350 5,000 773,330 773,330 Required: 1. Prepare closing entries. 2. Prepare a post-closing trial balance. Account Date 12/31 M. MacAusland, 2022 Mac's Caf Post-Closing Trial Balance 12/31/21 Debit Credit Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started