Answered step by step

Verified Expert Solution

Question

1 Approved Answer

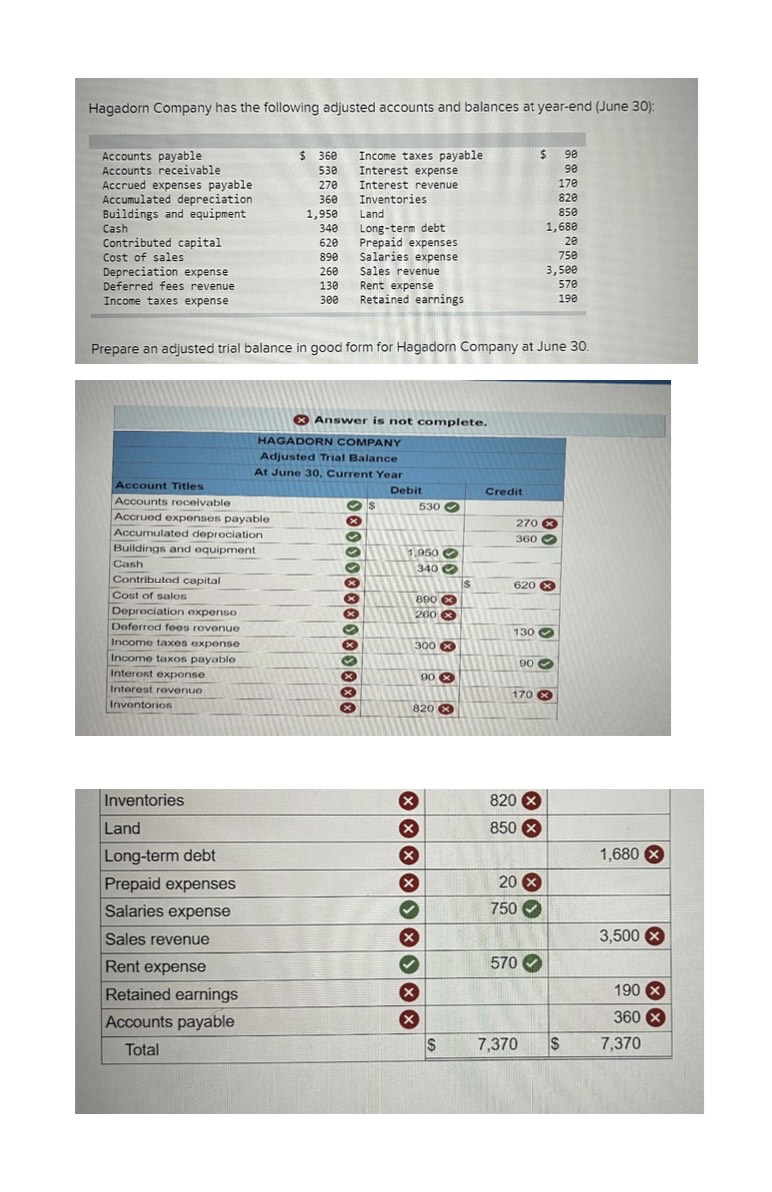

Hagadorn Company has the following adjusted accounts and balances at year-end (June 30): Accounts payable $ 360 Income taxes payable $ 98 Accounts receivable

Hagadorn Company has the following adjusted accounts and balances at year-end (June 30): Accounts payable $ 360 Income taxes payable $ 98 Accounts receivable 530 Interest expense 90 Accrued expenses payable 270 Interest revenue 170 Accumulated depreciation 360 Inventories 820 Buildings and equipment Cash 1,950 Land 850 340 Long-term debt 1,680 Contributed capital 620 Prepaid expenses 20 Cost of sales 890 Salaries expense 750 Depreciation expense 260 Sales revenue 3,500 Deferred fees revenue 130 Rent expense 570 Income taxes expense 300 Retained earnings 198 Prepare an adjusted trial balance in good form for Hagadorn Company at June 30. Answer is not complete. HAGADORN COMPANY Adjusted Trial Balance Debit Credit 530 Account Titles Accounts receivable At June 30, Current Year Accrued expenses payable Accumulated depreciation Buildings and equipment Cash Contributed capital Cost of salos Depreciation expenso Deferrod fees revenue Income taxes expense Income taxos payable Interost exponse Interest revenue Inventorios 000000 270x 360 1.950 340 620 890 260 130 300 90 90 170 820 Inventories Land 820x 850x Long-term debt 1,680x Prepaid expenses 20 750 Salaries expense > > 3,500 Sales revenue 570 Rent expense 190x Retained earnings Accounts payable 360x $ 7,370 S 7,370 Total

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Hagadorn Company based on the provided adjusted accounts and balances as of June 30 Adjusted Trial Balance for Hagadorn Company at June 30 Current Year Account Titles Debit Credit Accounts receivable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started