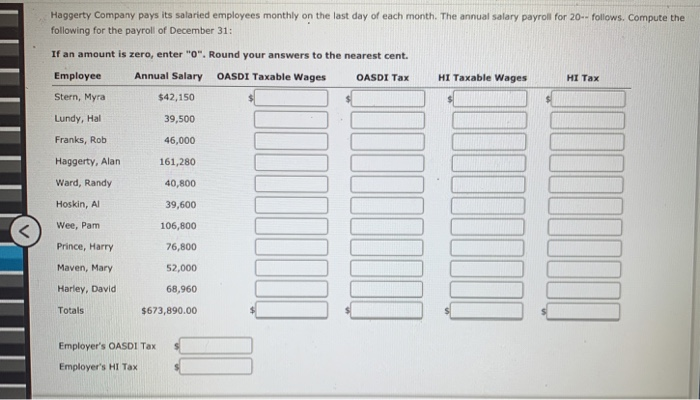

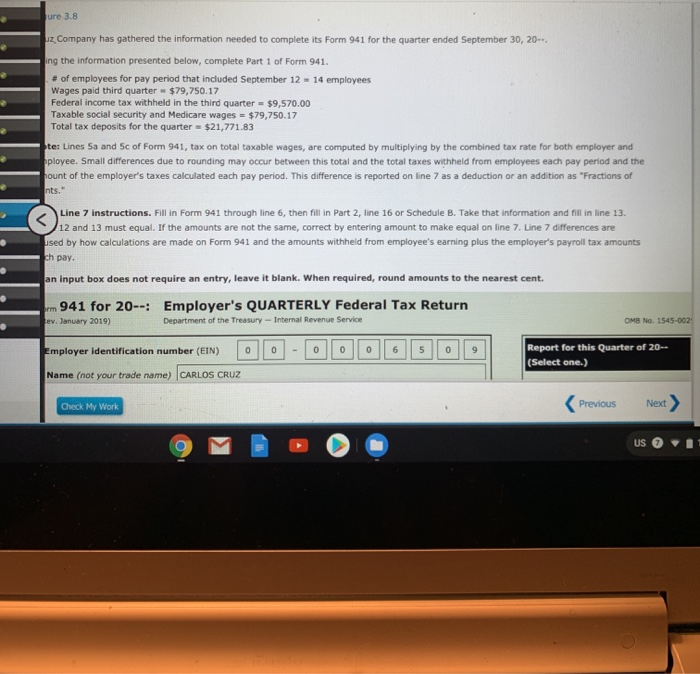

Haggerty Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31: If an amount is zero, enter "0". Round your answers to the nearest cent. Employee Annual Salary OASDI Taxable Wages OASDI Tax HI Taxable Wages HI Tax Stern, Myra $42,150 Lundy, Hal 39,500 Franks, Rob 46,000 Haggerty, Alan 161,280 40,800 Ward, Randy Hoskin, AI 39,600 Wee, Pam 106,800 Prince, Harry 76,800 Maven, Mary 52,000 III ILIT Harley, David 68,960 Totals $673,890.00 Employer's OASDI Tax Employer's HI Tax ure 3.8 uz Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 20- ing the information presented below, complete Part 1 of Form 941. # of employees for pay period that included September 12 - 14 employees Wages paid third quarter $79,750.17 Federal income tax withheld in the third quarter = $9,570.00 Taxable social security and Medicare wages - $79,750.17 Total tax deposits for the quarter - $21,771.83 te: Lines Sa and Sc of Form 941, tax on total taxable wages, are computed by multiplying by the combined tax rate for both employer and ployee. Small differences due to rounding may occur between this total and the total taxes withheld from employees each pay period and the hount of the employer's taxes calculated each pay period. This difference is reported on line 7 as a deduction or an addition as "Fractions of nts." Line 7 instructions. Fill in Form 941 through line 6, then fill in Part 2, line 16 or Schedule B. Take that information and fill in line 13. 12 and 13 must equal. If the amounts are not the same, correct by entering amount to make equal on line 7. Line 7 differences are used by how calculations are made on Form 941 and the amounts withheld from employee's earning plus the employer's payroll tax amounts ch pay. an input box does not require an entry, leave it blank. When required, round amounts to the nearest cent. 941 for 20-- Employer's QUARTERLY Federal Tax Return orm ev. January 2019) Department of the Treasury - Internal Revenue Service OMB No 1545-002 Employer identification number (EIN) 0 0 0 0 0 6 5 0 9 Report for this Quarter of 20-- (Select one.) Name (not your trade name) CARLOS CRUZ Check My Work US Haggerty Company pays its salaried employees monthly on the last day of each month. The annual salary payroll for 20-- follows. Compute the following for the payroll of December 31: If an amount is zero, enter "0". Round your answers to the nearest cent. Employee Annual Salary OASDI Taxable Wages OASDI Tax HI Taxable Wages HI Tax Stern, Myra $42,150 Lundy, Hal 39,500 Franks, Rob 46,000 Haggerty, Alan 161,280 40,800 Ward, Randy Hoskin, AI 39,600 Wee, Pam 106,800 Prince, Harry 76,800 Maven, Mary 52,000 III ILIT Harley, David 68,960 Totals $673,890.00 Employer's OASDI Tax Employer's HI Tax ure 3.8 uz Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 20- ing the information presented below, complete Part 1 of Form 941. # of employees for pay period that included September 12 - 14 employees Wages paid third quarter $79,750.17 Federal income tax withheld in the third quarter = $9,570.00 Taxable social security and Medicare wages - $79,750.17 Total tax deposits for the quarter - $21,771.83 te: Lines Sa and Sc of Form 941, tax on total taxable wages, are computed by multiplying by the combined tax rate for both employer and ployee. Small differences due to rounding may occur between this total and the total taxes withheld from employees each pay period and the hount of the employer's taxes calculated each pay period. This difference is reported on line 7 as a deduction or an addition as "Fractions of nts." Line 7 instructions. Fill in Form 941 through line 6, then fill in Part 2, line 16 or Schedule B. Take that information and fill in line 13. 12 and 13 must equal. If the amounts are not the same, correct by entering amount to make equal on line 7. Line 7 differences are used by how calculations are made on Form 941 and the amounts withheld from employee's earning plus the employer's payroll tax amounts ch pay. an input box does not require an entry, leave it blank. When required, round amounts to the nearest cent. 941 for 20-- Employer's QUARTERLY Federal Tax Return orm ev. January 2019) Department of the Treasury - Internal Revenue Service OMB No 1545-002 Employer identification number (EIN) 0 0 0 0 0 6 5 0 9 Report for this Quarter of 20-- (Select one.) Name (not your trade name) CARLOS CRUZ Check My Work US