Answered step by step

Verified Expert Solution

Question

1 Approved Answer

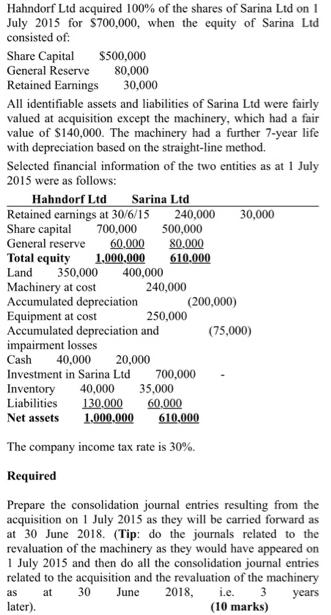

Hahndorf Ltd acquired 100% of the shares of Sarina Ltd on 1 July 2015 for S700,000, when the equity of Sarina Ltd consisted of:

Hahndorf Ltd acquired 100% of the shares of Sarina Ltd on 1 July 2015 for S700,000, when the equity of Sarina Ltd consisted of: Share Capital General Reserve Retained Earnings $500,000 80,000 30,000 All identifiable assets and liabilities of Sarina Ltd were fairly valued at acquisition except the machinery, which had a fair value of $140,000. The machinery had a further 7-year life with depreciation based on the straight-line method. Selected financial information of the two entities as at 1 July 2015 were as follows: Hahndorf Ltd Retained earnings at 30/6/15 700,000 Sarina Ltd 240,000 30,000 Share capital General reserve 60.000 1.000,000 400,000 500,000 80.000 610.000 Total equity Land 350,000 Machinery at cost Accumulated depreciation Equipment at cost Accumulated depreciation and impairment losses 240,000 (200,000) 250,000 (75,000) 20,000 Investment in Sarina Ltd Cash 40,000 700,000 Inventory Liabilities 40,000 130.000 1,000,000 35,000 60,000 610,000 Net assets The company income tax rate is 30%. Required Prepare the consolidation journal entries resulting from the acquisition on 1 July 2015 as they will be carried forward as at 30 June 2018. (Tip: do the journals related to the revaluation of the machinery as they would have appeared on 1 July 2015 and then do all the consolidation journal entries related to the acquisition and the revaluation of the machinery 2018, as at 30 June i.e. 3 years later). (10 marks) Required Prepare the consolidation journal entries resulting from the acquisition on 1 July 2015 as they will be carried forward as at 30 June 2018. (Tip: do the journals related to the revaluation of the machinery as they would have appeared on 1 July 2015 and then do all the consolidation journal entries related to the acquisition and the revaluation of the machinery 2018, 30 June i.e. (10 marks) as at 3 years later). Formatting Please be mindful that assignments are marked in soft copy. To assist with making the marking process efficient, effective and not time-consuming, you must comply with the following formatting requirements: Document type: Your answer must be in Word format. This will allow the marker to use track-changes to indicate where you received marks. Please do not submit a pdf document as this will not be marked. Also, please do not submit an excel file for your figures and calculations or copy and paste a table from an excel spreadsheet for any calculations into your Word document. Use the "insert table" function within Word and type all figures into the table. Show all calculations below the table. Ensure the marker will be able to use the track-changes function in Word to indicate in your table where you received or lost marks for your figures. Page: Portrait orientation Footer: Your full name(s) and student ID(s), page number and number of pages (e.g. Cat Bird s0123456, page 1 of 3) File saving convention: Include your student name(s) in the name of the file when you save the document, and ensure that you include the appropriate .doc or docx at the end. For example, save your file as: Cat Bird.docx 1

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Required solution Journal Entry for Revolution of Machinery SNo Account Title...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d7b77c4cc2_176039.pdf

180 KBs PDF File

635d7b77c4cc2_176039.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started